Marathon Digital sold debt to buy bitcoin, after BTC mining profits deteriorated this year.

The miner is following Michael Saylor’s footsteps in using borrowed money to add BTC to its balance sheet.

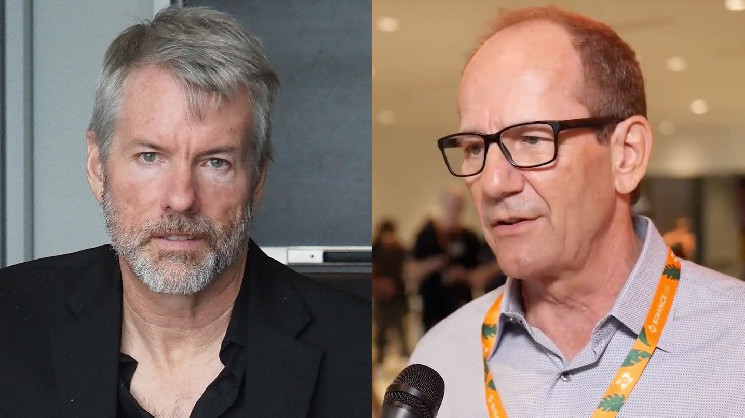

Billionaire Michael Saylor famously pioneered large-scale corporate purchases of bitcoin (BTC), using borrowed money to turn his publicly traded software developer MicroStrategy (MSTR) into one of the world’s largest holders of the cryptocurrency.

Now, another company – a surprising one – is following a similar strategy. It’s a bitcoin miner, a company that can theoretically snag discounted BTC through mining. The fact that it’s following Saylor’s playbook, selling debt to fund bitcoin purchases, not using that borrowed money to buy equipment to mine more coins, puts a spotlight on how tough the mining sector has gotten this year.

The miner is Marathon Digital (MARA), which this month sold $300 million of convertible notes, or bonds that can be turned into stock, and purchased 4,144 bitcoin with most of the proceeds.

Rather than purchase more mining rigs, “given the current mining hash price, the internal rate of return (IRR) indicates that purchasing bitcoin using funds from debt or equity issuances is more beneficial to shareholders until conditions improve,” the largest publicly traded miner posted recently on X. “Hash price” is a measure of mining profitability.

MicroStrategy’s bitcoin accumulation strategy was widely criticized when prices crashed in 2022, putting the company’s stake underwater. No one is laughing now, given MicroStrategy’s bitcoin hoard is worth billions more than the company paid.

Read more: Michael Saylor’s MicroStrategy Bitcoin Bet Tops $4B in Profit

MicroStrategy and Marathon’s paths in the stock market were largely similar after Saylor began buying bitcoin in 2020. Both were essentially a proxy for bitcoin’s price – an attractive quality in the era before bitcoin ETFs were approved early this year.

But this year, there’s been a massive divergence. MicroStrategy’s stock has soared 90% as it continued to track bitcoin’s price. Marathon has plummeted about 40% as the mining business got much harder. The Bitcoin halving in April slashed the reward for mining bitcoin in half, substantially reducing miners’ primary source of income.

Read more: Bitcoin Halving Is a ‘Show Me the Money’ Moment for Miners

Amid that plunge, Marathon adopted a “full HODL” strategy of keeping all the bitcoin it mines – and raising money to buy more.

“Adopting a full HODL strategy reflects our confidence in the long-term value of bitcoin,” Fred Thiel, Marathon’s chairman and CEO, said in a statement last month. “We believe bitcoin is the world’s best treasury reserve asset and support the idea of sovereign wealth funds holding it. We encourage governments and corporations to all hold bitcoin as a reserve asset.”

Not long after debuting that HODL strategy, it announced the $300 million debt offering. Marathon now owns more than 25,000 bitcoin, second only to MicroStrategy among publicly traded companies.

Profit squeeze

The share price divergence between MicroStrategy and Marathon isn’t a surprise, given the woes in mining. The industry is overcrowded, more competitive and facing increased costs. To make matters worse, the Bitcoin network’s hashrate and difficulty – two measures of how hard it is to create new bitcoin – are getting higher.

JPMorgan recently said that mining profitability fell to all-time lows as the network hashrate rose in the first two weeks of August, while hashprice (the average reward miners get per unit of computing power they direct toward mining) is still around 30% lower than the levels seen in December 2022 and about 40% below pre-halving levels. Miners are now so stressed that they’ve been forced to pivot from purely being miners – once a highly profitable strategy – to diversifying into other ventures such as artificial intelligence just to survive. Swan Bitcoin, a miner, even just canceled its initial public offering and shut down some of its mining business due to a lack of revenue in the near term.

