Core Scientific, Inc., a prominent digital infrastructure provider for bitcoin mining, has revealed its intent to issue $350 million in convertible senior notes. This offering is anticipated to close in September 2029, with the raised capital earmarked primarily for debt repayment and other corporate necessities.

Core Scientific Unveils Convertible Notes Offering, Eyes Debt Repayment

On Tuesday, Core Scientific outlined plans to utilize the proceeds to settle existing loans and redeem outstanding senior secured notes due 2028. The notes will be sold privately to institutional investors, with Core Scientific holding the option to expand the offering by an additional $52.5 million. These unsecured notes will accrue interest semi-annually and can be converted into cash or common stock shares.

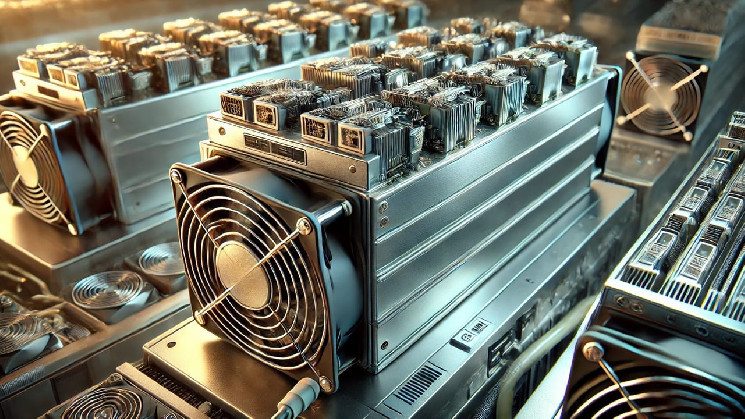

The bitcoin mining entity disclosed that the remaining funds are slated to support various corporate activities, including acquisitions and operational expenses. This announcement comes on the heels of Marathon Digital, now known as MARA, revealing a private sale to raise funds for bitcoin purchases. Core Scientific recently partnered with Jack Dorsey’s Block in order to get 15 exahash per second (EH/s) of Block’s mining ASIC chips.

Core Scientific’s strategy allows investors the option to request a repurchase of the notes if certain key changes occur within the company. Additionally, the firm can redeem the notes under specific conditions. The company emphasized that this financial maneuver is part of a broader strategy to optimize its capital structure while maintaining financial agility.