An extraordinary reveal: Mining was never banned in China.

Yes, you read that right. In fact, not only was it not banned, but Chinese miners are leading the world in innovative uses of Bitcoin mining.

But what of this Reuters report and others that says it was banned?

Let’s have a closer look.

Yes, network hashrate dropped from 179.2 EH/s to 87.7 EH/s (a 51.1% drop) seemingly confirming that China banned mining.

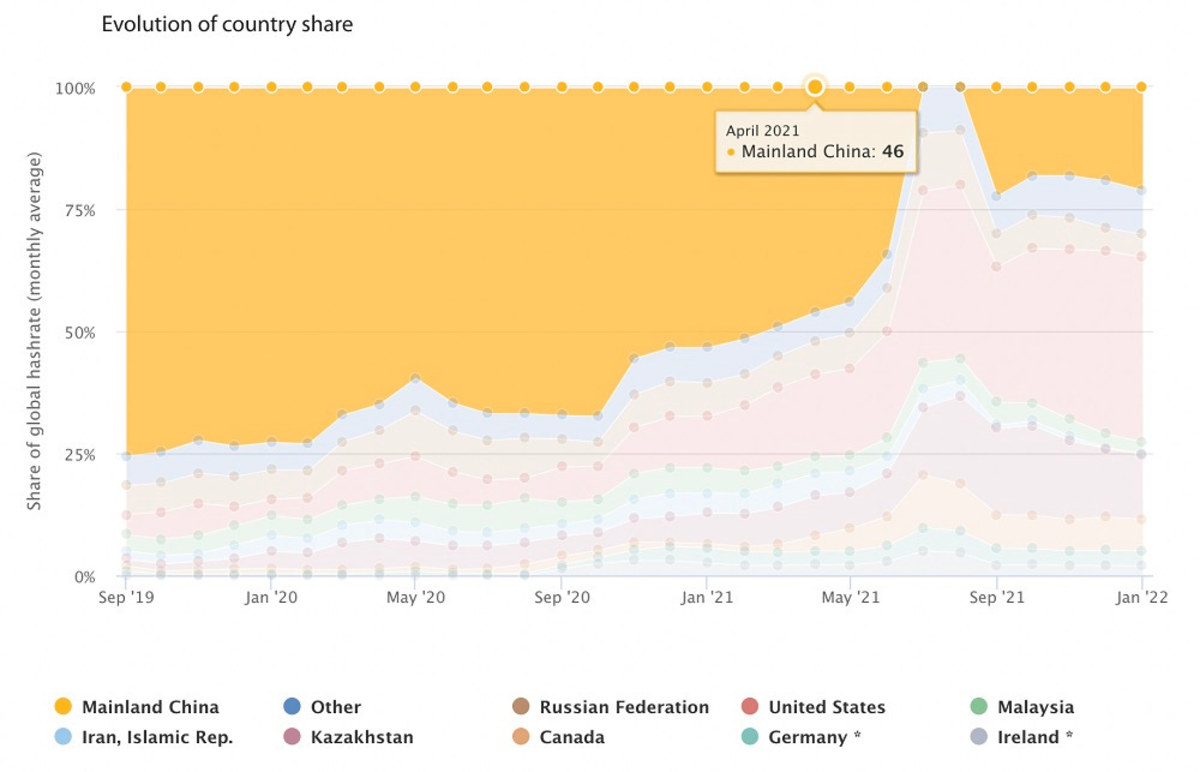

After all, China was according to Cambridge 46% of global hashrate the month prior to the “ban” (April 2021). So the figures roughly tally up with the thesis that “mining has been banned in China.”

But there’s a big gap in this logic. If you are a disruptive student, and the principal sends you away from school, those “days absent from school” don’t mean you’ve been expelled. It could mean you’ve merely been suspended. Turns out that’s exactly what happened in China.

Here’s how we know.

