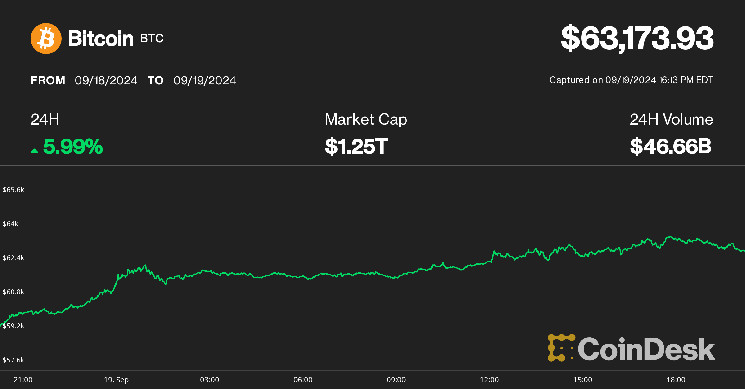

Cryptocurrencies surged higher with bitcoin (BTC) nearing $64,000 on Thursday as the Federal Reserve’s jumbo rate cut bolstered risk appetite across asset classes.

Bitcoin climbed nearly 6% over the past 24 hours from Wednesday’s whipsaw below $60,000 as traders digested the Fed’s decision to lower benchmark interest rates by 50 basis points, a move many observers say may mark the beginning of an easing cycle by the U.S. central bank. The largest crypto hit its highest price this month at $63,800 during the U.S. trading hours before stalling and retracing to just above $63,000.

Ethereum’s ether (ETH), the second-largest cryptocurrency by market capitalization, bounced off from its crucial 200-week simple moving average and was up over 7% during the same period.

The broad-based crypto benchmark CoinDesk 20 Index outperformed BTC and ETH with its 8% advance, indicating that altcoins led the market higher with native tokens of Solana (SOL), Avalanche (AVAX) and Aptos (APT) up 10%-15%. All the 20 assets of the index were up today, underscoring the breadth of the rally.

Crypto-focused stocks and listed bitcoin miners also surged, with MicroStrategy (MSTR) and TeraWulf (WULF) leading the sector with 10% gains.

Crypto’s rally over the past 24 hours outperformed most traditional financial asset classes. The S&P 500 and Nasdaq, two stock indexes that bitcoin recently has correlated with, traded 1.7% and 2.5% higher, respectively.

This could be because non-yielding assets like bitcoin or gold are typically preferred investments when interest rates are lower, said Jim Iuorio, managing director of TJM Institutional Services and host of the Futures Edge podcast.

“These assets prefer rates that are lower than where they should be relative to the current economic condition,” he said. “They do well in an environment that could reignite inflation.”

The 10-year U.S. Treasury yield moved higher after the Federal Reserve lowered interest rates on Wednesday which signals that inflation remains a worry. Similarly, bitcoin’s uptick in price could indicate that the Fed’s decision to lower rates may be premature and could result in a weakening of the U.S. dollar, Iuorio added.

Key test for BTC rally at $64,000

Bitcoin’s rally faces a key hurdle at the $64,000 level, which was the local peak last month, bouncing from the early August crash due to the strengthening Japanese yen carry trade. The leading crypto should make a higher high to break the bearish trend of making consecutive lower lows since the $73,000 peak in March.

“The easy part of the cycle is almost done,” Bob Loukas, a well-followed trader and analyst, said, based on bitcoin’s daily cycle pattern. Cycles theory argues that price movements happen in waves with roughly regular periodicity. “Soon bitcoin will have to work for the gains,” he added.

Even with a potential pullback in the cards, options traders are anticipating higher bitcoin prices for next month heading into the historically bullish period for the asset.

Options data for October 25, 2024 expiry on crypto derivatives exchange Deribit reveals significant interest at the $70,000 strike, with $130 million in notional value, CoinDesk analyst James Van Stratten noted.

The total open interest stands at 34,199 BTC, with a put/call ratio of 0.55, reflecting a strong bullish sentiment in the market, he added.

While September has been the worst performing month for BTC with an average loss of -4% since 2013, the year-end period starting with October usually brings the greatest returns for the asset, CoinGlass data shows. October’s average monthly return is 23%, while Q4’s tally is 88% gain, per CoinGlass.