[ad_1]

Donald J. Trump won as the 47th POTUS and ushered in quite a Bitcoin and stocks rally. Now, that rally has met unforeseen problems. According to data from IntoTheBlock, there has been a significant drop in the amount of Bitcoin held by short-term traders.

Per on-chain data, short-term BTC reserves have reached the lowest point since mid-November 2024. Analysts attribute this to reduced interest from speculative traders. Also, there is a decline in new market entrants. The trend also suggests the market is consolidating as investors await clearer price movement signals.

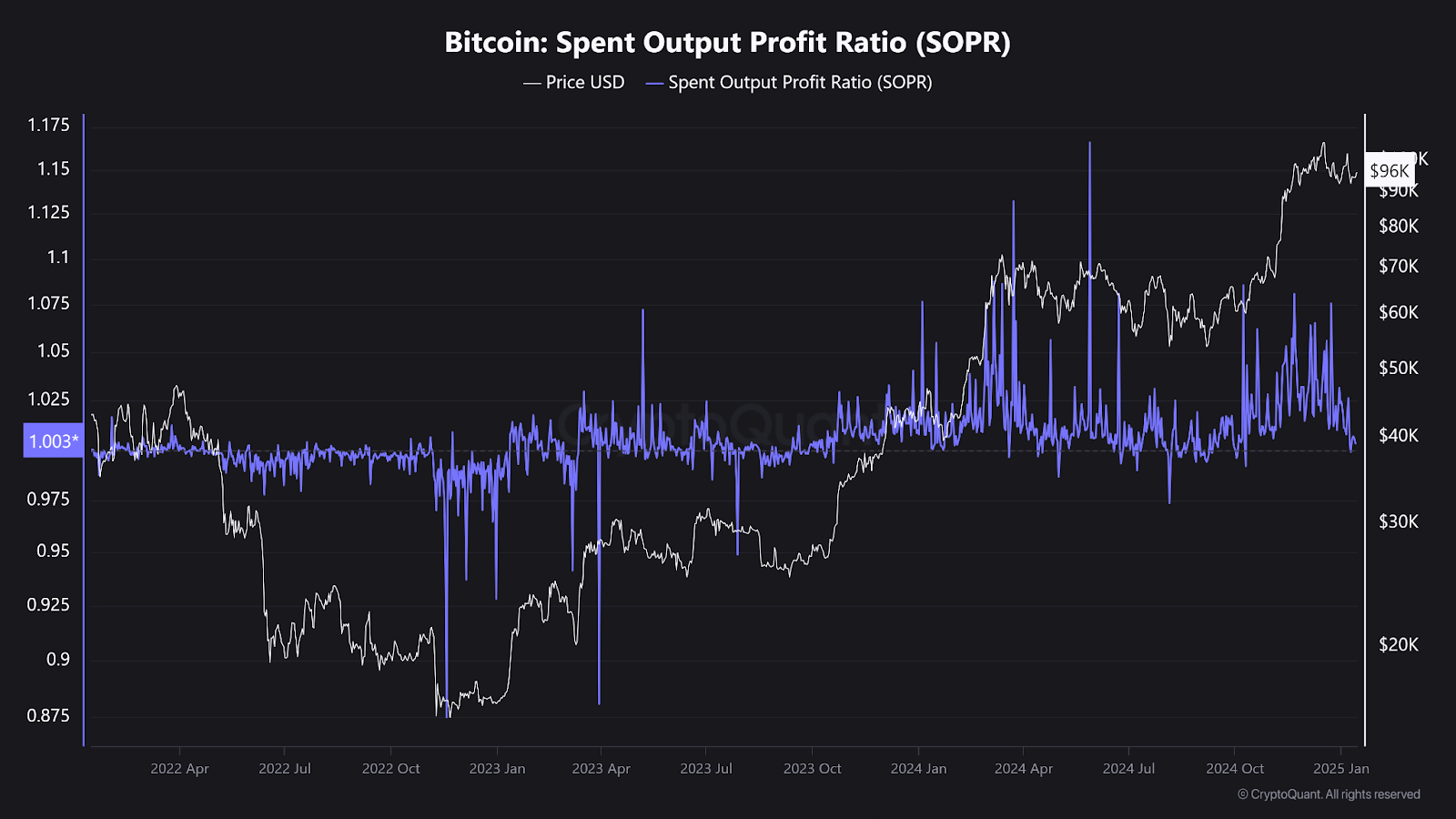

In addition, several traders on social media have pointed to recent declines. The Bitcoin Spent Output Profit Ratio (SOPR) for short-term holders is weak.

