[ad_1]

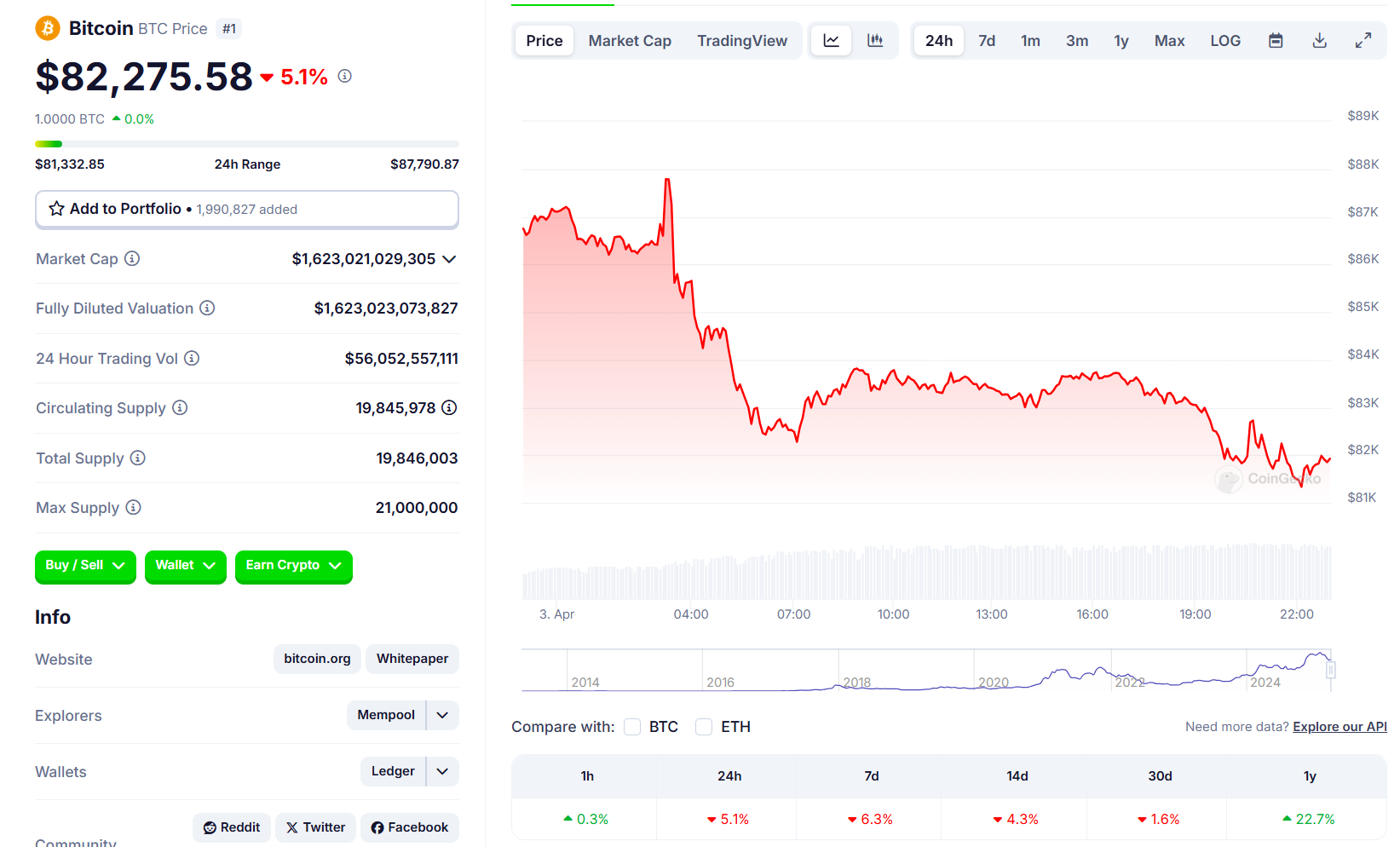

Bitcoin fell 5% to $82,200 on Thursday amid a broad market selloff triggered by President Donald Trump’s announcement of new global tariffs, according to CoinGecko data.