“At current hashprice levels, a meaningful proportion of the network is still profitable, but only marginally,” Galaxy Research said in a note on July 31. “Some miners on the fence may continue to operate because they can generate positive gross profits. However, when factoring in operating expenses and additional cash costs, many miners find themselves unprofitable and slowly running out of cash,” the report added.

Read more: Bitcoin Mining Is So Back (Except It’s AI Now)

Moreover, the January launch of bitcoin exchange-traded funds in the U.S. gave institutional investors that don’t want to buy cryptocurrencies, yet still want crypto investment exposure, a more direct route than buying stock in bitcoin miners. After the rollout of ETFs, short selling the miners and going long on ETFs became a prevalent trading strategy among institutional investors, essentially capping the share price appreciation of the miners.

To stay competitive and to survive the squeeze, miners have few choices besides diversifying. Even if a miner with a strong balance sheet like Marathon wants to stay a pure-play mining company, it needs to either invest more capital into an already capital-intensive business or buy competitors. Both options take time and come with significant risk.

In light of that, it’s not hard to see why Marathon took a page out of MicroStrategy’s successful playbook and bought bitcoin in the open market.

“During periods of significant price appreciation, we may focus solely on mining. However, with bitcoin trending sideways and costs increasing, which has been the case recently, we expect to opportunistically ‘buy the dips,'” Marathon said.

Nishant Sharma, founder of BlocksBridge Consulting, a research and communications firm dedicated to the mining industry, agrees with Marathon’s BTC accumulation strategy. “With bitcoin mining hashprice at record lows, companies must either diversify into non-crypto revenue streams like [artificial intelligence or high-performance computing] or double down on bitcoin to capture investor excitement around an anticipated crypto bull market, similar to MicroStrategy’s approach,” he said.

“For MARA, the largest bitcoin producer, it makes sense to choose the latter: HODLing bitcoins mined at lower costs than the market rate and raising debt to buy more, increasing its BTC stockpile.”

Return of debt financing?

Marathon’s bitcoin buying isn’t new. The miner bought $150 million worth of bitcoin in 2021. What’s new is Marathon used convertible senior notes, a type of debt that can be converted into the company’s shares, to raise money to buy more BTC – similar to MicroStrategy’s strategy. According to Bernstein, Saylor’s company has raised $4 billion to date to buy bitcoin, which helped the company benefit from potential bitcoin upside while having a lower risk of being forced to sell the digital assets on its balance sheet – a strategy that seems to have resonated well with institutional investors.

Additionally, convertible debt tends to cost companies relatively little and avoids immediately diluting the equity stakes of shareholders like a stock offering would. “With bitcoin prices at an inflection point and anticipated market tailwinds, we see this as an opportune moment to increase our holdings, employing convertible senior notes as a lower-cost capital source that is not immediately dilutive,” said Marathon.

The miner offered its notes at a 2.125% interest rate, cheaper than current 10-year U.S. Treasury rate of 3.84% and comparable to MicroStrategy’s latest raise at 2.25%. The miner was able to offer such a low rate and still attract investors because investors get the steady income from the debts and retain the option to convert the notes into equity, tapping into potential upside of the stock.

“The advantage of convertible notes over traditional debt financing is that $MARA will be able to acquire a much lower interest rate than they otherwise would due to the fact that the notes may be converted into equity,” Blockware Intelligence said in a report.

Being able to raise debt at a cheap interest rate also helps Marathon shore up its war chest for potential acquisitions. “The bitcoin mining industry is in the early phases of consolidation, and the natural acquirers are the companies with large balance sheets,” said Ethan Vera, chief operating officer or Luxor Tech. “Adding a Bitcoin balance sheet position allows companies to raise capital with a clear use of funds, while preparing their balance sheet for potential M&A.”

In fact, such debt financing could make a comeback for the entire mining industry, after disappearing from the market during the crypto winter as many miners defaulted on their poorly structured loans. “Previously, debt financing options available to miners were primarily structured around collateralizing ASICs,” said Galaxy, adding that lack of liquidity on those loans after the 2022 price collapse hurt the entire sector. Other miners tapping into debt markets recently also include Core Scientific (CORZ) and CleanSpark (CLSK).

“We believe the industry is in a much better position now to take on some debt and not rely solely on equity issuance for growth,” Galaxy said.

Read more: Bitcoin Bottom Is Near as Miners Capitulating Near FTX Implosion Level: CryptoQuant