BTC SOPR chart | Source: CryptoQuant

The chart above shows a move from profit-taking to loss realization. The 7-day simple moving average (SMA) of the STH SOPR dropped to 0.99. To that end, loss realization now slightly exceeds profitable sales.

In addition, it could mean these traders have been selling coins while counting losses more than profits. This has prompted them to hold off on making sales.

During the last months of 2024, when BTC hit highs, the SOPR spiked above 1. This is because bulls were enjoying a period of profit-taking. However, the subsequent market crash has led short-term holders to liquidate positions at a loss.

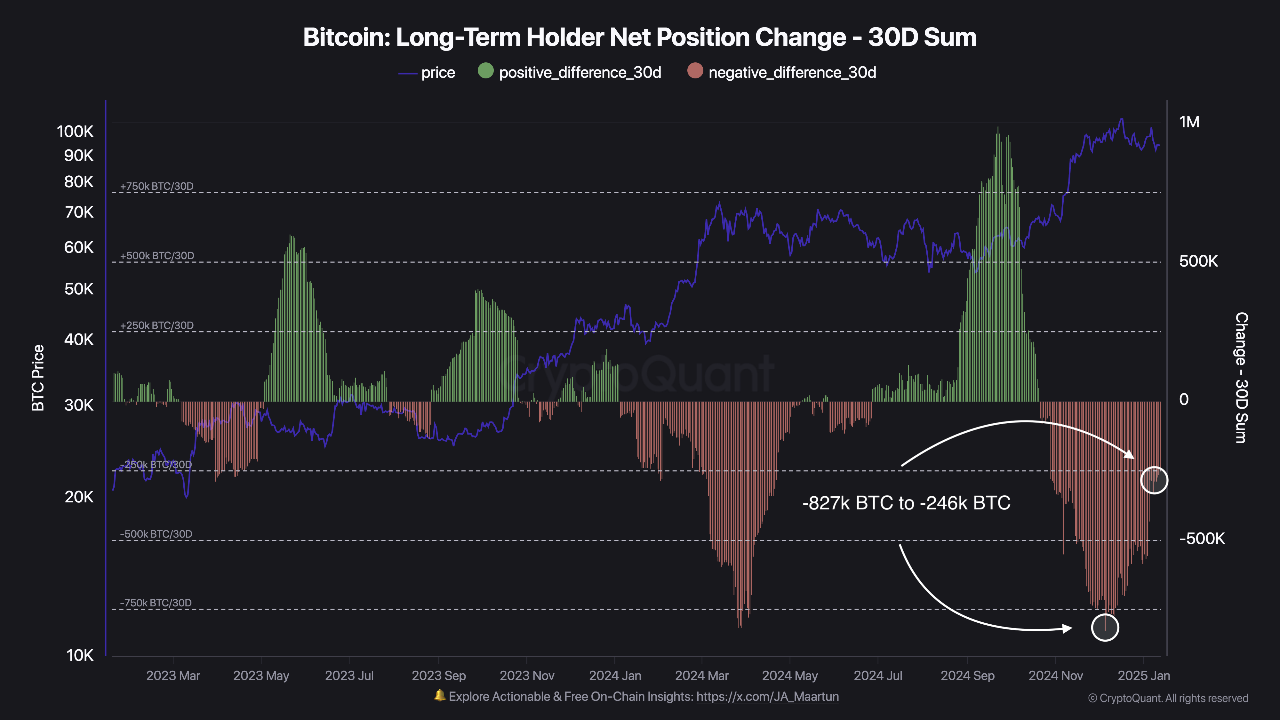

Long-term holder’s activity signals declining selling pressure

During the last year, BTC holdings among long-term investors have also shown a decreasing trend. According to CryptoQuant’s Darkfost, the net position change of long-term holders peaked at −827,000 BTC. This was when Bitcoin’s price reached $97,000 on December 5.

