[ad_1]

Bitcoin (BTC) is also depleting its OTC reserves available for sale, in addition to exchange reserves. More BTC is flowing into wallets that are less willing to sell, leading to a supply crunch.

Reserves of Bitcoin (BTC) on OTC desks keep dwindling after more outflows in the past weeks. The one source of BTC for whales is depleting fast, in addition to the lowered balances of exchanges. BTC is moving toward accumulation wallets, which may hold longer and remove coins from the open market.

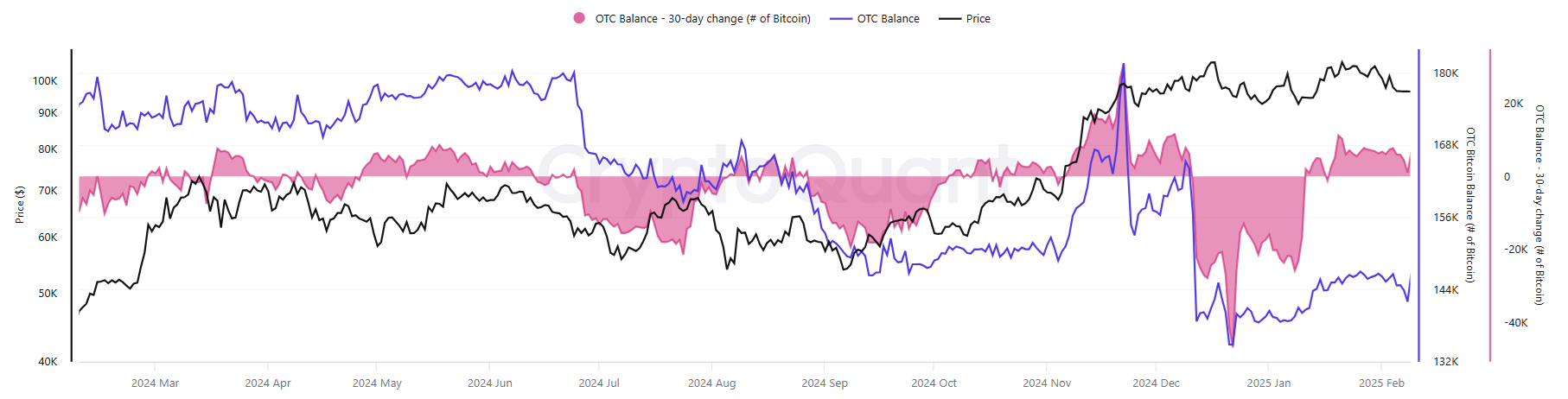

Supply of BTC on OTC desks is dwindling, reviving the narrative of a possible supply crunch. | Source: Cryptoquant

The supply crunch narrative is still around for BTC, especially after the latest halving. OTC desk supply was estimated at around 144K BTC. More coins are held by ETF, which see small daily outflows, but hold onto the bulk of coins acquired to date. The drop in OTC reserves coincided with one of the biggest exchange withdrawals on February 7. The recent market dip led to more whale accumulation.

Recent data also showed the cohort of wallets aged 7-10 years moved 14,000 BTC. The coins, acquired at a lower price range, may still sway their holders decision to realize gains. However, even those coins are not sufficient to raise the easily available BTC. New cohorts of decisive holders are appearing, as some of the older whales start to redistribute their holdings.

Depleted OTC funds may lead to open market buying

BTC still hovered just above $97,000, with no significant rally based on the eventual supply crunch. BTC dominance increased to 58.3% as the asset managed to retain more value in comparison to Ethereum (ETH) and altcoins.

OTC demand may come from corporate buyers, even MicroStrategy’s renewed purchases. The other source of demand is market makers, who can acquire crypto assets through OTC desks, then use them on exchanges to affect the market. OTC purchases do not directly sway the price, but they signal multiple potential sources of demand.

If OTC reserves are sufficiently low, buyers may have to turn to the open market to acquire coins. Those deals would then affect the BTC market price, getting amplified through the derivative market.

One of the reasons for the low OTC balance is the lack of new inflows. During the 2021 bull market, OTC desks saw high demand, but also inflows during market peaks. During the 2024 bull cycle, there are only relatively smaller OTC inflows, which are quickly bought up. This has brought the overall balance to an all-time low.

Overall BTC demand slows down

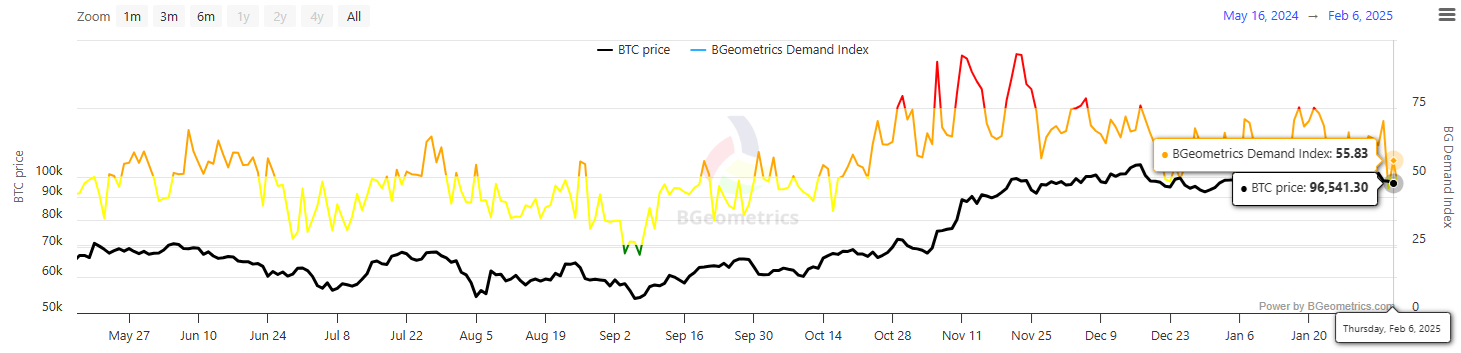

While whales and strategic buyers are still accumulating, the post-election frenzy for BTC is unwinding. BTC demand reached a local peak on November 22, coming down from the hottest level since then.

BTC demand reflects the unwinding of the post-election trade, but demand is still at a higher baseline. | Source: bgeometrics

In the coming weeks, BTC demand may decrease to levels not seen since September 2024. The market has not seen overall FOMO, but both retail and institutions are accumulating tokens more strategically. As demand slowed down, the Bitcoin fear and greed index shifted downward rapidly, sinking to 43 points or the ‘fear’ zone. Most of February has seen fearful trading, after a more bullish sentiment in January.

During recent dips, BTC buying continued, showing demand for controlling actual coins. At the same time, BTC open interest for derivative trading remained relatively flat at $28B. BTC continues the pattern of shaking down derivative positions, while having whales accumulate the remaining available BTC.

BTC spot buying is now slower compared to 2023. Derivative exchanges still take the lead, despite the series of liquidations. At the same time, spot buying is trying to set up a recovery, increasing the spot to derivative trading volume by around 30% in the past months.

The effect may be due to demand for Coinbase trading, coming from US-based buyers. The US dollar still takes up nearly 20% of all BTC trading volumes, showing the effect of US traders.

Demand for BTC remains relatively stable, as altcoins have failed to break out, while memes are seen as short-term trades. With the weakness of Ethereum (ETH), BTC maximalists keep stressing the importance of controlling BTC in a self-custodied wallet. Google searches also show no signs of capitulation, remaining at a relatively high baseline.

[ad_2]