Bitcoin prices are finally stabilizing after a turbulent period that led to a massive liquidation event that impacted thousands of traders.

BTC’s value dropped from over $100,000 to $92,000 within 12 hours on Monday, erasing $1.7 billion in leveraged positions from nearly 584,000 traders. However, it has since rebounded, trading above $98,000, with a 2% increase today to $98,661.

Bitcoin Market Seeing Drop in Leverage

Amid the recovery, market data indicates a slowdown in volatility and a notable reduction in leverage across exchanges. According to CryptoQuant CEO Ki Young Ju, the BTC-USDT perpetual futures estimated leverage ratio has been steadily declining.

Leverage in #Bitcoin market is easing.

BTC-USDT futures open interest is down 7% from its peak, while exchange-held USDT balances have surged 32% in a month.

If the deposited $USDT is for futures trading, more USDT collateral reduces cascade liquidation risk. pic.twitter.com/ASOUIH0x5U

— Ki Young Ju (@ki_young_ju) December 11, 2024

This ratio, which measures the amount of leverage used in futures trading, fell from 0.511 on Dec. 8 to the current figure of 0.462. The recent ratio further represents a 24% drop from the 0.608 peak recorded on Nov. 21.

BTC Estimated Futures Leverage Ratio for the USDT Pair Across All Exchanges

Ju noted that open interest in BTC-USDT futures has decreased by 7% from its recent high, while exchange-held USDT balances have risen by 32% over the past month.

Additionally, data shows that ERC-20 USDT tokens on exchanges have surged by 68% since Nov. 1, growing from 23.27 billion to 39.17 billion. This inflow of USDT on exchanges could provide more collateral if market participants use it for futures trading.

Notably, the recent reduction in leverage implies fewer high-risk positions, decreasing the likelihood of sharp price swings from liquidations. Meanwhile, the influx of USDT suggests increased buying power, which could fuel further price gains as traders deploy funds.

Liquidation Trends Reflect Price Recovery

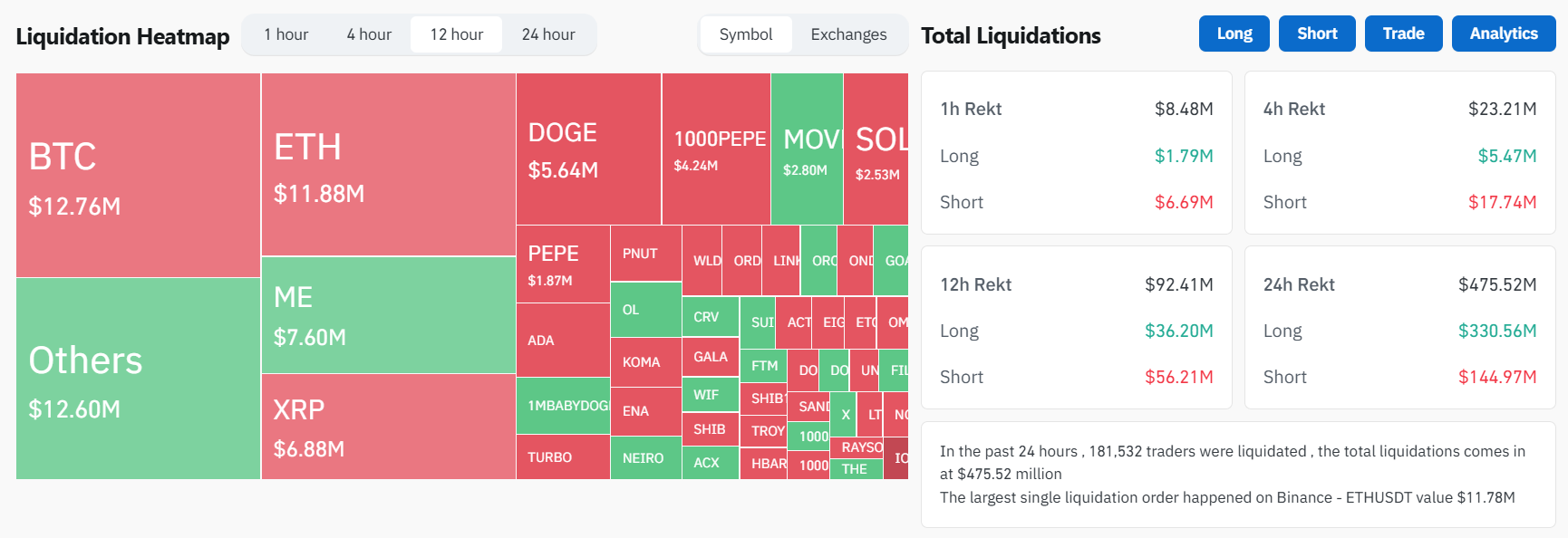

In addition, recent data from Coinglass shows that liquidation volumes are declining, with short positions now facing more liquidations than long positions.

Liquidation Data | Coinglass

Over the last 12 hours, $92.41 million worth of positions were liquidated, with short positions accounting for 60.8% of this amount, or $56.21 million. In contrast, long positions accounted for $36.20 million. This suggests a market recovery, as bullish sentiment begins to strengthen.

Analysts Hold Mixed Bitcoin Recovery Outlooks

Meanwhile, market analysts and traders hold varying perspectives on Bitcoin’s next moves. Ali Martinez, a prominent analyst, pointed out a cup-and-handle pattern on Bitcoin’s weekly chart.

Buy the dip, and don’t overleverage! #Bitcoin $BTC will reach $275,000, based on this cup and handle pattern! pic.twitter.com/cqf99cBtmB

— Ali (@ali_charts) December 10, 2024

He has maintained his optimism, predicting that Bitcoin could reach $275,000 if this pattern plays out. The analyst advised traders to buy dips and avoid excessive leverage to minimize risk.

Meanwhile, crypto trader XO stressed the importance of Bitcoin holding the $90,000–$91,000 range. He suggested that losing this range could lead to a pullback to $85,000–$87,000. However, XO leans toward continued price compression in the near term.

Interestingly, as BTC looks to recover, CryptoQuant analyst Mignolet highlighted that Coinbase’s spot market dominance remains relatively low, despite the exchange’s major role earlier this year.

Following the approval of Bitcoin ETFs in January, Coinbase saw increased dominance, driving market gains during that period. However, during the latest rally in September and October, Coinbase’s influence declined, and it has not rebounded massively since.

Mignolet emphasized that while Coinbase liquidity remains important, Binance appears to be the more critical source of market liquidity driving the current rally.