Trump announced on Wednesday a sweeping set of tariffs in response to what he described as a national emergency caused by large and persistent US trade deficits.

The executive order imposes a minimum 10% tariff on all imported goods from every country, set to take effect on April 5. For nations with which the US has significant trade deficits, higher tariffs will apply starting April 9.

China will face a 34% tariff, the European Union 20%, Taiwan 32%, South Korea 25%, and Israel 17%.

These tariffs are part of the administration’s strategy to promote US economic interests and reduce dependence on foreign goods.

Uncertainty regarding US trade tariffs and recession risks has shaken the market, prompting investors to divest from risky investments like crypto and stocks.

Apart from Bitcoin, major altcoins also suffered sharp losses, with Ethereum down 6%, XRP falling nearly 8%, Dogecoin and Cardano dropping over 9%, and Solana sliding into double-digit losses.

Binance Coin fared slightly better, dipping just 3%.

Smaller altcoins took an even harder hit, with Hyperliquid, Pi Network, Ethena, Pepe, Bonk, Celestia, and Official Trump all posting double-digit declines.

As a result, the total crypto market cap tumbled 6.5% to $2.7 trillion, as investors grappled with heightened uncertainty.

Wall Street wipeout: Over $2 trillion erased

The broader US stock market saw more than $2 trillion in value erased following Thursday’s opening, with technology companies bearing the brunt of the selloff, according to Yahoo Finance data.

The S&P 500 fell 4%, the Nasdaq tumbled 5%, and the Dow Jones Industrial Average declined 3%.

The tech-heavy Nasdaq Composite has now fallen 13% year-to-date, marking its worst performance since 2022.

Apple and Amazon led the tech stock sell-off, with each tumbling nearly 9%. Apple is on track for its worst single-day performance since 2020, weighed down by its Asian manufacturing.

Meta and Nvidia fell over 7%, while Tesla slid more than 5%. Microsoft and Alphabet saw mild declines, around 2%. Nvidia, with its Taiwan chip production and Mexico assembly, was especially vulnerable to trade policy news.

Semiconductor stocks were also hit by the downturn, as Marvell Technology, Arm Holdings, and Micron Technology each saw losses exceeding 8%. Broadcom and Lam Research fell 6%, and Advanced Micro Devices declined by over 4%.

According to Maksym Sakharov, co-founder of WeFi, Trump’s tariffs are more of a negotiation tactic than a long-term policy, suggesting that “their effect on businesses and consumers will remain manageable.”

Beyond trade tensions, inflationary pressures pose another risk, potentially disrupting the Fed’s rate-cut outlook, Sakharov added.

“Besides that, an impending fiscal debate in Washington over the federal budget is also causing jitters in the market,” said the analyst. “Resolving the debt ceiling remains a pressing issue, as the Treasury currently relies upon “extraordinary measures” to meet US financial obligations. The exact timeline for when these measures will be exhausted is unclear, but analysts anticipate they may run out after the first quarter.”

According to BitMEX co-founder Arthur Hayes, Trump’s tariffs will reduce the amount of US dollars held by foreign nations, which, in turn, will decrease their ability and willingness to purchase US Treasury bonds.

To counteract the decreased foreign demand and maintain a functioning Treasury market, Hayes predicts the Fed will have to intervene. The analyst suggests that the central bank will be back to printing money, which will be beneficial to Bitcoin’s prices.

Trump’s tariff formula is further evidence he is laser focused on reversing these imbalances. The problem for treasuries is that without $ exports foreigners can’t buy bonds. The Fed and banking system must step up to ensure a well functioning treasury mrkt, which means Brrrr. pic.twitter.com/doGPAaRfAl

— Arthur Hayes (@CryptoHayes) April 3, 2025

[ad_2]