[ad_1]

BTC retreated to $95K, mostly due to the Bybit hack and Fed rate jitters, both of which shook market confidence.

Crypto Market Reels as Bitcoin Drops to $95K Following Bybit Hack and Fed Speculation

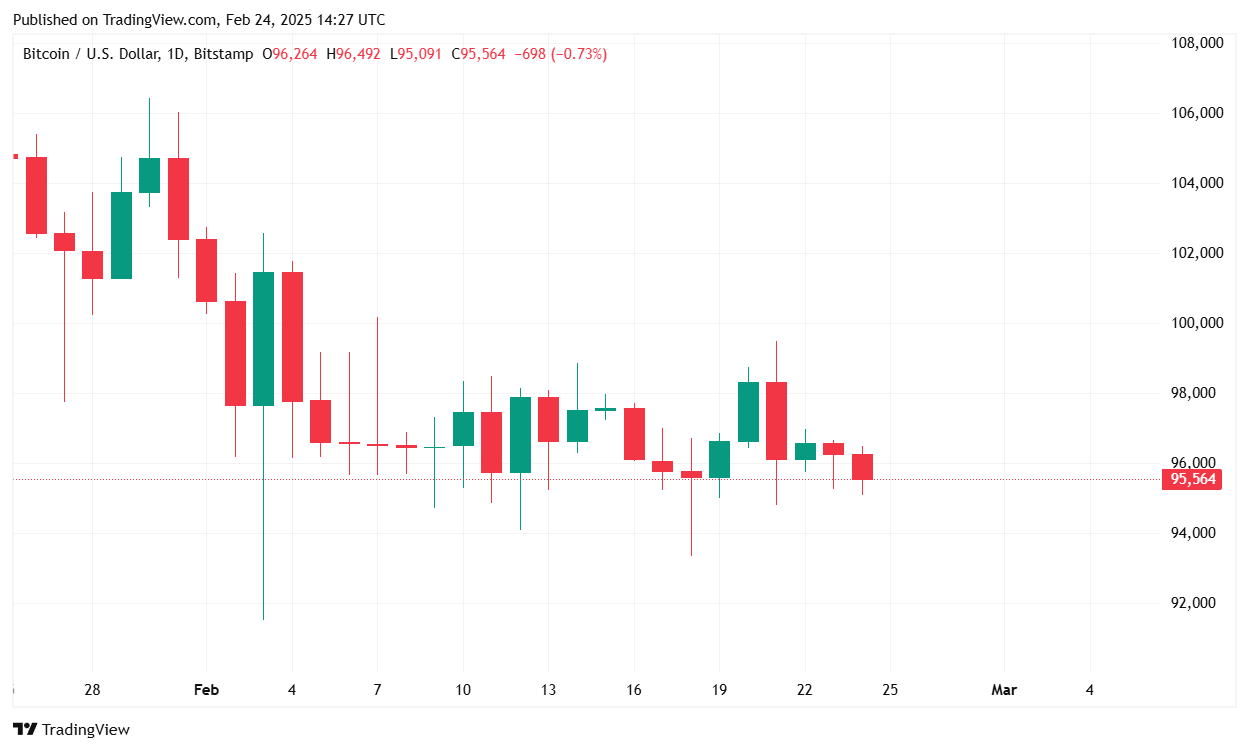

Bitcoin (BTC) is navigating a turbulent market landscape, with price fluctuations driven by a historic exchange hack and ongoing uncertainty surrounding U.S. Federal Reserve policies. At the time of reporting, BTC is trading at $95,505.39, reflecting a 0.49% decline over the past 24 hours and a 1.26% drop over the past week, according to data from Coin Market Cap.

(BTC price / Tradingview)

Market Performance and Key Metrics

24-Hour Price Range: Bitcoin’s price has oscillated between $95,120.85 and $96,503.45, indicating some degree of volatility.

Trading Volume: BTC’s 24-hour trading volume surged 69.77% to $25.72 billion. While this marks a significant increase, such spikes are expected following weekends when trading activity often slows.

Market Capitalization: Bitcoin’s total market cap currently sits at $1.89 trillion, down 0.58% from the previous day.

