[ad_1]

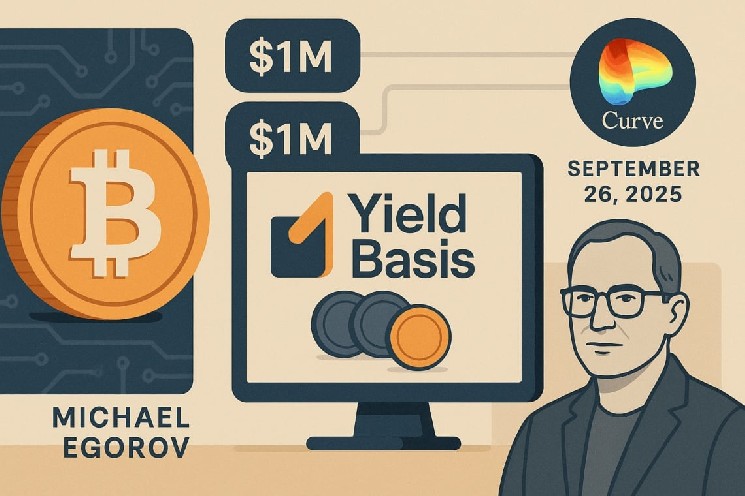

Three capped pools, $1M each, for a total of $3 million. The stated goal is to eliminate impermanent loss (IL) for LPs on Bitcoin on-chain and make the market more suitable for institutional capital.

The initiative — led by Michael Egorov, founder of Curve Finance — starts as a controlled test with incentives tied to real performance.

The news was reported by CoinDesk on September 26, 2025; the project is also noted as the first debut on a joint launchpad supported by Legion and Kraken.

According to data collected by our research team and market analyses, initial capped rollouts tend to limit capital volatility for LPs, especially if accompanied by performance-linked issuance rules.

Industry analysts observe that vote-escrow mechanics and “value-protecting” incentives can reduce exposure to IL in the early stages of limited liquidity; the time references and data cited are updated as of September 26, 2025.

Yield Basis aims to realign incentives and risk for LPs in BTC.

What is Yield Basis and what changes for LPs in BTC

Yield Basis is a BTC yield protocol that reconsiders the traditional model of AMM (automated market maker), which are liquidity pool exchange systems without an order book.

The critical point of classic models remains the impermanent loss (IL): the “unrealized” loss that affects liquidity providers when the price of one asset moves relative to the other in the pool.

That said, the project aims to offer a more efficient yield by reducing IL through a redesigned swap curve and set of incentives.

The promise is to provide a more predictable risk profile for those providing BTC, leveraging the experience gained from years of operations on Curve.

How it attempts to eliminate impermanent loss

The logic of Yield Basis is to reallocate the value within the pool so that, in the event of price divergences, the LP does not suffer the usual erosion from IL. In practice, the price curve and the fees are adjusted to compensate for imbalances, transferring yield towards positions that would otherwise incur the loss.

For example, in a classic BTC/stable AMM, with BTC increasing by 10%, the LP ends up with a smaller amount of BTC compared to someone simply holding bitcoin, sacrificing part of the performance.

In the proposed model, a portion of fees and incentives is structured to bridge this difference, up to eliminating it under target conditions — although deviations may occur in market stress situations or in the presence of high slippage.

Controlled Launch: 3 Capped Pools and Key Numbers

The rollout begins in limited mode to test the mechanics and observe liquidity behavior. The initial parameters communicated are as follows:

- Number of initial pools: 3

- Cap per pool: $1,000,000

- Implicit total cap: $3,000,000

- Funding raised: approximately $5,000,000 (recently, as reported by CoinDesk)

It must be said that the cap for the pool is designed to contain risk in the initial phase, directing participation towards professional operators, pending the completion of audits and a gradual increase in limits.

Governance and tokenomics: veYB, fees, and “value-protecting” incentives

The governance of the protocol adopts a vote-escrow (veYB) model: the YB token must be locked to obtain veYB, participate in decisions, and earn a share of the generated fees.

The fees can be distributed in crvUSD – the stablecoin linked to Curve – or in wBTC (wrapped Bitcoin, meaning BTC tokenized on other chains).

A distinctive aspect of the project is that the emissions of the tokens are not distributed “across the board,” but are tied to the actual performance of the positions, following a “value‑protecting” approach: the incentives reward performance, not just the amount of capital deposited.

Why It Interests Institutional Investors: Comparison with Traditional Lending and AMM

In recent times, BTC lending markets have offered returns below 1% (average value observed in 2025), while numerous AMM pools on BTC/stable pairs have generated returns in the order of 1–2% annually net of IL.

In this context, a model that reduces IL can improve the risk/return profile, making the initiative more attractive for institutional and professional investors.

If IL compensation proves effective, the net yield for an LP on BTC could approach that of a “directional” market making activity, but with significantly lower volatility. However, it remains crucial to monitor the system’s behavior during periods of significant market stress.

Risks, limits, and points to verify

- Smart‑contract risk: technical vulnerabilities or bugs can lead to losses. Thorough audits and bug bounty programs are crucial in the initial phase. To delve deeper into the topic of security, read our article on AI in public administration.

- Design risk: the IL compensation strategy may not withstand extreme price movements or markets with low liquidity.

- Governance: there could be an excessive concentration of voting power if the veYB were predominantly held by a few entities.

- Cap limits: the caps imposed on liquidity reduce the tradable volume and could compress the fees earnable by LPs.

- Asset wrapping: the use of wBTC introduces dependencies on custodians or external bridge mechanisms. For more information, see our in-depth article on BitGo and wrapped Bitcoin.

Possible Extensions: Ethereum and Tokenized Assets

The Yield Basis model could be extended to Ethereum or even to commodities and tokenized stocks, expanding the on-chain assets capable of generating yield with mitigated IL. The effectiveness of such extensions will depend on the available liquidity and the specificity of the pairs traded.

Quick FAQ

Who funded Yield Basis?

The project recently raised approximately $5 million in funding, debuting as the first project on the joint launchpad of Legion and Kraken. Further official details are awaited.

What is the role of YB?

YB is the native token of the protocol. Users lock it to obtain veYB and access governance functions, earning a share of the fees related to the performance of the positions.

How are the fees paid?

The fees for eligible parties can be distributed in crvUSD or wBTC, depending on the configuration chosen by the governance.

Timeline and Next Steps

- Initial rollout: ongoing with 3 capped pools (status updated as of September 26, 2025).

- Cap/liquidity expansion: expected after the completion of audits and risk assessments.

- Roadmap governance: definition of parameters related to veYB (lock duration, multipliers) and schedule of emissions.

[ad_2]