1. Investigative reporting

Let’s start with the mainstream news reports.

First, NBC reported in May 2021 that at least some miners were “unfazed” by the latest “ban”.

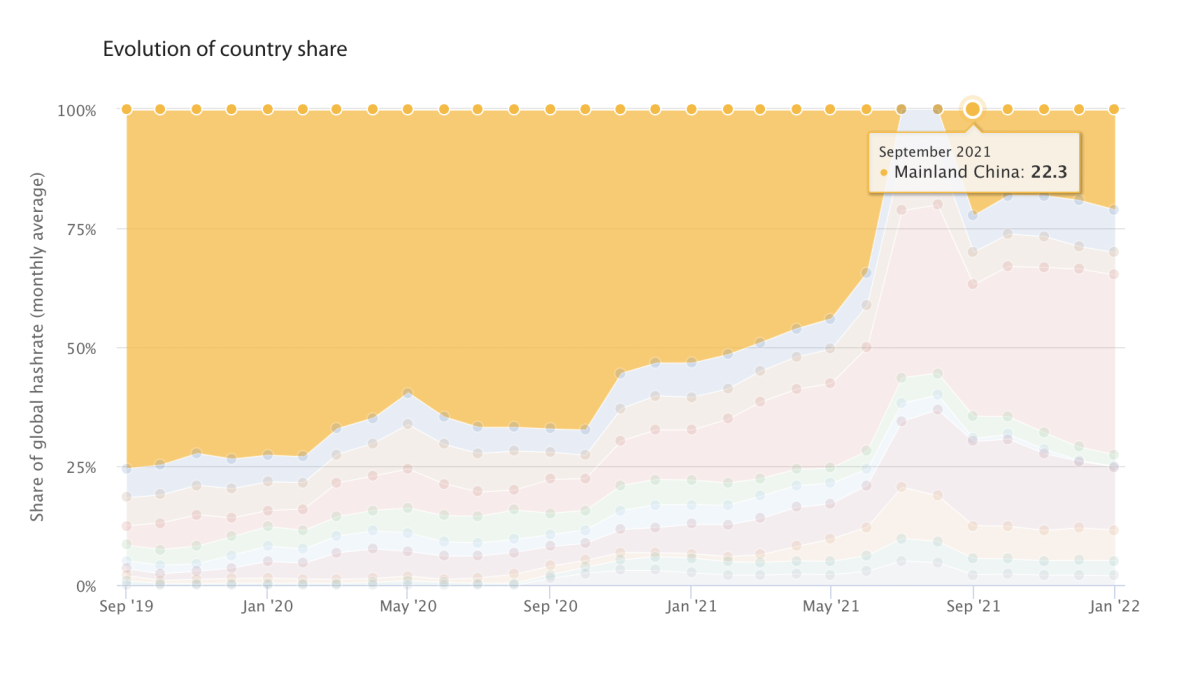

The New York Times then reported a “ban” in China in September 2021, citing this policy disclosure from the Chinese Government (more on that later), even though that same month, publicly available data from Cambridge showed that mining activity had already bounced back to 22.3% of global hashrate.

