On Tuesday, the Bitcoin price plunged from $49,900 to $48,300 following the release of the US inflation data. As NewsBTC reported, the data came in hotter than expected. Instead of 2.9%, headline CPI came in at 3.1%, while the core CPI was even at 3.9% instead of the expected 3.7%.

The traditional financial market reacted negatively and dragged Bitcoin down with it, as expectations for interest rate cuts have shifted further into the future. The prediction markets are now pricing in only 4 rate cuts in 2024 after CPI inflation reached 3.1% in January.

This is a huge drop in expectations as just over a month ago the markets were still pricing in 6 rate cuts. The Fed’s most recent forecast was for 3 rate cuts in 2024. The probability of a rate cut in March is below 10% and the probability of a rate cut in May is falling rapidly.

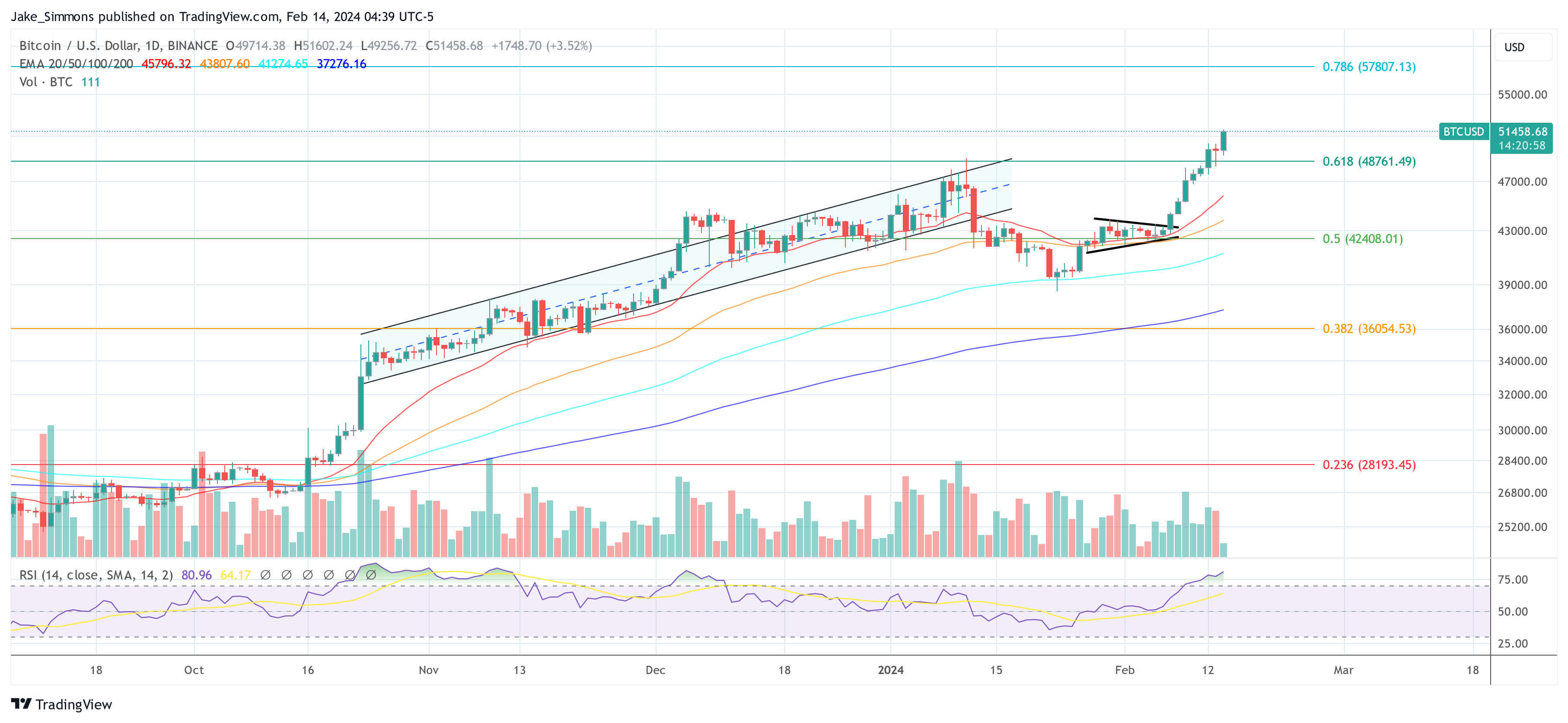

In contrast to the S&P 500, however, the Bitcoin price showed a strong reaction and quickly rose again to $49,900. The reaction of the Bitcoin market is quite telling for the short-term future. And the Bitcoin price is showing just that today. At press time, BTC rose above $51,500, marking a new yearly high. Here are 4 key reasons:

