[ad_1]

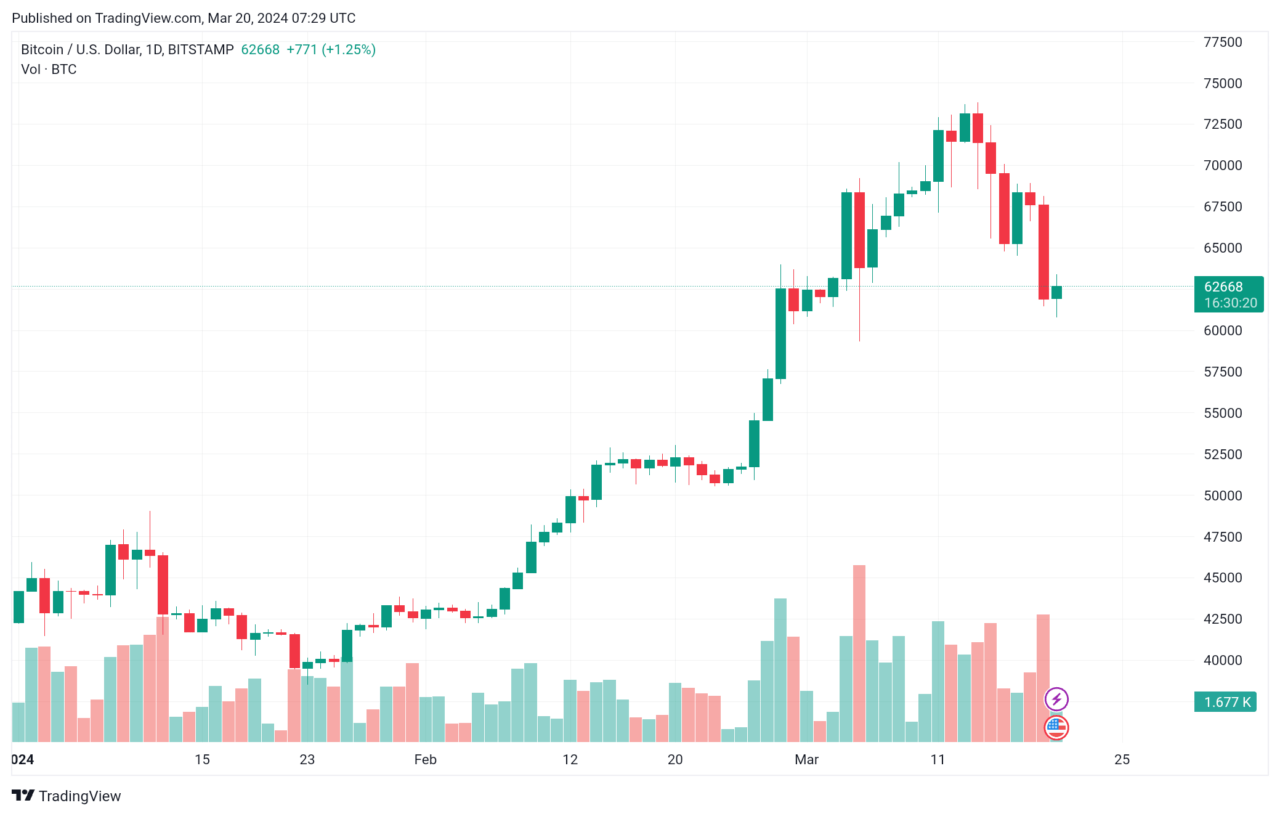

In recent weeks, the cryptocurrency community has witnessed Bitcoin’s thrilling ascent to new all-time highs, only to see it retreat below the $63,000 mark.

According to data from TradingView, although the Bitcoin price got as high as $73,794 on crypto exchange Bitstamp on March 14, it fell to as low as $61,447 yesterday.

Source: TradingView

This rollercoaster has left many investors and enthusiasts seeking clarity on the forces at play in such dramatic price movements. Enter Jason Urban, the global head of trading at Galaxy Digital, who appeared on CNBC’s “Crypto World” on March 19 to explain what is happening in the crypto market and share his short-to-medium price target for Bitcoin.

