As the broader cryptocurrency market experiences a downturn, Bitcoin (BTC) remains under significant selling pressure, currently trading at $65,685. Meanwhile, silver (XAG/USD) clings to a key support level of $29.00, rebounding as US bond yields come under pressure.

This dynamic economic landscape has led investors to reconsider their options, weighing the benefits of Bitcoin as a growing digital asset against silver’s integral role in emerging technologies and its sensitivity to industrial demand cycles.

Divergent roles in investment portfolios

Bitcoin and silver offer unique opportunities in investment portfolios due to their divergent roles. Bitcoin’s potential for aggressive growth and high volatility makes it an appealing speculative investment. Its decentralized nature and limited supply make it an attractive hedge against traditional financial market instability and inflation.

Additionally, Bitcoin’s growing acceptance as a form of payment and potential for institutional adoption adds to its appeal.

Silver, on the other hand, provides stability and growth potential tied to emerging technologies and global sustainability trends.

Unlike Bitcoin, silver is less volatile and benefits from its dual role as both an investment and an industrial commodity. Its sensitivity to industrial demand cycles and use in high-tech solutions position it for steady appreciation.

Silver also serves as a traditional hedge against inflation and economic downturns, making it a reliable choice for more conservative investors.

ChatGPT’s insights on Bitcoin vs. Silver

In the current economic landscape, characterized by fluctuating interest rates and industrial demand shifts, the debate between Bitcoin and silver is increasingly relevant for investors.

Finbold sought insights from ChatGPT-4o, OpenAI’s advanced AI model, to determine which asset might excel in the coming months. ChatGPT analyzed technical data and market projections to assess which is a better investment option for 2024.

According to ChatGPT, both Bitcoin and silver offer unique investment opportunities with distinct advantages. Bitcoin appeals to those with a higher risk tolerance and a focus on aggressive growth.

Silver, on the other hand, offers a more stable investment option due to its industrial demand and role in emerging technologies. Including both assets in a diversified portfolio could also be a wise approach to balance potential risks and rewards.

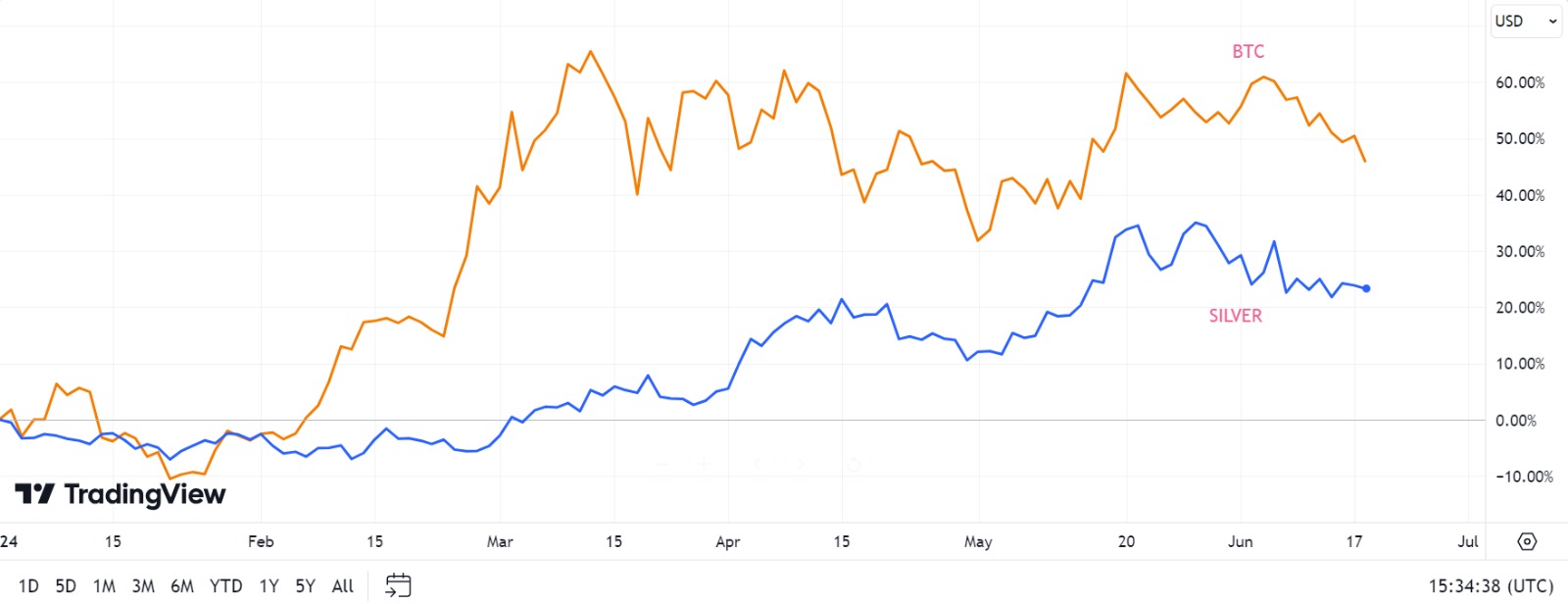

Bitcoin and Silver’s recent price performance

As of 2024, the year-to-date (YTD) performance for Bitcoin and silver presents a clear contrast in investment returns. Bitcoin has seen a significant rise, with an increase of 52.75%, showcasing its volatile yet high-growth nature. The current price of Bitcoin stands at approximately $64,525. In comparison, silver has gained 24% YTD, with its current price at about $29.39 per ounce.

From a technical perspective, both Bitcoin and silver present compelling but distinct opportunities for investors. Bitcoin’s high volatility and potential for aggressive growth make it suitable for those with a high-risk tolerance and a focus on short to medium-term gains. However, its susceptibility to regulatory and macroeconomic factors requires careful consideration of market trends and risk management strategies.

Silver’s 14-period RSI oscillates between 40 and 60, suggesting consolidation and potential stabilization. Trading in a Falling Channel pattern, each pullback is viewed as a selling opportunity, with the 200-period Exponential Moving Average (EMA) at $29.40 being a critical level for potential bullish reversals.

The economic backdrop of slower US Retail Sales growth and speculation of early Federal Reserve rate cuts provides a supportive environment for silver.

In conclusion, investors should align their choices with their risk appetite, investment horizon, and market outlook. Bitcoin offers high reward potential with significant risk, while silver provides stability and growth linked to industrial demand and macroeconomic factors

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.