#1 Record-Breaking Bitcoin ETF Inflows

The surge in Bitcoin ETF inflows marks a pivotal moment for Bitcoin, reflecting a significant shift in investor sentiment and market dynamics. On a record-breaking day on Tuesday, the net inflows into spot Bitcoin ETFs reached $631 million, led by The Nine with an inflow of $704 million, signaling a substantial accumulation of Bitcoin.

Key players like Blackrock and Fidelity played a significant role in this influx, with Blackrock experiencing nearly half a billion dollars ($493 million) in inflows and Fidelity $164 million. The overall net inflow of $2.07 billion over four trading days, averaging over half a billion per day, highlights the staggering sustained demand for Bitcoin.

This demand is notably new capital, as GBTC outflows remained stable at $73 million, indicating these inflows are not merely a rotation from GBTC but represent fresh investments. Matt Hougan, CIO of Bitwise emphasized the significance of this movement:

IMHO the [numbers] undercounts the fundamental new investor demand for these ETFs. People assume all of the money flowing out of GBTC to date is rotating into other bitcoin ETFs. But a good chunk of it is from inorganic holders […] Long-term investors have backfilled that and added $3b more on top. I suspect the real new investor-led new demand is north of $5b, and shows no signs of slowing.

#2 Genesis GBTC Liquidation Concerns Alleviated

Fears of a Bitcoin crash, similar to FTX’s sale of GBTC, triggered by Genesis’ planned liquidation of Grayscale Bitcoin Trust (GBTC) shares have been alleviated, as reported today on Bitcoinist. The liquidation, necessary due to Genesis’ bankruptcy, was initially viewed as a potential market downturn catalyst.

The bankrupt lender needs to liquidate approximately 36 million shares of GBTC, valued at around $1.5 billion, as part of its strategy to resolve financial challenges stemming from significant loans and regulatory settlements.

However, the proposed Chapter 11 settlement involves in-kind repayments to creditors, reducing direct selling pressure on Bitcoin. This strategy aligns with the interests of long-term Bitcoin holders, potentially limiting market volatility. Greg Schvey, CEO at Axoni, highlighted:

The proposed Ch 11 settlement requires Genesis to repay creditors in kind (i.e. bitcoin lenders receive bitcoin in return, rather than USD). […] Notably, in-kind distribution was a priority negotiation topic to prevent long-term BTC holders from recognizing gains when receiving USD back (i.e. a forced sale). This would seem to indicate a substantial volume of lenders don’t plan to sell immediately.

