[ad_1]

The US CPI data is out, indicating that inflation increased in May and for the first time since February. Bitcoin reacted to the news, approaching the $109,120 level.

Beyond the CPI, traders and investors will also monitor US jobs data and the PPI (Producer Price Index), due for release on Thursday.

Inflation Rose To 2.4% in May, US CPI Data Shows

The US Bureau of Labor Statistics (BLS) released the Consumer Price Index (CPI), showing that inflation rose at an annual rate of 2.4% in May, after 2.3% Year-on-Year (YoY) in April.

This is the first time CPI has increased in 3-4 months. In the immediate aftermath, Bitcoin recorded a modest surge, rising to $109,456 as of this writing.

Bitcoin (BTC) Price Performance. Source: BeInCrypto

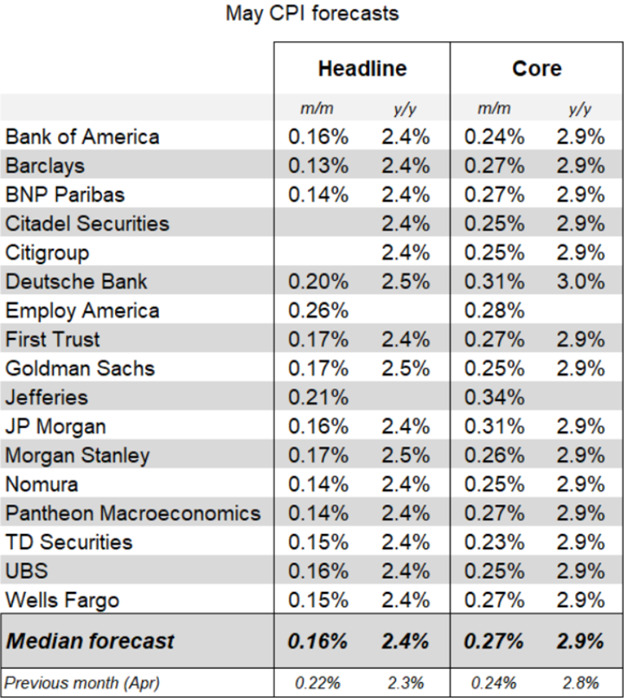

Ahead of the US CPI data release, consensus expected the headline reading to rise by 0.2% Month over Month (MoM) and accelerate to 2.5% year over year (YoY).

Perhaps, the expectation of rising inflation explains the modest surge in the Bitcoin price, as the impact was already priced in.

“If CPI > 2.5%, expect a sell-off as the chances of Fed rate cut will go lower. If CPI = 2.5%, a sell-off will happen but the dip will be for buying. If CPI < 2.5%, expect pump-and-dump but the market will close in green. Except the first scenario, the market will be bullish,” analyst Cas Abbé had projected.

Notably, several banks expected the May CPI to show mild headline inflation and monthly core inflation close to the median reading from the previous 12 months.

May CPI forecasts. Source: Nick Timiraos on X

Meanwhile, it is easy to pinpoint what caused the US CPI inflation data to rise in May. All signs point to Trump’s tariffs, with the latest data indicating the first impact of the trade policies in the US, particularly on goods inflation.

“Expectations are for a slight increase compared to last month which is likely due to the increase in OIL and some of the tariffs that are getting pushed through to consumers,” wrote analyst Daan Crypto Trades.

With the CPI inflation data priced in, focus shifts to additional US indicators this week, namely initial jobless claims and PPI, due for release tomorrow, June 12. Beyond that, interest will also be on the Federal Reserve’s (Fed) policy decision next week.

Next Wednesday, the Fed will release policymakers’ interest rate decision for their June 17/18 meeting, followed by Chairman Jerome Powell’s speech.

The US CPI is a lagging indicator, making it a primary focus for inflation targeting and, therefore, tied to the Federal Reserve’s 2% target. The US CPI inflation data today will affect the FOMC’s interest rate decision next week.

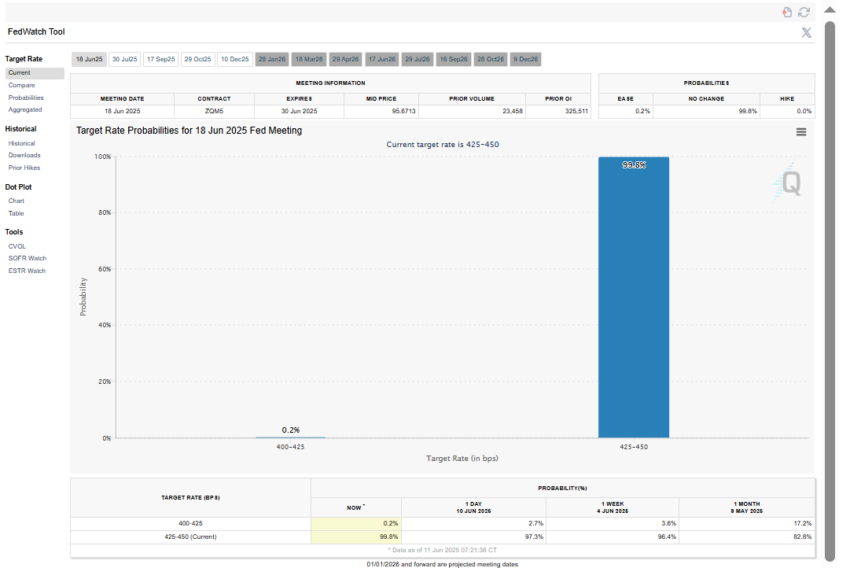

Interest rate cut probabilities. Source: CME FedWatch Tool

According to the CME FedWatchTool, there is a 99.8% chance the Fed will keep interest rates steady at 4.25-4.50% in the next meeting. This is as opposed to the 99.9% chance before the CPI data today that the Fed would keep interest rates steady.

However, despite the perceived impact of Trump’s tariffs on US inflation, Powell articulated that political pressure will not influence the Fed’s policy decision.

With inflation still rising above the Fed’s 2% target, policymakers may continue to take a cautious approach.

“The market generally expects the Federal Reserve to continue to take a wait-and-see approach…market movements will still be event-driven, with the key factors being adjustments to interest rate cut expectations following the Federal Reserve meeting and officials’ statements,” Bitunix analysts told BeInCrypto.

Beyond inflation, however, the labor market is also becoming a fundamental macroeconomic catalyst for Bitcoin. The Fed may only need a resilient labor market and an economy that has not derailed so far to cut interest rates.

[ad_2]