Bitcoin long-term holders market activity | Source: CryptoQuant

However, this figure has since recovered to −246,000 BTC. This indicates a threefold reduction in selling pressure. This shift suggests long-term holders are becoming less inclined to sell at current price levels. This comes even as Bitcoin’s price trends downward.

Over the past 12 months, the amount of Bitcoin held by long-term holders has been declining.

The red arrows on the chart below highlight similar periods in past cycles.

While these indicators don’t precisely forecast price peaks, it’s important to understand that long-term… pic.twitter.com/fllfjl4B6V

— IntoTheBlock (@intotheblock) January 13, 2025

Darkfost says that while the market remains in a corrective phase, the reduced selling pressure from long-term holders is a positive signal. For the market to transition into a bullish phase, these holders must return to an accumulation phase.

Another market trader, Percival, notes a slight slowdown in on-chain volume. The volume now remains at a peak of $12 billion in exchange inflows and outflows. This shows sustained interest in Bitcoin despite recent price corrections.

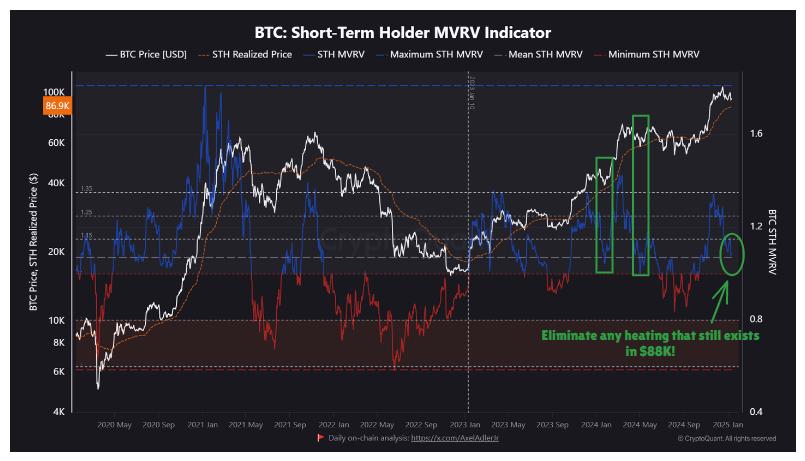

BTC Short-term trading MVRV chart | Source: CryptoQuant contributor Percival.

However, the analyst clarified that there is still a discrepancy between the short-term holder cost base of $88,000 and the average of the Short-Term Holder Market Value to Realized Value (STH MVRV), which could pose problems.

Bitcoin in the middle of a bear-bull race

According to Coingecko’s on-chain data, Bitcoin recently experienced a sharp drop to $89,000. This comes as key short-term support levels broke. However, the price quickly rebounded. It is now holding its previous key support level, breaching the $95,000 price barrier and changing hands above it.

This pattern is known as “stop hunting.” It often signals increased volatility and opens the possibility of a trend reversal. Analysts note that for a full reversal to occur, activity from major market players is essential.

Despite the potential for a reversal, data from Coinbase Premium Gap (CPG) suggests whale entities remain focused on selling.

Unlike previous market dips where buying whales hoarded significant supply, no such activity has been detected this time.

Market traders believe the lack of noticeable whale activity from exchanges like Binance reinforces a bearish sentiment in the market.