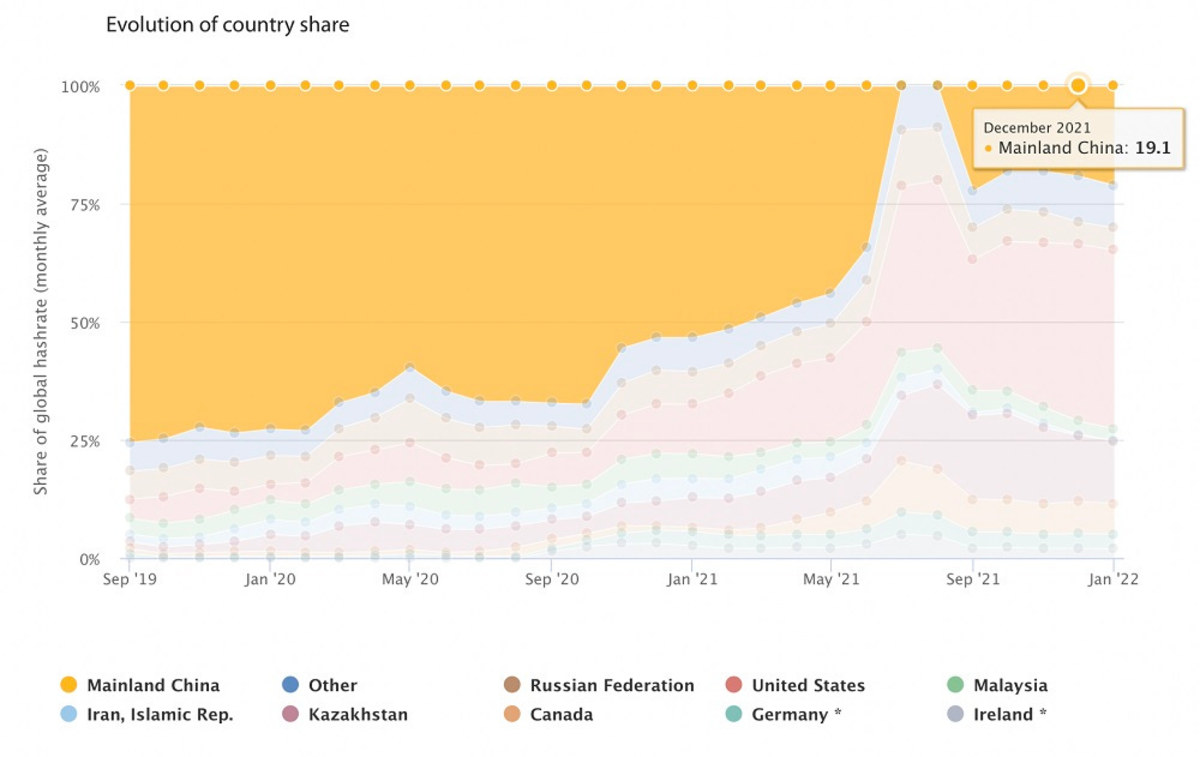

Cambridge data showed that by Dec 2021 China was still at 19.1% of global hashrate.

It wasn’t until May 2022 that CNBC ran a full report on the significant Bitcoin mining hashrate still operating within China, even though this data had been publicly available to all media outlets since September 2021.

Apart from the New York Times piece, the evidence points to mining never being banned, merely suspended. Let’s look more closely then at the New York Times article and the document they cite as evidence for a ban.

2. Our surprising find in Chinese legislation

When I read the document the New York Times used as evidence for a ban, it did not support their interpretation.

The Chinese policy document of 24 September 2021 does not legislate a ban, but rather a moratorium on the establishment of any new mining sites, plus a “signal of intent” (but not a ban) to “at some stage” grandfather existing mining activity (which three years later has still not occurred).

Regarding the statement of intention: the policy says that bitcoin mining sites are something that should be gradually eliminated, because it does not support the Chinese Government’s carbon neutral goals. Other reasons stated are that it is easy to use for money laundering and a high user of electricity.

Cultural factors not taken into account by the New York Times

In China, it is common that policy says one thing, but what is implemented is very different

As a general rule, in the more developed cities, the letter of the law will be carried out literally. However, in smaller cities and regions, this is seldom the case.

For example, officially in China there is a policy where all banks must by law reduce the steps their customers go through to get any legal certified documents.

However, in most cities, private banks don’t follow the regulation, the opposite is practised. For example, if a parent or spouse dies and you need to get the leftover amount in their bank account, the bank can say “your death certificate is not enough”. There have been cases of the bereaved needing to bring the dead body to the bank to prove it. I kid you not.

