[ad_1]

The leading digital asset has tumbled from its recent all-time high, even as retail and institutional investment reach record levels.

Record Crowds at Bitcoin Event, But Price Remains Stuck Below $105K

More than 35,000 of the Bitcoin faithful flocked to Sin City and packed the Venetian Resort in record numbers last week. But on the Monday after, the cryptocurrency struggled to stay above $105K after peaking at nearly $112K on May 22.

Perhaps it was President Donald Trump’s impromptu announcement of 50% tariffs on U.S. steel imports on Friday or the increasing tension between the world’s two largest economies over trade policies. Whatever the reason, bitcoin’s rally has stalled, and the mixed price action appears to have extended beyond crypto markets.

The S&P 500 and the Dow are currently down 0.13% and 0.50% respectively, according to CNBC indices. The Nasdaq is up slightly by 0.2% at the time of writing. Crypto markets have edged lower, down 0.78%. Bitcoin ( BTC), despite shedding 0.80% over the past 24 hours and floundering below $105K is still expected to eventually rise to $120K by the end of the summer according to projections provided by Standard Chartered.

With the cryptocurrency seeping into the mainstream, and a record number of retail and institutional investors seeking to allocate BTC to their portfolios, the current lackluster price action may just be the calm before the storm.

Overview of Market Metrics

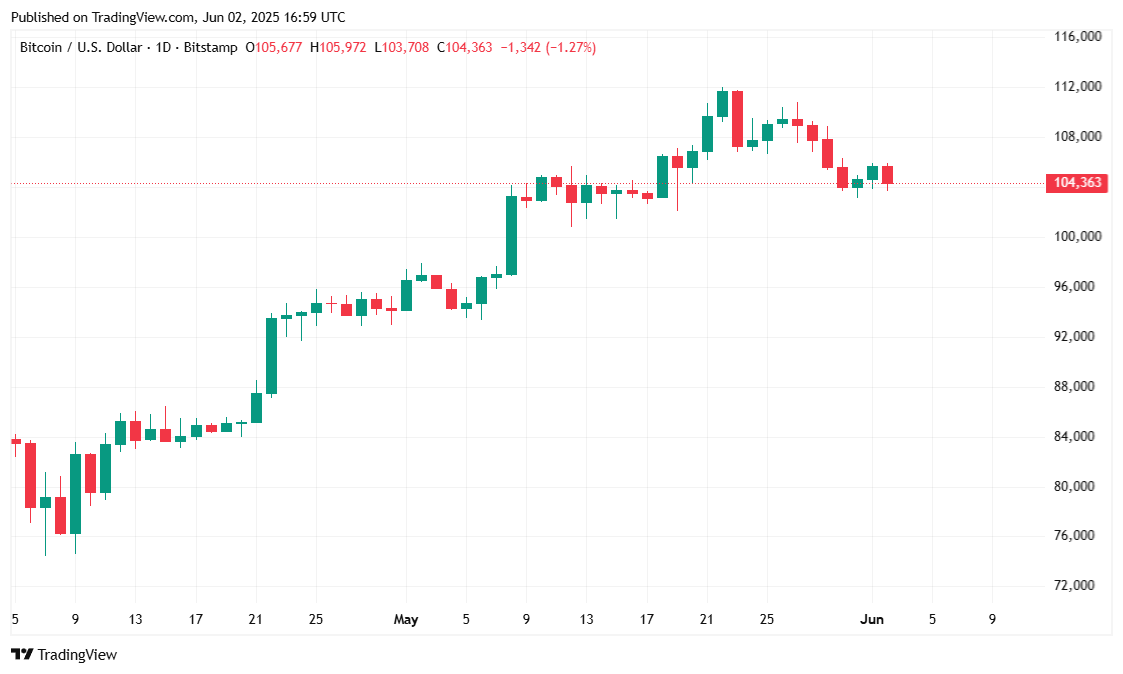

Bitcoin traded within a relatively narrow band of $103,727.55 to $105,930.65, suggesting a reduction in volatility as prices continued to retrace from recent highs. BTC’s price had slipped to $104,377.45 at the time of reporting, down 0.80% in the past 24 hours and 4.61% over the past seven days.

( BTC price / Trading View)

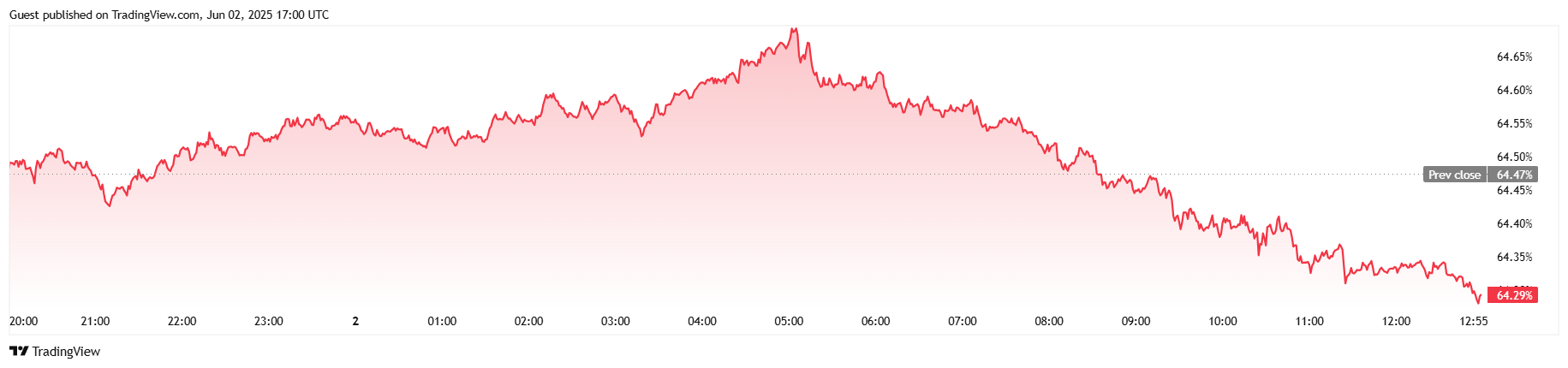

Despite the price dip, 24-hour trading volume surged by 22.27% to $42.53 billion, consistent with the typical post-weekend pickup in activity. Bitcoin’s market capitalization dropped by 0.68% to $2.07 trillion, while its market dominance shrunk to 64.30%, down 0.28%, suggesting increased capital movement into altcoins or stablecoins.

( BTC dominance / Trading View)

Bitcoin futures open interest remained relatively flat, inching down just 0.03% to $72.22 billion. Liquidations were thin at only $149,130 according to Coinglass, but even then, it was the bulls who ultimately bet the wrong way as long liquidations came in at $145,160 while shorts were only $3,970.

[ad_2]