[ad_1]

A popular crypto analyst says technical indicators are suggesting that Bitcoin (BTC) is in the middle of a rapid ascent to the $160,000 mark.

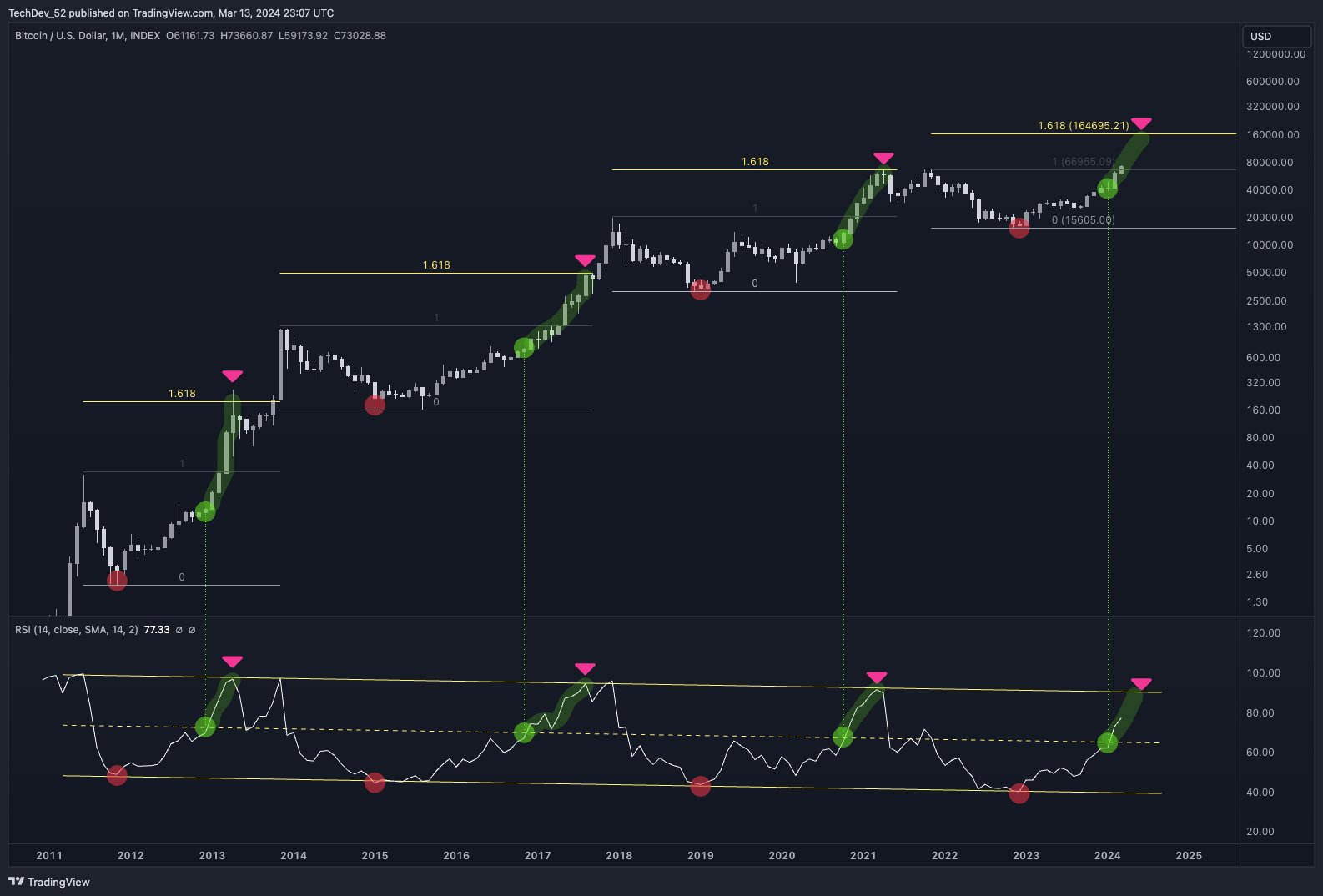

Pseudonymous analyst TechDev tells his 439,000 followers on the social media platform X that he’s watching Bitcoin’s relative strength index (RSI) and its Fibonacci extension levels on the monthly timeframe.

