[ad_1]

The Bitcoin price just hit new record highs in euros and British pounds.

BTC/EUR crept above €60,000 during early Monday trade, before briefly surpassing €62,000 during US trading hours.

BTC/GBP, meanwhile, hit £53,000, convincingly surpassing its prior record peaks of around £51,000 in 2021.

In US dollar terms, Bitcoin surpassed $67,000 and is now within 3% of November 2021 record highs at $69,000.

Just four days into March, and Bitcoin is already up around 10%.

Following February’s 44% price pump and amid seemingly unstoppable ongoing bullish momentum, it almost now feels inevitable that the Bitcoin price will hit record highs in dollar terms this month.

Bitcoin Price Hits Record Highs Amid Massive Exodus of BTC Tokens from Exchanges

Bitcoin’s price has gone parabolic this year in wake of the introduction of new spot Bitcoin ETFs in the US.

Without a doubt, the launch of spot Bitcoin ETFs has been the most hyped and most successful ETF launch ever.

As per ZeroHedge, BlackRock’s new spot Bitcoin ETF hit $10 billion in assets under management in seven weeks.

That makes it the fastest-growing ETF in history.

BlackRock’s iShares Bitcoin Trust has accumulated $10 BN in just seven weeks — the fastest an ETF has ever hit that milestone and a feat which the first gold ETF took more than two years to accomplish: BBG

— zerohedge (@zerohedge) March 3, 2024

By comparison, the first gold ETF took over two years to reach $10 billion.

BlackRock’s IBIT is also up over 30% since launch, with one trader pointing out it took the first gold ETF 63 weeks to post the same gains.

And that’s just BlackRock’s ETF.

Fidelity, Ark and half a dozen other firms also launches spot Bitcoin ETF in January.

And these spot ETFs have also hoovered up billions in BTC tokens.

This sudden new demand shock to the spot market comes at a time when Bitcoin supply is being squeezed.

10x head of research Markus Thielen noted in a research paper on Monday that BTC tokens held on exchanges dropped by over 63,000 coins last week.

Falling exchange BTC reserves suggest traders/investors are increasingly taking self-custody of their coins, presumably to HODL them.

That implies lower sell pressure.

And sell pressure is about to experience another massive drop in April when the Bitcoin issuance rate to miners halves.

With the Fed also on the cusp of cutting rates (starting later this year), its no surprise then that Bitcoin bears appear to have virtually gone extinct.

Here’s Where BTC is Headed Next

Traders are unlikely to stop pumping until the Bitcoin price hits record highs in US dollar terms.

That’s a typical feature of market psychology. Traders typically place a lot of importance on key levels (like the $69,000 record highs) being hit.

Short-term speculators should be prepared for a spike in profit-taking once the all-time highs are hit.

But amid the above noted bullish fundamentals, any price dip is unlikely to last long, as longer-term buyers rush in.

Bitcoin could then quickly vault above $70,000 for the first time as shorts get wiped out, just as they did when the price punched above $64,000 this week, and $53,000 in late February.

Then the question is “how high can BTC go?”.

The next major psychological target for BTC would be the $100,000 level.

Traders will then have to get creative using valuation of technical tools to predict where it might go next.