More developed cities will follow the letter of the law. But in China, most mining activity is now happening in Inner Mongolia, far from the large developed cities. In these regions what matters culturally is not the government regulations but your network. If you have the right network you can do “this and that” to go around the legislation.

So in summary:

1. Mining was never banned, rather there was a moratorium on new mining and unfriendly overtures about grandfathering existing mining facilities at some point.

2. Fossil fuel use was the stated primary reason (though we know from inside sources within the Communist party that while this was definitely a factor, capital control was the primary reason). Energy policy expert Magdalena Gronowska has cross-validated this.

3. Apart from coal-based mining, the moratorium was never implemented in the more secluded regions. There, new mining activity has come online.

4. The New York Times did not accurately portray the Chinese policy document, lacked an appreciation of cultural factors that rendered even the moratorium something that may not be widely enforced, and failed to cross-check publicly available hashrate records which would have told them that mining activity was still occurring on a large scale in China.

This would not be the first time there has been a discrepancy between what is reported and what actually happened in Bitcoin mining ban stories. News reports of “bans” in Paraguay (it wasn’t, it was a clamp-down on power-theft), and New York (it wasn’t, it was a two year moratorium only on new fossil-fuel based mining) were similarly overstated.

Then just this month, numerous media outlets even within the crypto-community reported that Venezuela had banned bitcoin mining “to protect the power-grid”, even referring to the government’s action as “an anti-corruption initiative.”

However, it turns out the source of power outages were due to widespread corruption (theft of power within government) that led to the well documented case of Venezuela’s State Owned energy company PDVSA being unable to deliver enough power to stabilize their own grid. For context: Venezuela is tied for second worst out of 180 nations on Transparency International’s corruption index, over time trending more corrupt not less.

But back to China. Sebastian Gouspillou, CEO of BigBlock who is experienced in mining matters in China, gave permission for us to include his own take on this: “They cut the mining and then started it again after a few weeks. But not everywhere; only where it was useful.”

3. Interviews with players in the bitcoin mining industry

In total, we talked to four independent mining organizations operating in China (HashX_Mining, and three others who wished to remain anonymous). What’s interesting is that none of them say they are “risking it all” as a CNBC news article dramatically suggested, but rather are actively encouraged by Chinese authorities to help solve different energy challenges.

We discovered that Bitcoin mining is not only occurring in China, but miners are actively using the positive environmental externalities of Bitcoin mining, particularly heat recycling and stranded renewable energy monetization.

For context, the first reported examples of heat recycling from Bitcoin mining were in Canada as early as 2018. Since then, heat recycling has emerged as a major way that Bitcoin mining (basically an electric resistance heater that mines Bitcoin) can lessen the need for fossil fuel heating. China has joined the heat recycling party.

One mining distributor confirmed: “With the downturn in the Chinese economy, some heavy industry has left Inner Mongolia and Xinjing province. As a result, there is often an oversupply of electricity.” Chinese authorities have invited Bitcoin mining companies to fill the void, to stop renewable energy being wasted.

These Bitcoin mining operations in Inner Mongolia are typically only 200-500 miners (~1 MW), and all using either hydro, wind or solar energy.

Think of Inner Mongolia as the Texas of China. Like Texas it had a fossil fuel past, but is now pushing for renewable energy solutions faster than any other part of the country (reportedly 57% of the country’s wind farms). And like Texas it has needed and wanted Bitcoin mining to help monetize wasted renewable energy and counterbalance renewable intermittency.

So why did China suspend mining operations in the first place, and why are the ones they let back mostly smaller and renewable energy based?

Capital controls

Large scale bitcoin mining was problematic for China. It offered a way to get money out of China. Large operations turned Yuan into Bitcoin, then Bitcoin into USD. A second reason, but not as important: large operations were often using coal factories. This endangered the government’s emission targets.

