[ad_1]

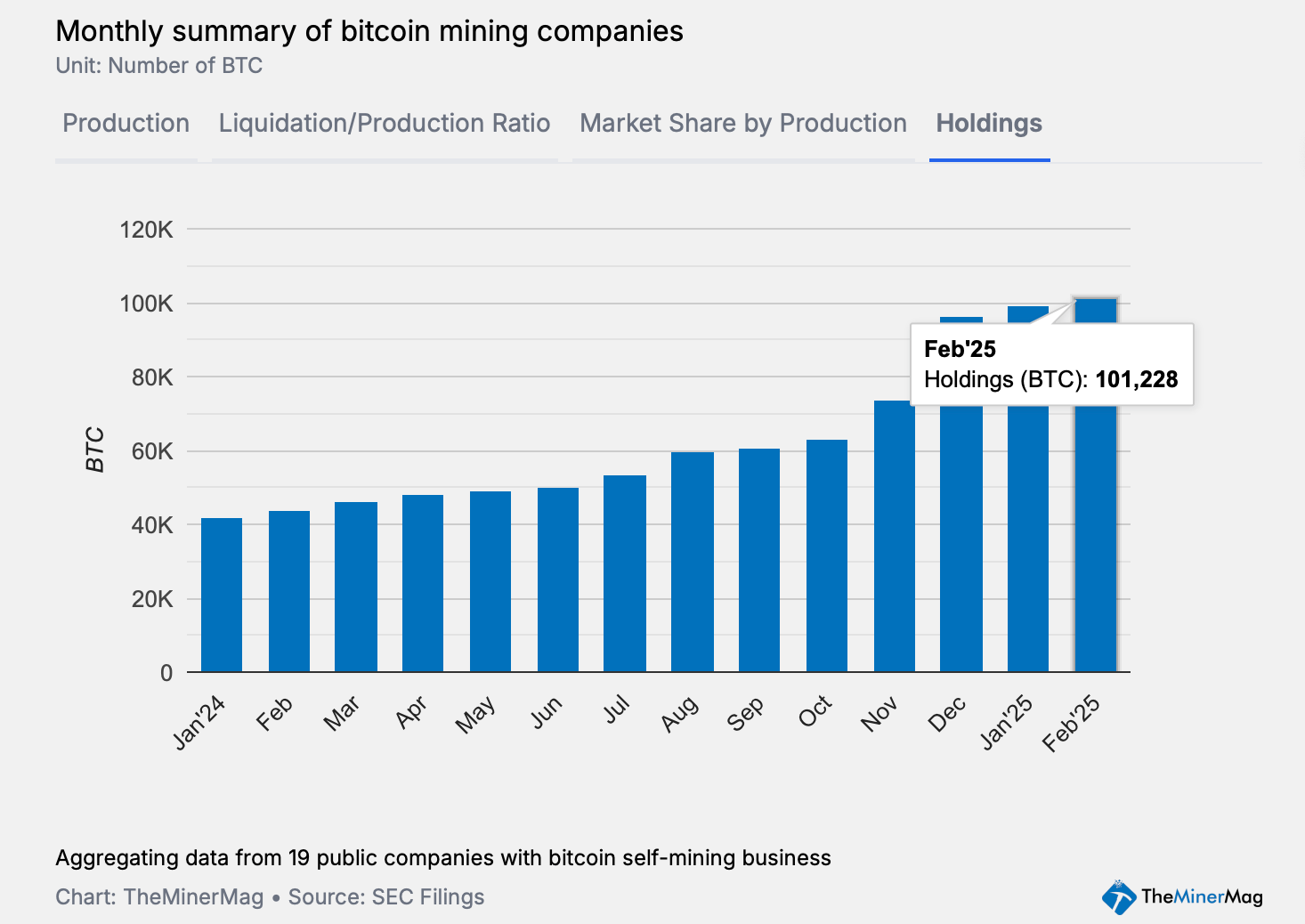

According to a recent report, bitcoin mining companies privately run or traded on the stock market now hold over 100,000 BTC in their accounts. But there’s a catch — these businesses have also taken on a hefty $4.6 billion in debt.

Bitcoin Miners Walk Debt Tightrope With 100K BTC in Hand

This past Friday, all ten leading bitcoin mining companies listed publicly climbed higher, with Applied Digital stealing the spotlight thanks to an 11.46% jump. Moreover, theminermag.com, a Blocksbridge Consulting news, data, and research platform, published a report this week on the current state of bitcoin miners.

The analysis highlights that among 14 firms spanning private and public sectors, all closed out February with a combined 101,000 BTC. According to theminermag.com’s findings, companies like Cango, Core Scientific, Hut 8, Riot, Cleanspark, and MARA have all faced double-digit declines since January.

Source: theminermag.com

This collective BTC stash now holds a value of $8.51 billion based on current exchange rates. Meanwhile, the report also reveals that publicly traded bitcoin miners have racked up $4.6 billion in debt financing.

“With Bitcoin’s hashprice—daily revenue per unit of computing power—falling below $50/PH/s again, hitting $45/PH/s during the recent market downturn, it will be interesting to see how these dynamics shift, particularly for companies colocating their equipment,” theminermag.com analysis states.

Bitcoin’s hashprice? Think of it as the estimated daily earnings a miner can pocket from one petahash per second (PH/s) of SHA256 hashing power. Flashing forward to March 15, 2025, the hashprice clocked in at $47.85 per PH/s. Since Feb. 15, the hashprice has slid 11.84% over the last 30 days.

[ad_2]