[ad_1]

As bitcoin trades at $81,626—just shy of the $82,000 mark—disparities in mining costs among leading public firms expose striking operational differences, with some companies extracting bitcoin at a fraction of the network’s estimated average.

Mining Bitcoin for Profit? It Depends on Who’s Paying the Power Bill

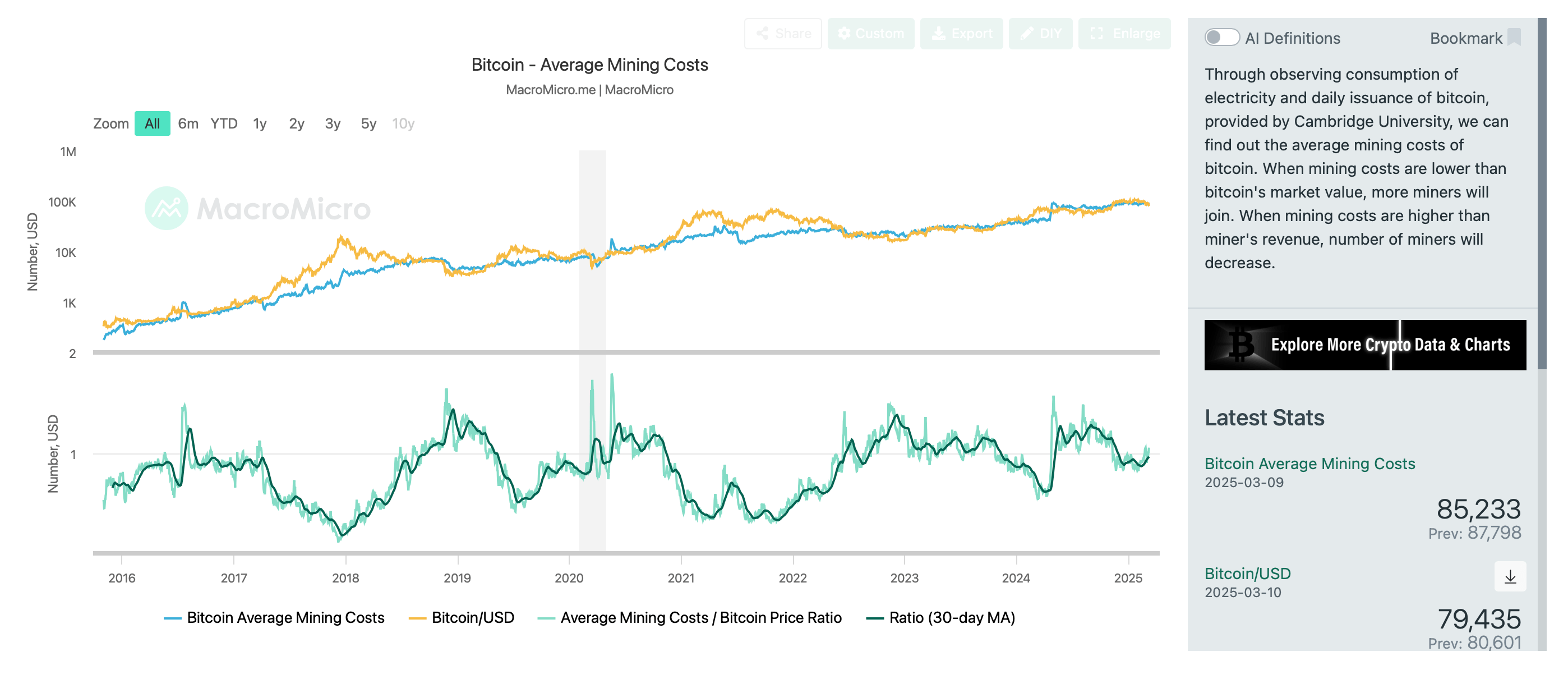

On March 11, 2025, bitcoin’s spot price settled at a low of $81,626, bringing mining profitability into focus. Data provider Macromicro.me placed the average cost to mine one BTC at $85,233 as of March 9, a figure based on electricity consumption models. However, this estimate stands in stark contrast to the self-reported expenditures of major publicly traded mining firms, where per-coin costs vary widely—from as low as $21,000 to more than $48,000. This cost range, spanning from $21,000 to over $48,000, is derived from an analysis of roughly 280 distinct reports and financial disclosures.

Macromicro.me cost statistics have a one day lag.

Macromicro.me, however, derives its estimates and calculations using the Cambridge Bitcoin Electricity Consumption Index, which assumes a global electricity rate of $0.05 per kilowatt-hour (kWh). By applying this rate to Bitcoin’s annualized power consumption—approximately 176.69 terawatt-hours—the platform estimates an electricity-only cost per BTC. However, this calculation excludes crucial operational expenses, such as the type of hardware, labor, and maintenance, offering a narrow view of total mining costs.

The $85,233 figure, reported on March 9, likely reflects an extremely broad operational outlook, and the site’s reliance on a one-day data lag and limited metrics reduces its relevance for individual firms. Many miners operate below this threshold. MARA, the industry’s largest publicly traded mining company by market capitalization, disclosed a per-coin production cost of $28,801 in its Q4 2024 earnings. This figure, sourced from U.S. Securities and Exchange Commission (SEC) filings and earnings calls, reflects the efficiencies gained through energy procurement strategies and scaled operations.

In contrast, Hive Digital Technologies reported a Q1 2024 mining cost of $48,308 per BTC, highlighting the financial strain associated with high-cost operations. Among the 12 publicly listed mining firms examined, only a handful—including MARA and Riot Platforms—provided transparent cost breakdowns. For companies that did not disclose direct mining costs, our research applied a $25,000 per BTC estimate, based on an aggregation of 280 data points, including earnings reports and Canaccord’s 2025 mining sector analysis.

While these estimates encapsulate typical expenses for large-scale miners, they fail to account for firm-specific factors such as energy contracts and geographic advantages. MARA’s $28,801 cost, outlined in its Q4 2024 report, reflects investments in energy-efficient infrastructure. Riot Platforms reported a per-coin expense of $21,482 in its June 2024 filing, benefiting from Texas-based power credits and immersion cooling technology. Meanwhile, Hive’s $48,308 cost—calculated from its Q1 2024 revenue and production data—suggests difficulties in balancing renewable energy commitments with operational expenditures.

For the remaining firms, estimated costs in the $25,000 to $30,000 range indicate a moderate profitability margin at bitcoin’s current price. Cleanspark, for example, reported a per-coin cost of $21,400 for wholly owned facilities in its FY 2024 report, though additional corporate expenses likely push its effective cost higher. This cost disparity reveals a fundamental divide: miners operating below $25,000 per BTC maintain a comfortable buffer, while those exceeding $30,000 contend with narrowing margins.

With bitcoin trading 2.3% below Macromicro.me’s $85,233 estimate yet well above many firms’ actual costs, profitability ultimately depends on operational discipline. Marathon and Riot, for instance, could sustain profitability even if bitcoin dropped to $28,000, whereas Hive and several other miners would require prices above $48,000 to avoid losses. As of the second week of March, the data makes one thing clear—bitcoin mining remains an industry of stark economic contrasts.

[ad_2]