[ad_1]

Bitcoin miners brought in $40 million less in revenue during April than they did in March, marking the fourth straight month of dwindling returns since December as the sector continued its downward earnings trend.

April Wrecks Bitcoin Miners Again—Revenue Slides for Fourth Month in a Row

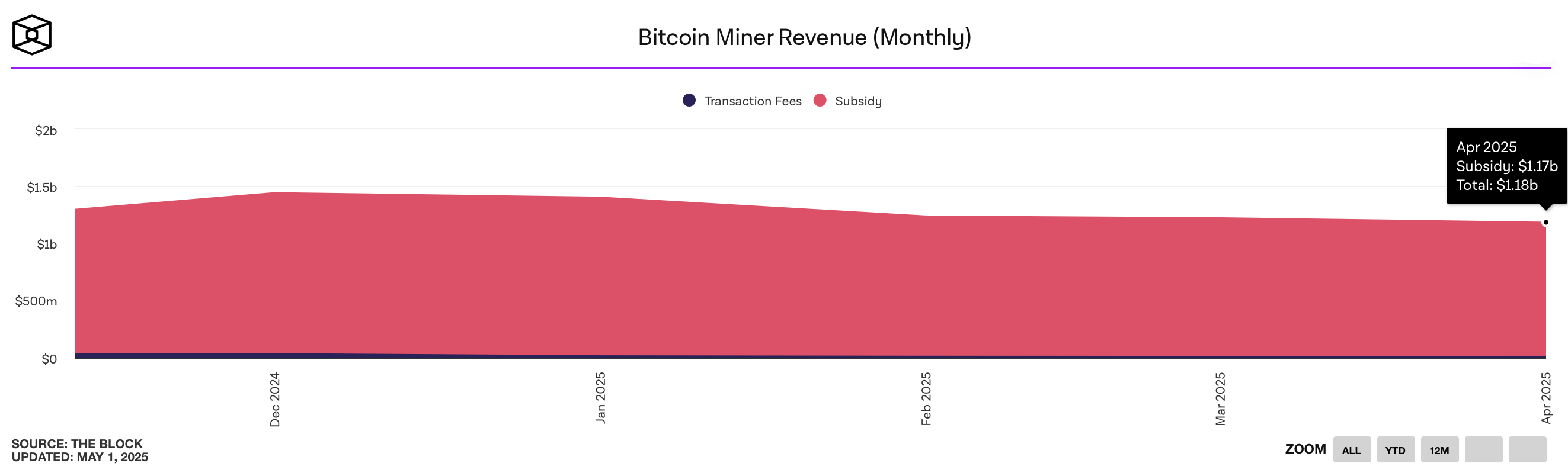

Though the dip wasn’t dramatic, it was nonetheless a contraction. In April, bitcoin miners brought in $1.18 billion in total revenue, encompassing both block subsidies and transaction fees, according to data compiled by theblock.co. Of that sum, fees comprised $15.65 million. For comparison, March revenues reached $1.22 billion, placing April’s shortfall at precisely $40 million.

Source: theblock.co

Interestingly, transaction fees in April were slightly higher, with March recording $15.11 million in onchain fees. The overall revenue decline coincides with a higher BTC price compared to 30 days prior and an uptick in hashprice — the projected daily yield for 1 petahash per second (PH/s) of SHA256 processing power.

On April 1, the hashprice hovered at $46.88, whereas by May 1, it had climbed to $50.26. Still, miners are contending with a formidable obstacle: network difficulty. The metric currently sits at a record 123.23 trillion. With average block times slowing, the next scheduled difficulty adjustment on May 4, 2025, is projected to ease the strain by an estimated 5.47%.

For now, price appreciation remains one of the few tailwinds for miners, and while monthly earnings have declined, the contraction has been relatively mild. As miners navigate thinning margins and rising operational thresholds, the market subtly hints at a shift in equilibrium. Efficiency is no longer optional—it’s existential.

[ad_2]