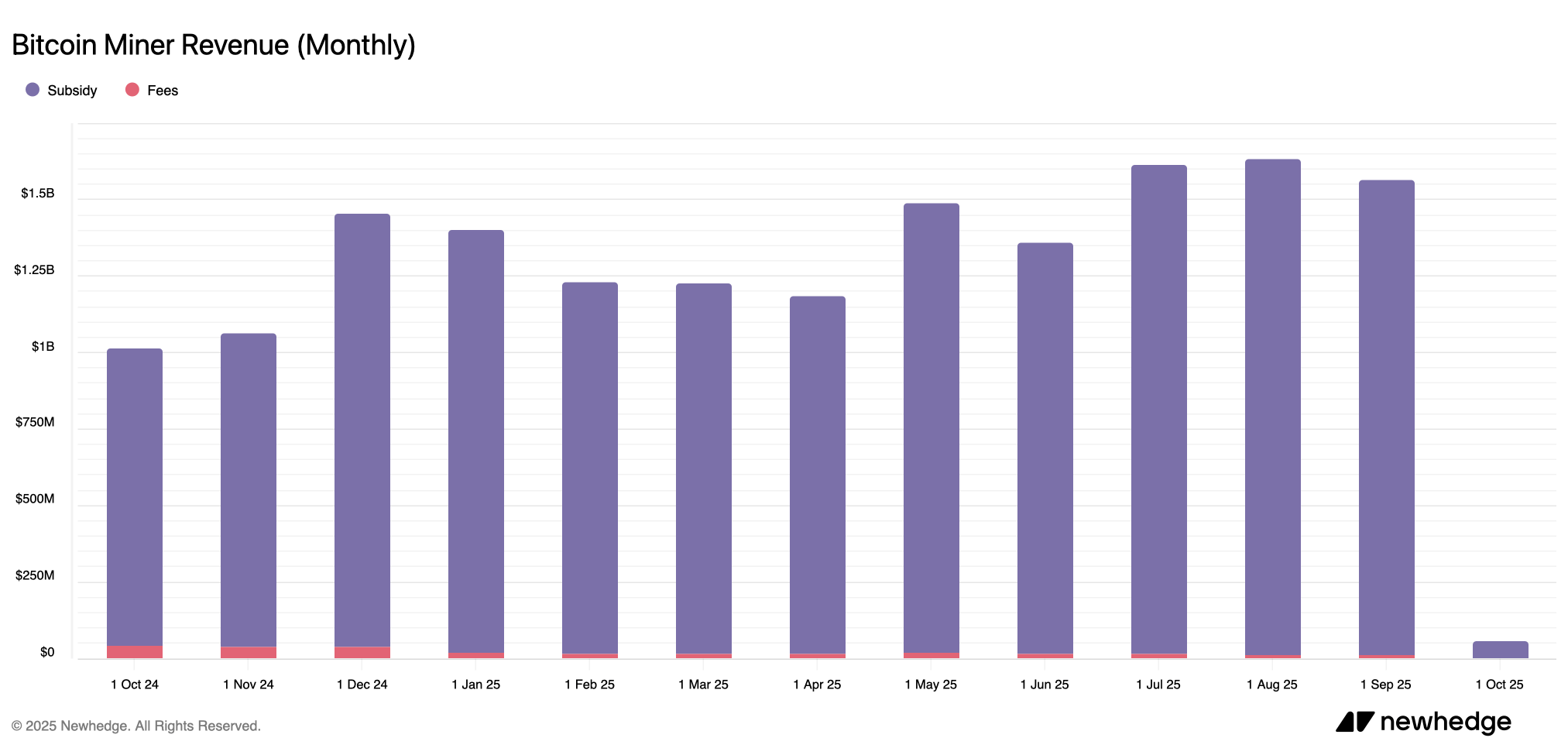

Bitcoin miners had a modest September slump, watching revenue shrink 4.23%—that’s $69 million gone compared to August’s haul.

September Slide for Bitcoin Mining Revenue

At the time of publication, hashrateindex.com data shows the spot valuation of one petahash per second (PH/s) of SHA256 hashrate stands at $52.10—a modest decline from the $53.15 figure documented on Sept. 1. September wasn’t exactly golden for bitcoin miners—revenue slipped by $69 million from August, landing at $1.564 billion.

Nearly all of it ($1.550 billion) came from good old block rewards, while a modest $14 million trickled in from onchain fees, according to figures collected by newhedge.io. Essentially, bitcoin miners went from raking in $1.633 billion in August—$13 million of that from transfer fees, to last month’s total.

Image source: newhedge.io

September’s metrics similarly trailed July’s totals, as mining operations collectively garnered $1.61 billion—with block subsidy alone constituting $1.595 billion of that sum. Onchain fees are still low, and miners get less than 1% of total rewards from fees, and the 24-hour average was 0.65% of block reward aggregates.

Even with revenue taking a hit, miners aren’t slowing down—the hashrate is flexing at 1,065.53 exahash per second (EH/s), miles above where it stood just 30 days ago. In September, Bitcoin’s computational prowess reached a zenith of 1,109 EH/s, while today block intervals clocked in considerably swifter than the standard ten minutes—averaging nine minutes and 26 seconds.

The blistering pace has miners chewing through the 2,016-block epoch faster than planned, setting the stage for a possible 4.63% to 5.9% difficulty hike expected today. Of course, that estimate isn’t set in stone—it could tip either way once the blocks fall into place. With revenue sliding and difficulty climbing, only the leanest rigs will keep humming—everyone else is getting squeezed in an arena where each epoch shaves margins thinner than a razor’s edge.