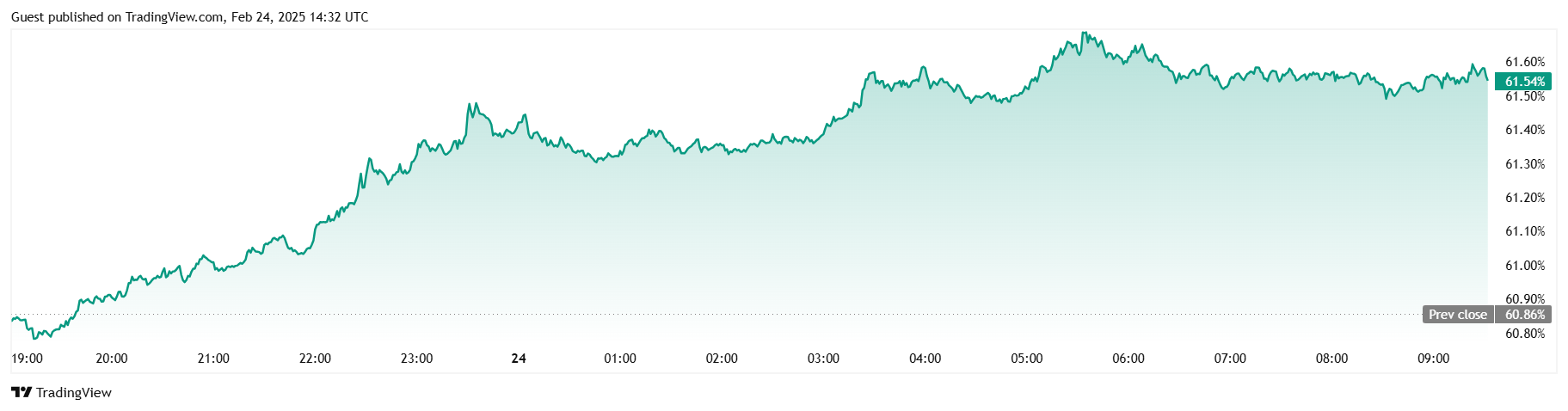

BTC Dominance: Bitcoin dominance has increased to 61.5%, up by 1.12% over the last 24 hours. This rise is partly attributed to BTC gaining ground on ETH and SOL following the fallout from the Libra debacle and the Bybit hack.

(BTC dominance / Trading View)

Futures Market: BTC futures open interest has climbed 2.24% to $59.61 billion, signaling increased speculation and leveraged positioning.

Liquidation Data: Total BTC liquidations remain relatively low at $2.71 million. Long positions faced the brunt of the liquidations, totaling $2.68 million, while short liquidations were minimal at $27,280.

Bybit Hack and Its Market Impact

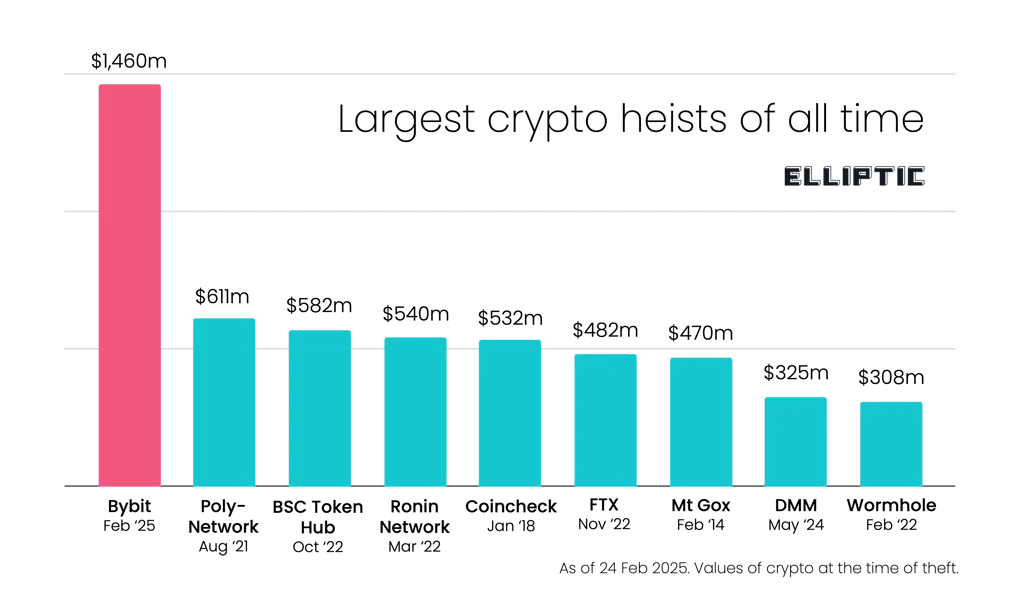

On Friday, Dubai-based crypto exchange Bybit, suffered a staggering $1.46 billion hack, marking the largest crypto heist in history. Analysts have attributed the attack to North Korea’s infamous Lazarus Group, which has stolen over $6 billion in digital assets since 2017, reportedly funneling the proceeds into the country’s ballistic missile program.

