[ad_1]

Bitcoin and Ethereum options worth early $2.6 billion in notional value expired today amid a broader market pullback.

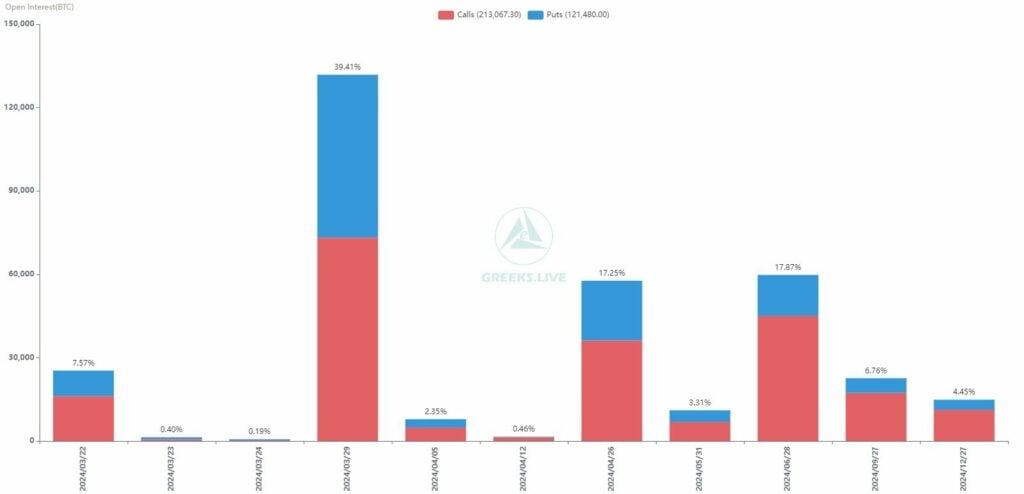

According to Greeks.live, 25,000 BTC options expired, showcasing a Put Call Ratio of 0.56. The ratio indicates a higher interest in call options than puts, suggesting optimism among a segment of investors.

The Max Pain point stood at $67,000 with a notional value of $1.7 billion. Similarly, 250,000 ETH options expired, with a Put Call Ratio of 0.51 and a Maxpain point of $3,500, amounting to a notional value of $890 million. The Max Pain point represents the strike price at which most options would expire worthless, often considered a pressure point for the market.

Bitcoin Open Interest | Source: Greeks.live

You might also like: Heco Bridge hackers launder over $145m via Tornado Cash in 8 days

The crypto market recently experienced a shift, moving away from the potential rally anticipated last week. Bitcoin’s inability to hold above $70,000 led to a pullback, defying previous expectations of a sustained rally.

This week, the market saw a surge in put demand alongside a sharp increase in implied volatility across all significant terms. However, contrary to expectations, many put positions closed at a profit, reflecting a strategic exit by investors.

Bitcoin’s price is now just below $63,000, marking a 6% decrease today. The price decline aligns with a record outflow of $742 million from Bitcoin ETFs over the week, underscoring investor caution and a shift in market sentiment.

As prices align closer to the Maxpain points, the once prevalent FOMO (Fear of Missing Out) sentiment has diminished, signaling a more cautious approach by market participants.

Read more: Ronin’s RON jumps 11% on the heels of Coinbase listing

[ad_2]