The original miner suspension represented a chance to clamp down on capital flows out of the Yuan. By allowing mining companies with 200-500 units to monetize wasted renewable energy, it helps China stabilize grids and monetize wasted renewable energy without the danger of large capital outflows.

Special thanks again to Dan Leslie from @HashX_Mining, Sebastian Gouspillou, CEO of Big Block, Magdalena Gronowska, partner at Metamesh and two Chinese nationals who wished to remain unnamed in compiling this special report.

——-

Additional Context

(Optional details we can add in if of interest to write up something more in-depth. Alternatively if we want to keep it tightly focused on the “ban that wasn’t”, we can leave all this out)

Other reveals from our interviews with Chinese mining companies.

- While a lot of hashrate migrated to other countries (US initially, Ethiopia more recently), a lot of new hashrate has also come into China since the China “ban”

- No offgrid coal-based mining occurs any more. It’s too easy to spot, it competes for baseload energy and interferes with Central Govt’s emission targets. This has caused a significant reduction of the emission intensity of Chinese mining post-”ban”.

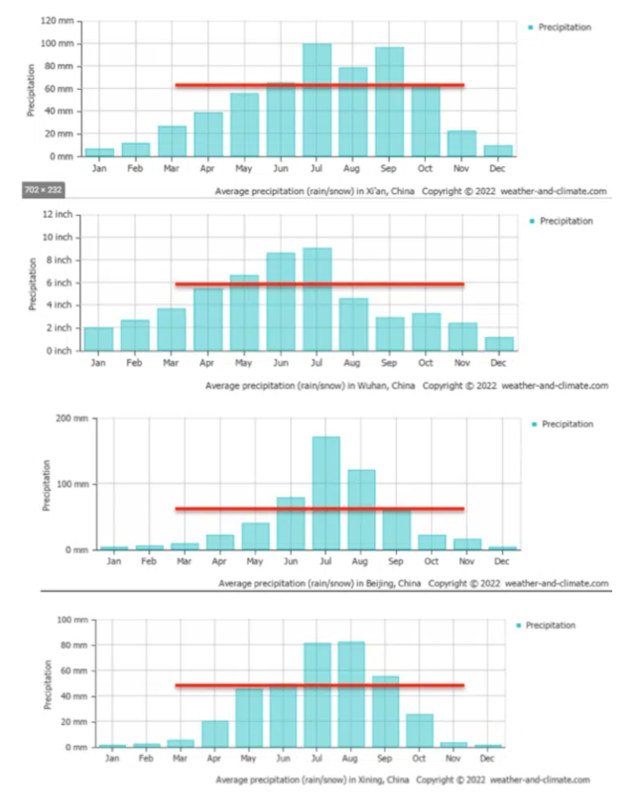

- Mining is mostly hydro, micro-hydro (particularly in the wet season). The areas above the red line are very wet months for 4 regions: Xi’an, Wuhan, Bejing and Xining, where hydro becomes incredibly cheap.

But we also uncovered a lot of ongrid mining and, more surprisingly, a lot of retail ongrid mining.

- Retail ongrid miners mine at a loss, because they pay, well, retail electricity rates. Why would they mine at a loss? Simple: to get money out of China, or out of the Yuan into USD. They convert Chinese Yuan for ASICS and electricity which creates BTC, which gets converted into USD. Many retail miners are happy to take the profitability hit simply to have a way to convert Yuan to USD.

- Local provincial govt often supports what Central Govt does not, because it’s economically advantageous to do so. We heard more than one story where the provincial govt gave an effective “licence to mine” in return for the rights to use their recycled heat.

For example, one 13 MW mining operation, an example of that new hashrate, works in tandem with the Provincial Govt. They buy electricity from them and in return the govt gets the right to use their recycled heat for free. Because 95% of the energy from Bitcoin mining is disbursed through heat, this is almost as effective as getting heating for free. What do they use that (free) heat for? Heating water for fish farms.

This is a guest post by Daniel Batten. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.