Urban began by addressing Bitcoin’s price drop, attributing it to a natural consolidation after a significant run-up. He emphasized the healthiness of this consolidation for the market, suggesting it allows for some price discovery before potentially moving higher again. Urban highlighted the success of the spot Bitcoin ETF launches in the U.S. on January 11 as a pivotal factor driving Bitcoin to new highs. He mentioned that traditional retail investors still face challenges in accessing cryptocurrencies, suggesting that as these platforms become more available, a steady flow of investment into Bitcoin can be expected.

Regarding forecasts, Urban responded to a prediction by Standard Chartered’s head of digital assets research, who raised the year-end Bitcoin price forecast to $150,000. Urban suggested a more cautious outlook, placing his expectation somewhere between $100,000 and $150,000, emphasizing the importance of healthy market action and price discovery.

According to a report by The Daily Hodl, Urban said:

“I certainly think that $100,000 is expected by a lot of, I’ll say, crypto natives. As you know, I’m out here at the Digital Asset Summit in London this week and just talking to a lot of the crypto natives, you know, there really is an underpinning. And then you have a lot of traditional finance players stepping in as well. And so I don’t think $100,000 is off the table...

“I certainly hope $150,000 is the right number, but it’s how we get there too that’s important, right? You need healthy price discovery and healthy market action. And so a little bit of a retracement here off of the $73,000 highs, I think you’re going to see a steady build. It’ll build a base in here and then all of a sudden start to really drive higher. So I’ll play the diplomat and say $120,000, $125,000.”

When discussing Galaxy’s performance in the ETF space, Urban pointed out the significance of long-term factors such as tracking error, in which he believes Galaxy excels. He anticipates the Invesco Galaxy partnership will gain traction over time, despite currently lagging behind competitors like BlackRock in terms of assets under management.

Regarding the potential approval of a spot Ether ETF, Urban expressed a tempered optimism. He anticipates that regulators will take a cautious approach, wanting to observe the performance of spot Bitcoin ETFs before rushing into spot Ether ETFs. Urban suggests that while a spot Ether ETF is likely in the future, it may take longer than some might hope.

Finally, Urban concluded with an optimistic view on the current state of crypto trading. He described it as “exceedingly healthy,” noting significant interest from both crypto-native and traditional finance players. Urban’s observations underscore a growing acceptance and integration of cryptocurrencies into the broader financial landscape, signaling robust activity and interest across the market.

As CryptoGlobe reported, earlier this week, Standard Chartered captured attention with an updated investment note, elevating its end-of-year prediction for Bitcoin (BTC) from $100,000 to $150,000, as detailed in a CoinDesk report from March 18.

The adjustment is based on an investment note distributed that same day, showcasing the bank’s increased confidence in Bitcoin’s price potential, alongside a forecast suggesting BTC could hit a peak of $250,000 next year, eventually settling at around $200,000.

The analysis from Standard Chartered offers an insightful parallel between the current trajectory of Bitcoin and the historical influence of gold ETFs on gold’s valuation. The bank posits that the US launch of spot Bitcoin ETFs might emulate the significant impact seen with gold ETFs, providing a robust framework for predicting Bitcoin’s future pricing.

“The analogy with gold, considering the influence of ETFs and the ideal asset mix, is a reliable method for estimating Bitcoin’s appropriate price in the medium term,” according to the bank’s note. It indicates that should ETF inflows hit or exceed a $75 billion midpoint estimate, or should reserve managers start buying BTC, Bitcoin’s value could potentially soar to $250,000 sometime in 2025.

Expanding its analysis to the broader cryptocurrency market, Standard Chartered predicts the Securities and Exchange Commission could greenlight a spot Ether (ETH) ETF by May 23. Approval could lead to an influx of up to $45 billion in the first year, potentially driving ETH’s price to about $8,000 by the end of 2024, marking a substantial increase from its present trading value of roughly $3,570.

Further into the future, as per an additional note cited by CoinDesk, Standard Chartered projects the ETH-to-BTC price ratio might return to the 7% range seen in much of 2021-22. With a projected Bitcoin price of $200,000 by the end of 2025, this analysis implies an Ethereum price of $14,000.

Featured Image via Pixabay

[ad_2]