The cryptocurrency exchange Figure Markets is mobilizing Ionic Digital shareholders, staging efforts through social media to shake up the Celsius-linked Bitcoin miner’s board of directors.

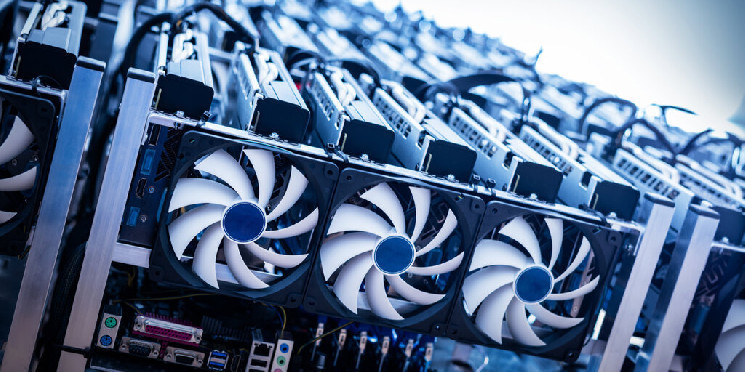

Ionic, a Texas-based mining firm, emerged from Celsius’ Chapter 11 bankruptcy as a company owned entirely by the failed lender’s creditors. The company became operational in February, aiming to run 127,000 mining machines across five different sites in North America.

After a week and a half of outreach, enough Ionic shares have been pledged to Figure to force a board meeting, according to CEO Mike Cagney. In an interview with Decrypt, the SoFi co-founder and former CEO said that shareholders have had enough of Ionic’s current direction.

“The Celsius community is very galvanized, very organized, and they’re very pissed off,” he said, referencing Ionic’s 86,000 shareholders. “The board of this company is just not acting on the behalf of shareholders, and so we want to lean in and change that.”

We are at 24.85% of shares to force a board meeting at Ionic Digital. 0.15% to go – every share counts! This is to force a board meeting to introduce alternative paths for Ionic (all with immediately liquidity options), and to force board action. Pledge your shares here:…

— Mike Cagney (@mcagney) September 3, 2024

At the same time, Cagney said that Figure has a “dual motive” with efforts to bring about change to Ionic’s board of directors. The company believes that Ionic could be listed on Figure’s alternative trading system (ATS), becoming the first public equity traded on blockchain natively.

The move would provide liquidity for Ionic shareholders, who have weathered an arduous bankruptcy process following Celsius’ abrupt failure, Cagney said. So far, Celsius creditors have received $2.5 billion in crypto and cash, with 15% of payouts comprising Ionic shares.

A demand letter shared with Decrypt, which was addressed to Ionic’s CLO, raises allegations of “apparently self-dealing behavior” among the company’s board members. Calling a delay in Ionic’s IPO plans “serious and unreasonable,” it demands corporate records be produced to “investigate potential wrongdoing, mismanagement, conflicts of interest, and corporate waste.”

Figure’s push for a new direction comes as Ionic’s leadership undergoes self-directed changes.

Ionic’s former CEO, Matt Prusak, left the company last month. The former CCO of U.S. Bitcoin Corp—a company that merged with Hut 8 last year—declined to extend his term as Ionic’s business leader, according to a company press release. At the same time, Ionic announced that the firm’s CFO, John Penver, would be appointed as Interim CEO to “ensure a smooth transition.”

On X, Penver acknowledged that the company has had “limited communication” with Ionic shareholders. Still, he said that Ionic had established a new website for communications, and it was “pleased” with progress in deploying mining assets and developing its Cedarvale, Texas, site.

However, Penver said that the company’s IPO plans had hit a snag because the company’s auditor RSM U.S. had resigned, stifling the process associated with one of Ionic’s main goals.

“Simply put, without an auditor, we can not update our SEC filings and resume the process of becoming a publicly traded company,” he said, adding that Ionic is currently evaluating multiple firms for the role with a decision likely made in the coming weeks.

Alongside Ionic’s announcement that Prusak’s term as CEO had ended, the company stated that it had appointed new members to its board of directors. Scott Flanders, the former CEO of Playboy Enterprises, and Mac Gardner, the chairman of the board of directors for Spirit Airlines, filled in as replacements Hut 8 CEO Asher Genoot and Max Holmes, a professor at NYU.

‘Should have never existed’

One of Ionic’s Bitcoin mining facilities is based in Cedarvale, and it’s currently being developed by Hut 8. The publicly traded mining firm also manages Ionic’s four other Bitcoin facilities under the terms of a recently renegotiated deal.

Ionic said in early August that it had amended its management services agreement with Hut 8, removing a liquidity deadline provision from the deal. Under that provision, Cagney said that Ionic would’ve been able to terminate the deal if it wasn’t listed on an exchange or ATS by June.

“There was absolutely no interest in shareholders to waive that liquidity provision,” Cagney said, arguing the provision created an opportunity for an orderly wind down if IPO plans stalled.

Hut 8 and Ionic didn’t immediately respond to a request for comment from Decrypt.

Figure Markets CIO Mike Abatte told Decrypt that he’s been heavily involved in mobilizing Ionic’s 86,000 shareholders. His familiarity with Celsius’ bankruptcy stems from prior experience as the managing partner of NovaWulf Digital Management.

The investment firm, which has since been wound down, was initially chosen as the company that would manage the distribution of Celsius’ assets and the firm that became Ionic. Ultimately, a consortium of crypto companies called Fahrenheit won the bid to acquire Celsius’ assets.

When the plan under Fahrenheit fell through, Celsius’ Official Committee of Unsecured Creditors decided to launch the mining company themselves, Cagney said. Following the departure of two board members and one CEO, Cagney said shareholders are upset.

In the demand letter, Abatte said the company is seeking a list of all of Ionic’s shareholders. In addition, Figure is challenging the assertion that Ionic’s bylaws can restrict the trading in Ionic’s shares under federal securities laws, he said.

At its peak, Celsius was a dominant crypto brand, claiming to have an $8 billion loan book and $25 billion in assets under management. But the company failed as the crypto market reeled in 2022, eventually leading to fraud charges brought against Celsius’ former CEO Alex Mashinsky.

Former Celsius customer Tony Vejseli remembers Mashinsky’s portrayal of the company as “safer than a bank.” Vejseli, who said he lost two Bitcoin (about $112,000 worth today) in the lender’s collapse, is now working with Cagney to rally Ionic shareholders toward the meeting with the company’s board.

From his perspective, Ionic’s fleet of miners is outdated. And the company faces increasingly stiff competition as miners’ revenues languish near all-time lows. From the beginning, he thought that Ionic’s IPO plans were overly optimistic in such a tough environment.

“This isn’t a company that should have ever existed,” he said. “To say that shareholders have no confidence would be the understatement of the century.”

Edited by Andrew Hayward