(Bybit hack compared to previous hacks / elliptic.co)

The stolen assets, mostly ether (ETH), are being converted into bitcoin, likely using unregulated services such as eXch, with further obfuscation via mixers expected. This conversion trend has likely contributed to bitcoin’s increasing dominance as investors shift assets away from ETH, which was more directly impacted by the hack.

Fed Rate Uncertainty Adds to Market Volatility

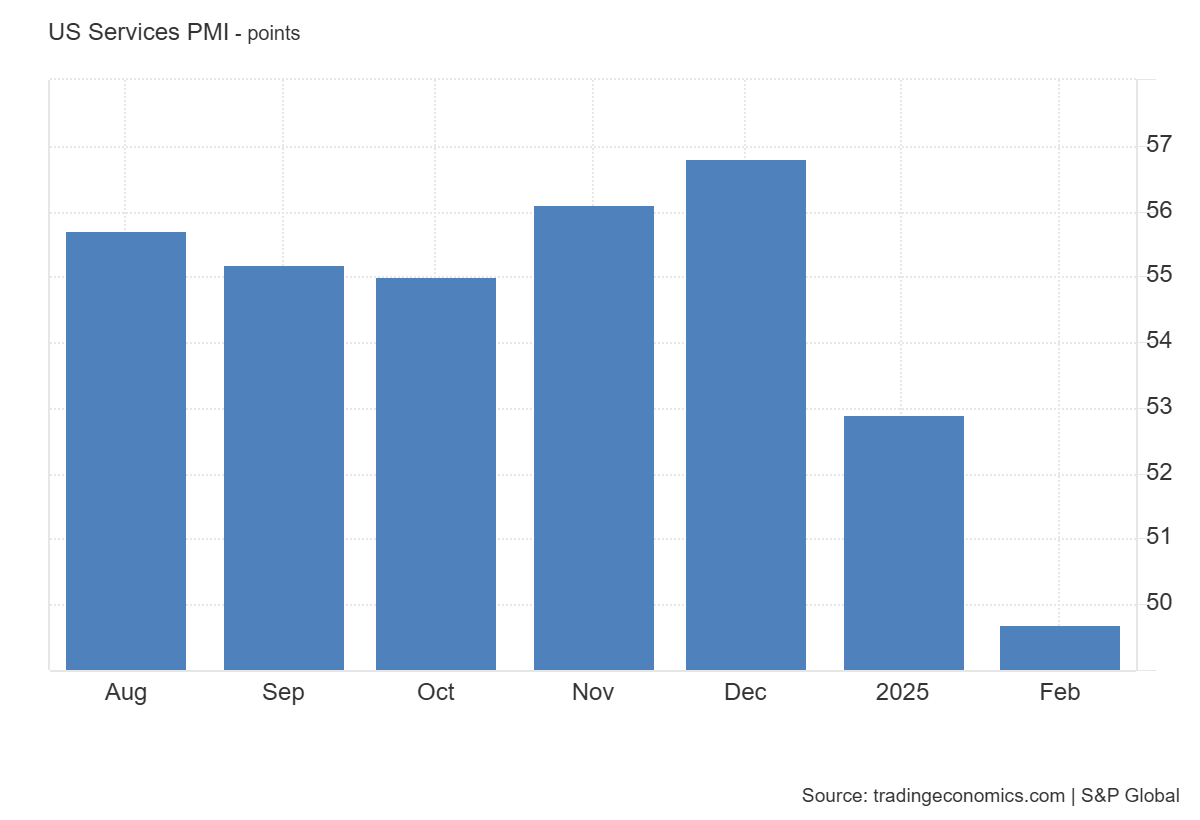

Recent data shows a slowdown in U.S. business activity, with the S&P Global US Services PMI dropping to 49.7 in February of 2025 from 52.9 in January. The dip was counter to expectations that it would rise by 53 and is an indication of economic contraction.

(U.S. Services PMI dipped in February / tradingeconomics.com)

Meanwhile, the Fed remains cautious, emphasizing the need to mitigate inflationary pressures. Factors such as persistent inflation, government cuts, and tariffs are complicating economic conditions, increasing volatility in traditional and crypto markets alike.

Market Outlook

With bitcoin dominance rising and futures open interest increasing, traders appear to be positioning for potential short-term gains. However, the Bybit hack’s ongoing ramifications and macroeconomic uncertainties could keep BTC under pressure in the near term.

If BTC holds above the $95,000 support level, a rebound toward $97,000 is possible. On the downside, failure to maintain this threshold could lead to further declines, with $93,500 emerging as a key support level. Overall, market sentiment remains cautious, with traders balancing bullish long-term prospects against short-term headwinds.

[ad_2]