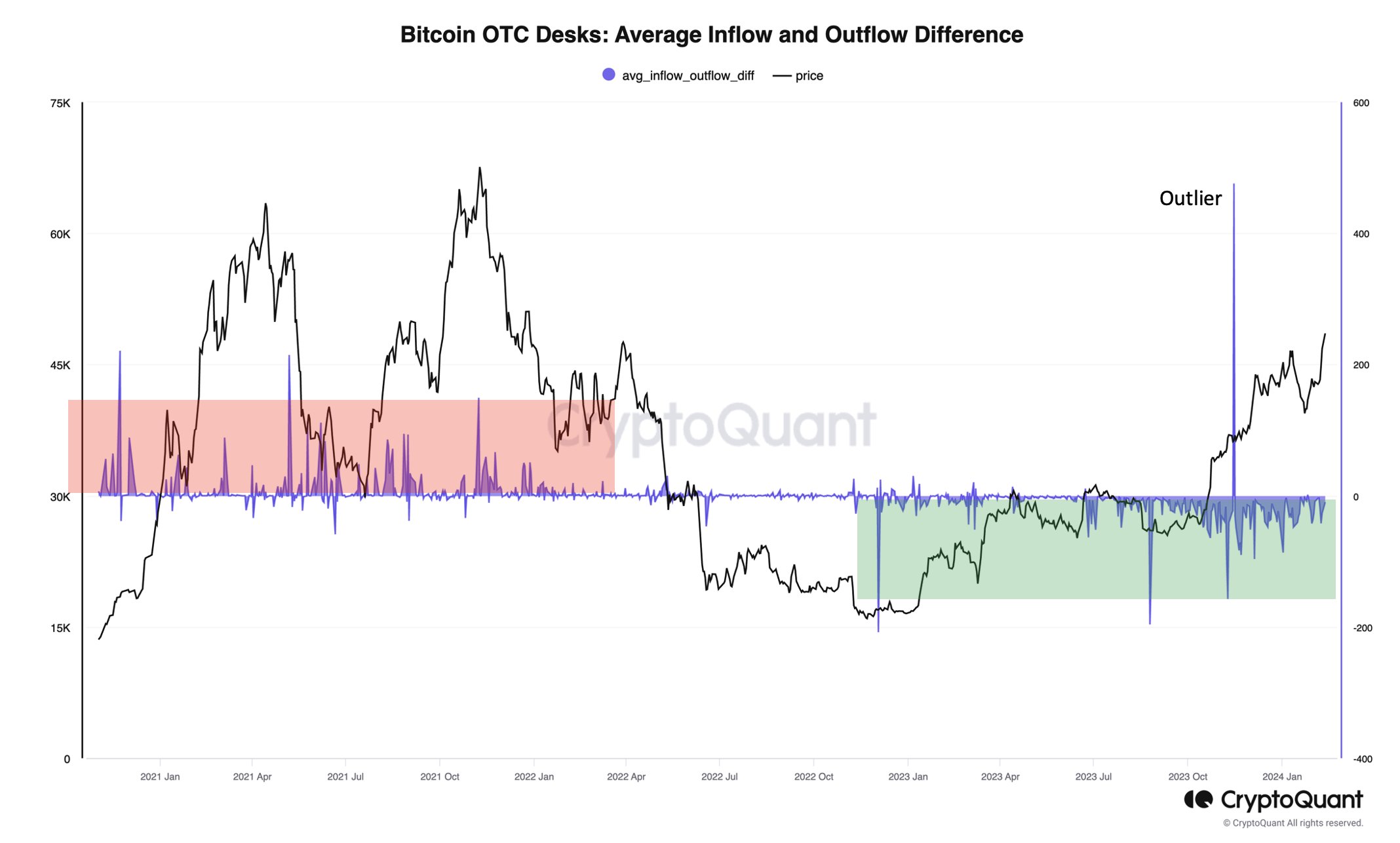

#3 OTC Demand Exceeds Supply

The statement by CryptoQuant CEO Ki Young Ju that “Bitcoin demand exceeds supply at OTC desks currently” is a significant indicator of underlying market strength. OTC transactions, preferred by large institutional investors for their discretion and minimal market impact, are reflecting a robust demand for Bitcoin. This demand-supply imbalance at OTC desks suggests that large players are accumulating Bitcoin, a bullish signal for the cryptocurrency’s price outlook.

#4 Futures And Spot Market Dynamics

The analysis of futures and spot market indicators by @CredibleCrypto sheds light on the technical factors signaling a bullish continuation for Bitcoin. The analyst points out, “Data supporting the idea that that was ‘the dip’. – OI reset back to levels before the last pump – Funding decreasing through this local consolidation – Spot premium is back.”

These observations suggested a healthy market correction rather than the start of a bearish trend, with the reset in open interest and the decrease in funding rates indicating that the market has absorbed the shock and is primed for upward movement.

In conclusion, The combination of record ETF inflows, alleviated concerns over Genesis’ GBTC liquidation, strong OTC demand, and favorable futures and spot market dynamics provides a compelling case for Bitcoin’s potential rally. Each of these factors, supported by expert insights and market data, underscores a growing investor confidence.

Featured image created with DALL·E, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.