[ad_1]

The below is an excerpt from a recent edition of Bitcoin Magazine Pro, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

Bitcoin has had another period of intense and record-breaking success, spurred on both by positive developments in international business and by increasingly large commitments from the spheres of traditional finance.

It’s truly stunning how well Bitcoin has been performing throughout the first quarter of 2024. The year began with Bitcoin’s valuation crossing the $40k mark, and March 1 saw a persistent hover around $60k. Now, however, Bitcoin has gone up to $72k, the highest valuation in its entire history. Although we still are not quite at the level where “digital gold” is more valuable than gold itself, we have even reached a new milestone: by market cap, Bitcoin is currently a more valuable commodity than silver. Considering the immense role that silver has played in global currency for thousands of years, this is certainly a milestone to remember.

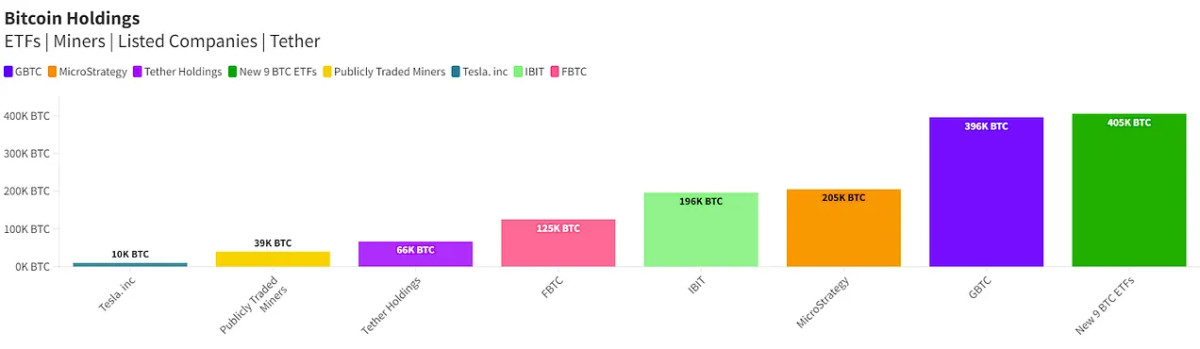

This period of success has been especially noteworthy for the continued confidence it’s been enjoying from some of the largest financial institutions in the world. On March 10, for example, it was reported that BlackRock, the world’s largest asset manager and prominent issuer of the Bitcoin spot ETF, had finally acquired enough bitcoin that it surpassed even the holdings of MicroStrategy. Considering that its board chairman, Michael Saylor, is such a Bitcoin evangelist, this development seemed especially huge. It was an even bigger surprise, however, when Saylor announced that he was buying enough to reclaim its leading position the very next day. Less than 24 hours passed between this original announcement and MicroStrategy’s purchase of 12k bitcoin, and this purchase took place when Bitcoin was already enjoying a price point over $70k. This purchase put MicroStrategy at the head of nearly every other private bitcoin stockpile, from all publicly traded miners to several major exchanges and ETF issuers.

It’s a stunning display of confidence in Bitcoin that anyone is prepared to make such major investments at a time when it’s never been more expensive. It seems that the mood in these companies is that the all-time highs of today will seem like a paltry sum in just a few years. Analysts from ETF issuer Bitwise, for example, were confident enough in their prediction that corporate entities representing trillions of dollars would begin ramping up investments that Bitwise’s Chief Investment Officer released an official memo on the subject. Claiming “serious due diligence” conversations with everyone from hedge funds to massive corporations, the memo predicts that Q2 will see even more massive inflows than the first three months of the year. This just leaves us with one question: Where does this kind of confidence come from?

The center of the issue seems to be the runaway success of the Bitcoin ETF and, in particular, BlackRock’s dominating position over the main issuers. Initially, it struggled with Grayscale, which had several natural advantages: it was a Bitcoin-native company with a massive stockpile, it was a real leader in the legal battle to actually get SEC approval, its GBTC was a previously-existing fund that was converted into an ETF, and it had other tricks up its sleeve. Nevertheless, BlackRock is the ETF that reached $10 billion faster than any other in history, shooting ahead of all other Bitcoin competitors and indeed all ETFs in general. Much of this revenue came from users fleeing GBTC’s high fees, and it seems like a confident industry leader today. Its success has even matured to the international stage, as Mudrex, a crypto investment platform based in India, is opening up BlackRock ETF sales to institutional and private investors in a country with more than 1 billion people.

This kind of success from BlackRock in particular has also led some of its competitors to change up their tactical approach. VanEck, for example, made an announcement on March 11 that they were waiving all fees on their Bitcoin ETF for an entire year. This will only continue so long as their VanEck Bitcoin Trust is under $1.5 billion, but the fees after this window will still be some of the lowest available. Grayscale, for its part, is also seeking to address the problem of high fees by spinning off a “mini-version” of its ETF, offering fractions of Bitcoin for a fraction of GBTC’s fees. It seems that BlackRock’s competitors are not yet willing to concede a market with such tremendous growth potential.

However, although the ETF market has been especially hot lately, that is not the only reason to believe that Bitcoin’s doing so well. ABC News, for example, credits some positive developments from the United Kingdom as a major factor in Bitcoin’s price jump. Britain has previously been considered a particularly hostile regulatory environment for Bitcoin, especially the ETF, trailing behind both Western Europe and most of the Anglosphere in official Bitcoin approval. It was quite a surprise, then, when the London Stock Exchange (LSE) released a new factsheet on exchange-traded notes (ETNs), deciding that this type of financial instrument would be offered on their platform.

ETNs do differ substantially from ETFs, even those like the Bitcoin futures ETF, which has no direct link to Bitcoin itself. ETNs are a type of debt security and do not even include the proviso that the issuer actually holds the bitcoin in question. Still, they are directly tied to the value of Bitcoin and offer investors a way to gain exposure to the world’s leading digital asset. Considering that these ETNs are subject to the stringent rules that govern securities, it’s particularly interesting that the LSE has suddenly changed its tune on Bitcoin-related financial products. In other words, it seems that the sea change in legal Bitcoin spot ETFs in the United States has undeniably changed the calculus for businesses worldwide. With all these billions flowing into the Bitcoin ETF, even an unfriendly regulator like Great Britain must join in the bonanza if it wishes to maintain relevance as a leading hub of global finance.

These are just a few of the developments that have occurred in the world of Bitcoin, as the intersection between decentralized currency and traditional finance has become both broader and deeper. Looking forward, there are still plenty of upcoming events, like the halving predicted in April, to keep propelling the hype forward. It may be difficult to predict exactly where the next major development and price jump will come from, but right now it looks as if there is a growing faith coming from some true financial giants. Bitcoin has come an incredibly long way since the days of its total pariah status, and now there’s well over a trillion dollars in the market. With growth like that, it’s an easy win to keep betting on Bitcoin.

[ad_2]