The RSI is a widely used technical indicator that tracks an asset’s momentum.

According to TechDev, every time Bitcoin’s RSI broke above the mid-point of a descending channel, currently near the 65 level, BTC made a run to the 1.618 Fibonacci extension level.

With Bitcoin now above TechDev’s channel median point, the pattern suggests BTC will rally towards its 1.618 level, currently at $160,000.

“No guarantees here, but I do find it interesting…

Each time monthly RSI broke above the channel median, it went to the channel top, and Bitcoin went to the 1.618.”

Source: TechDev/X

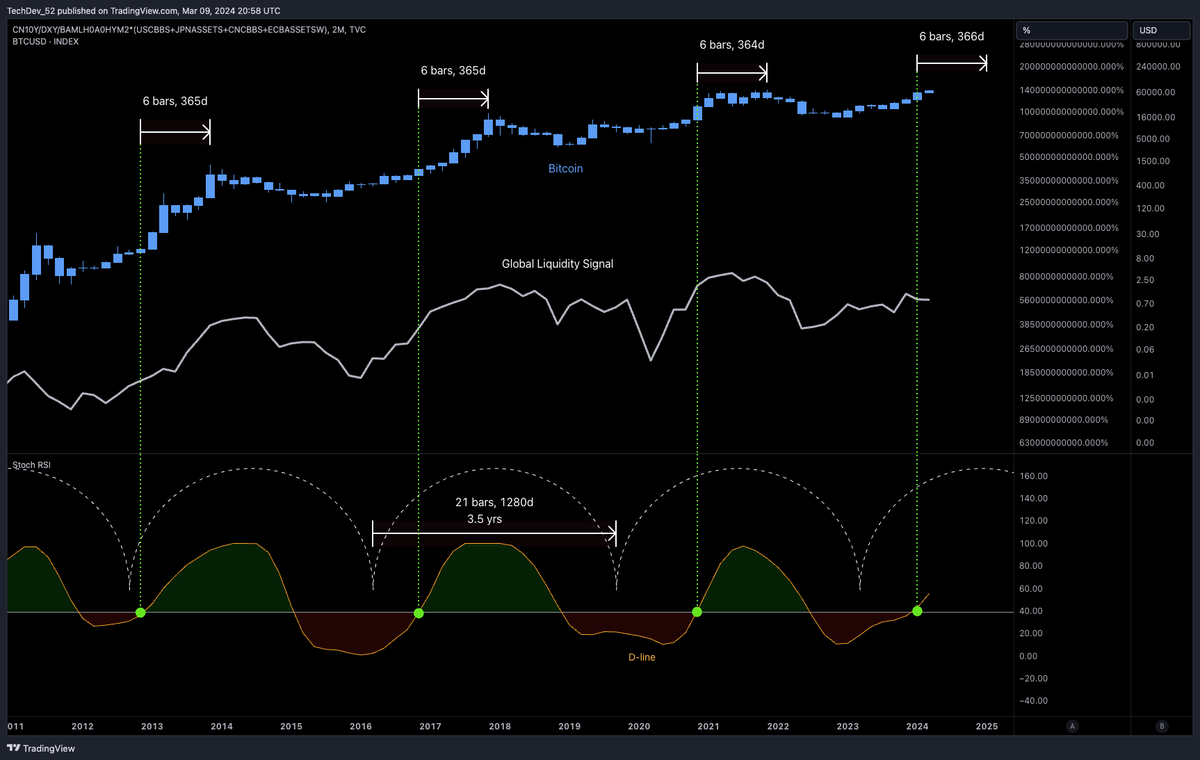

While there has been speculation on whether Bitcoin is ahead or behind its traditional four-year cycle based on halvings, TechDev says the cycle is right on time when looking at global liquidity, or the amount of dollars sloshing around in the financial system.

Using his global liquidity signal, plus a stochastic RSI, the analyst suggests BTC is nearing the stage where it historically enters into a parabolic move to the upside.

“To me, Bitcoin isn’t ahead of, or behind schedule.

The cycle is a liquidity one.

It is 3.5 years peak-to-peak.

And each cycle’s inflection point has determined Bitcoin’s price acceleration and peak timing.”

Source: TechDev/X

At time of writing, Bitcoin is worth $68,488.

Generated Image: DALLE3

[ad_2]