Indicators point to short-term selling pressure

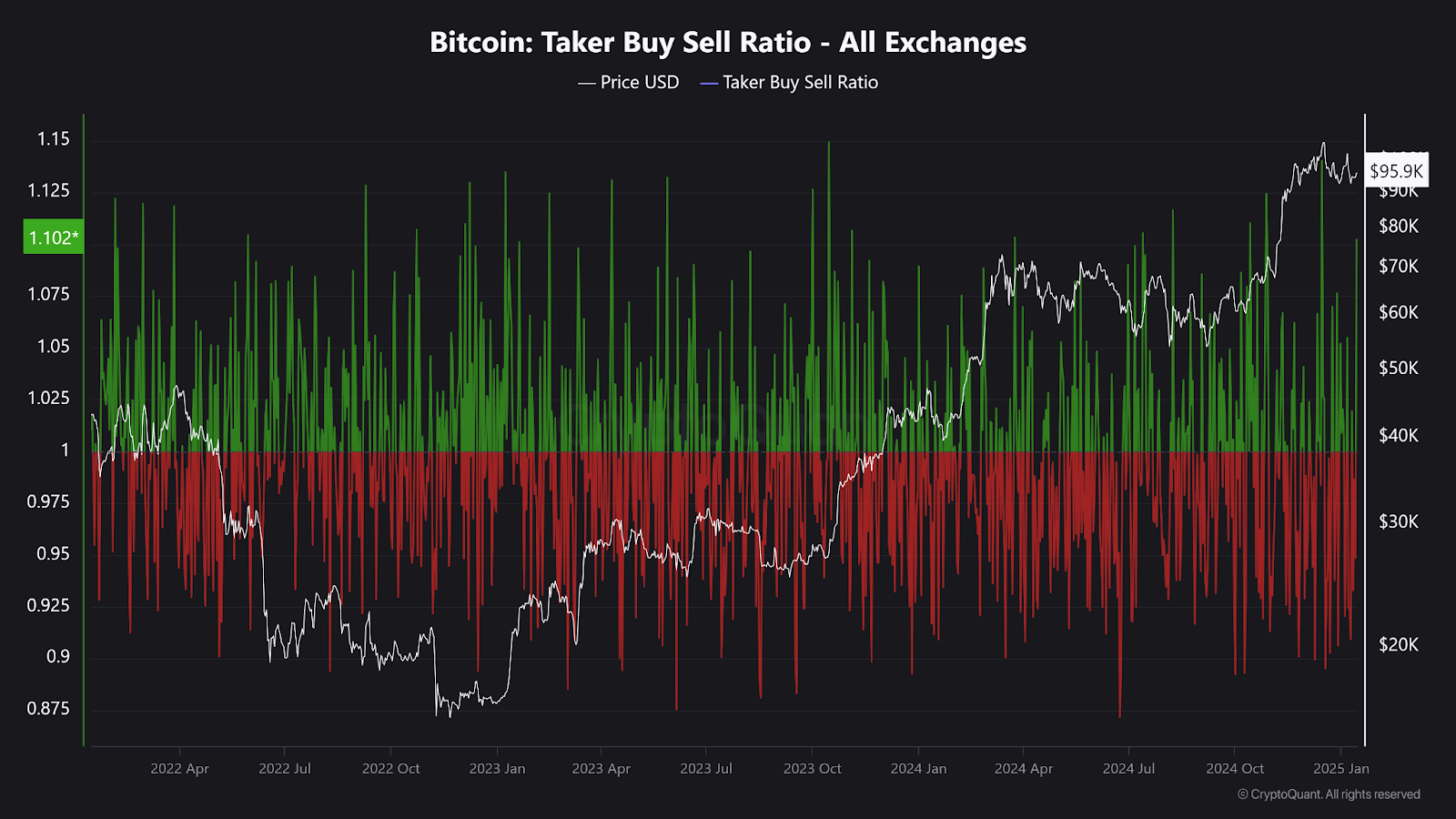

Meanwhile, indicators like the Take Buy Sell Ratio reflect a dominance of market selling. At present, supply exceeds demand in the short term. This behavior often coincides with significant profit-taking at resistance levels, leading to price corrections that precede “sideways” trading periods.

BTC Taker Buy Sell Ratio chart | Source: CryptoQuant

Short-term holders have been driving recent selling activity. They often liquidate positions with little to no profit, contributing to increased market volatility and placing downward pressure on BTC’s price.

On the price chart, a bearish structure appears to be forming. There’s a high probability of continued declines in the coming weeks.

A Step-By-Step System To Launching Your Web3 Career and Landing High-Paying Crypto Jobs in 90 Days.

[ad_2]