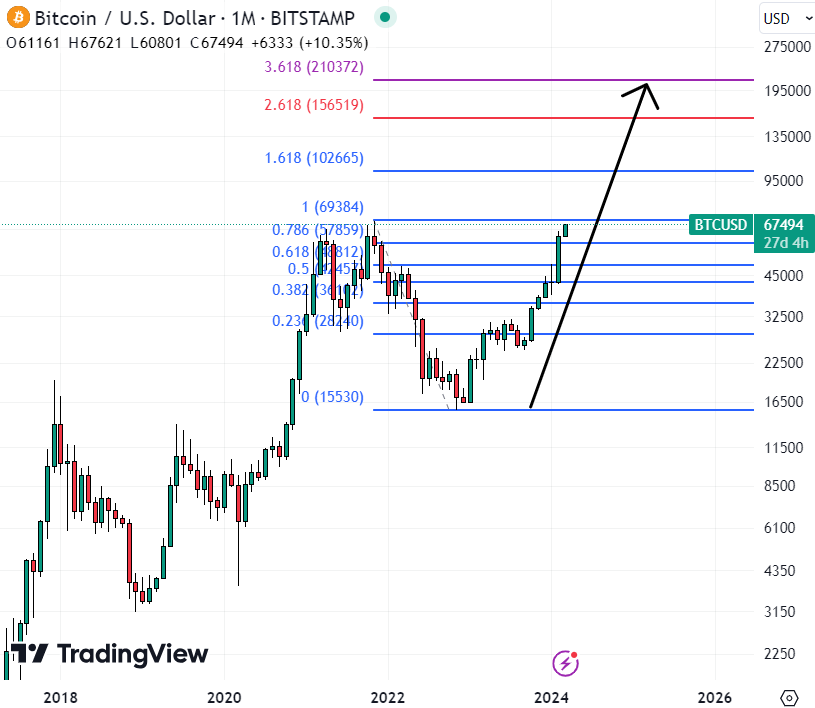

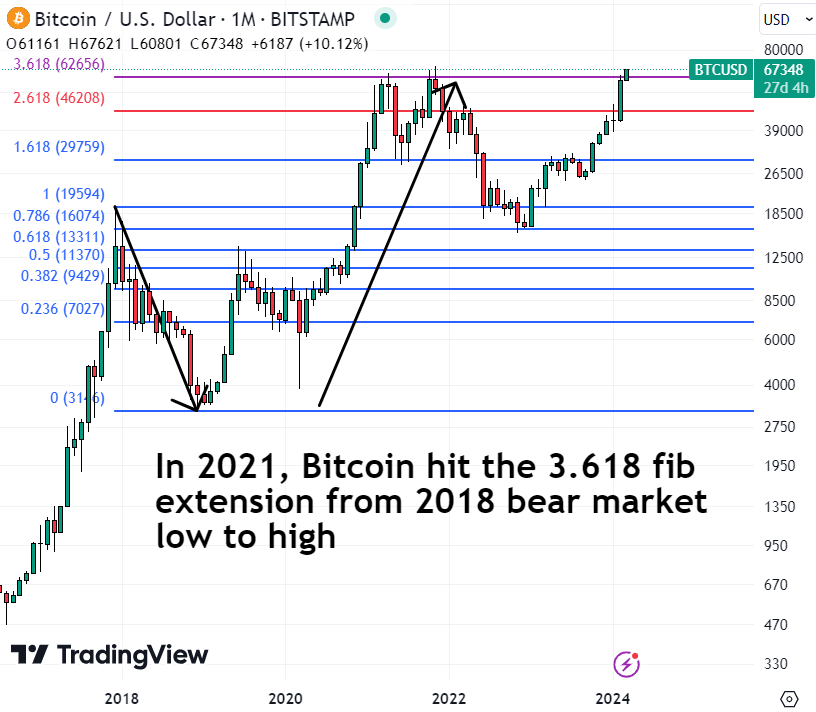

A Fibonacci extension from the 2022 bear market lows back to the 2021 bull market highs puts the 1.618 fib level at $102,000, the 2.618 fib level at $156,000 and the 3.618 fib level at $210,000.

Reaching this high might seem farfetched.

But BTC was able to reach these Fibonacci extension levels (from the 2018 bear) during the 2020/2021 bull market.

If Bitcoin supplants gold as the global reserve asset, that implies a market cap of more than $14 trillion.

That would imply Bitcoin eventually surpassing a market cap of $666,000.

While it might take a decade or more to reach such levels, Bitcoin reaching into the $100s of thousands in 2024/2025 isn’t out of the realms of possibility.

Follow Us on Google News

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

[ad_2]