Bitcoin has finally broken out of its boring $100k—$110k range and ripped through to a new all-time high of $122,000. Now, every bullish trader is pointing straight at the $136,000 level, which is the next resistance/price target. And if this momentum keeps rolling, they might just get there sooner than anyone expects.

This isn’t just some random breakout either. According to Glassnode’s Cost Basis Distribution (CBD) Heatmap, the recent chop wasn’t wasted.

While everyone else screamed “range-bound,” smart money was busy accumulating around $93k–$97k and again at $104k–$110k. Those zones are now loaded with bag holders who are already deep in profit, and that kind of stacked support doesn’t vanish overnight.

Bulls step into profit territory and don’t look back

According to Glassnode, the crypto market is different now because the spot price is above the 95th percentile of cost basis, which sits around $107,400, based on the Quantiles model.

That $107K level is usually where the profit-taking begins, mostly from short-term holders trying to lock in gains fast, as per usual.

That’s already happening. After topping out at $122.6k, Bitcoin quickly pulled back to $115.9k. And guess where that rejection hit? Right after pushing above the +1 standard deviation from the Short-Term Holder (STH) cost basis.

Source: Glassnode

That level has often worked like a magnet and a ceiling during high-momentum phases. Every time Bitcoin pushes through it, a chunk of traders dump bags and force the market to pause.

But according to Glassnode, the recent Bitcoin pullback didn’t wreck the structure; it’s merely a healthy cool-off, and if momentum holds, the next real fight will happen at the +2 standard deviation zone.

Short-term holders flood the market with profit-taking

Let’s talk about those short-term holders. Right now, about 95% of their supply is sitting in profit. That’s more than 1 standard deviation above the long-term average of 88%, making this the third breakout above 95% since early May 2025. That kind of repeated euphoria is a classic setup for a top.

If this profit number starts to fall back under 88%, that’s where the danger really starts, because it’ll mean demand is weakening and sellers are finally starting to run out of buyers. It doesn’t need to be dramatic, says Glassnode, just a slow drip of distribution from tired hands.

Source: Glassnode

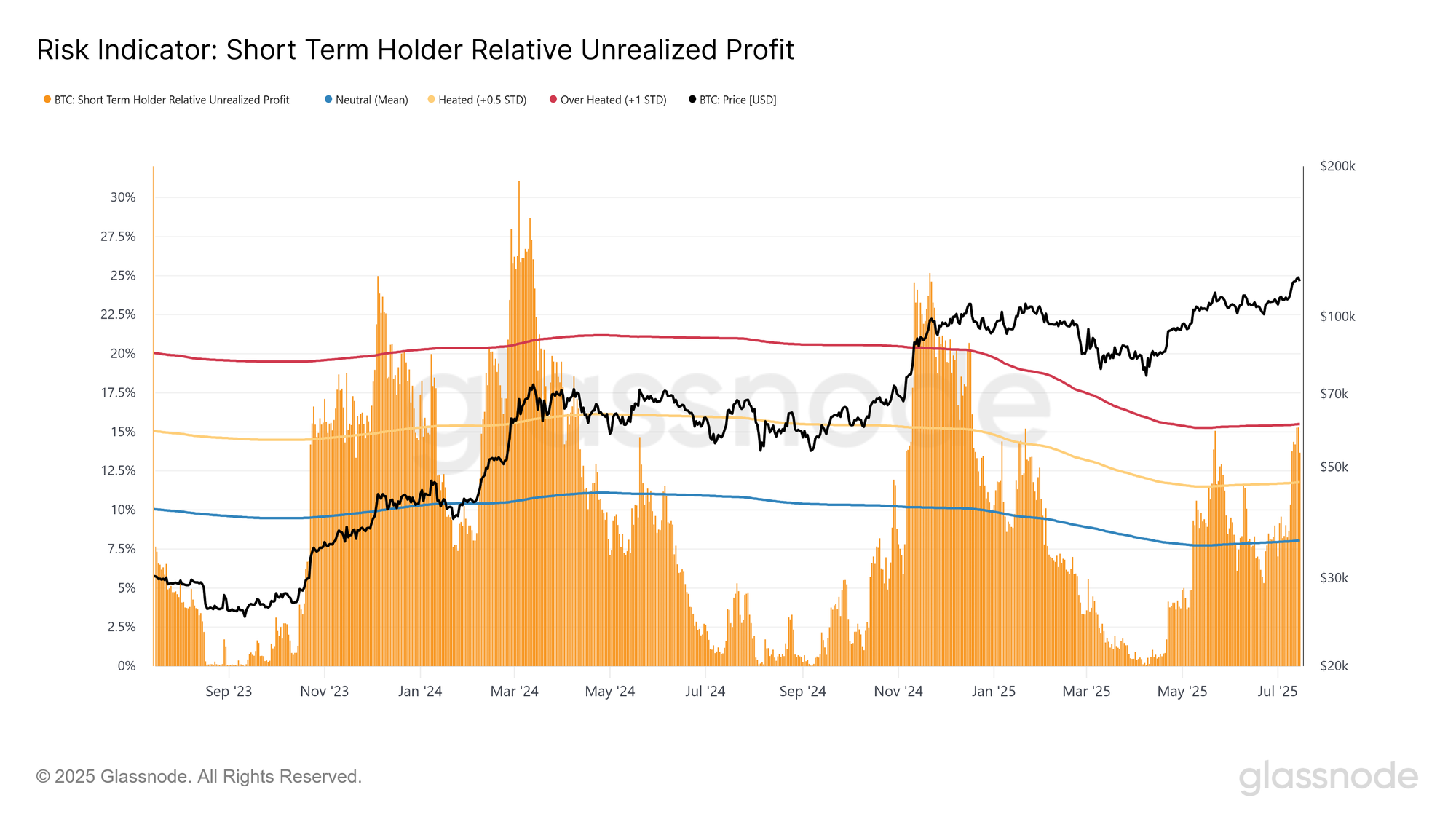

Next up, we’ve got the Short-Term Holder Relative Unrealized Profit, which had hit 15.4%, right at the overheated threshold, then backed off to 13.6% after the recent dip to $115,000. That kind of action says the gains are real, but not insane… yet. But this is the zone where tops often start to form, even if it takes a few more weeks of back-and-forth before things unravel.

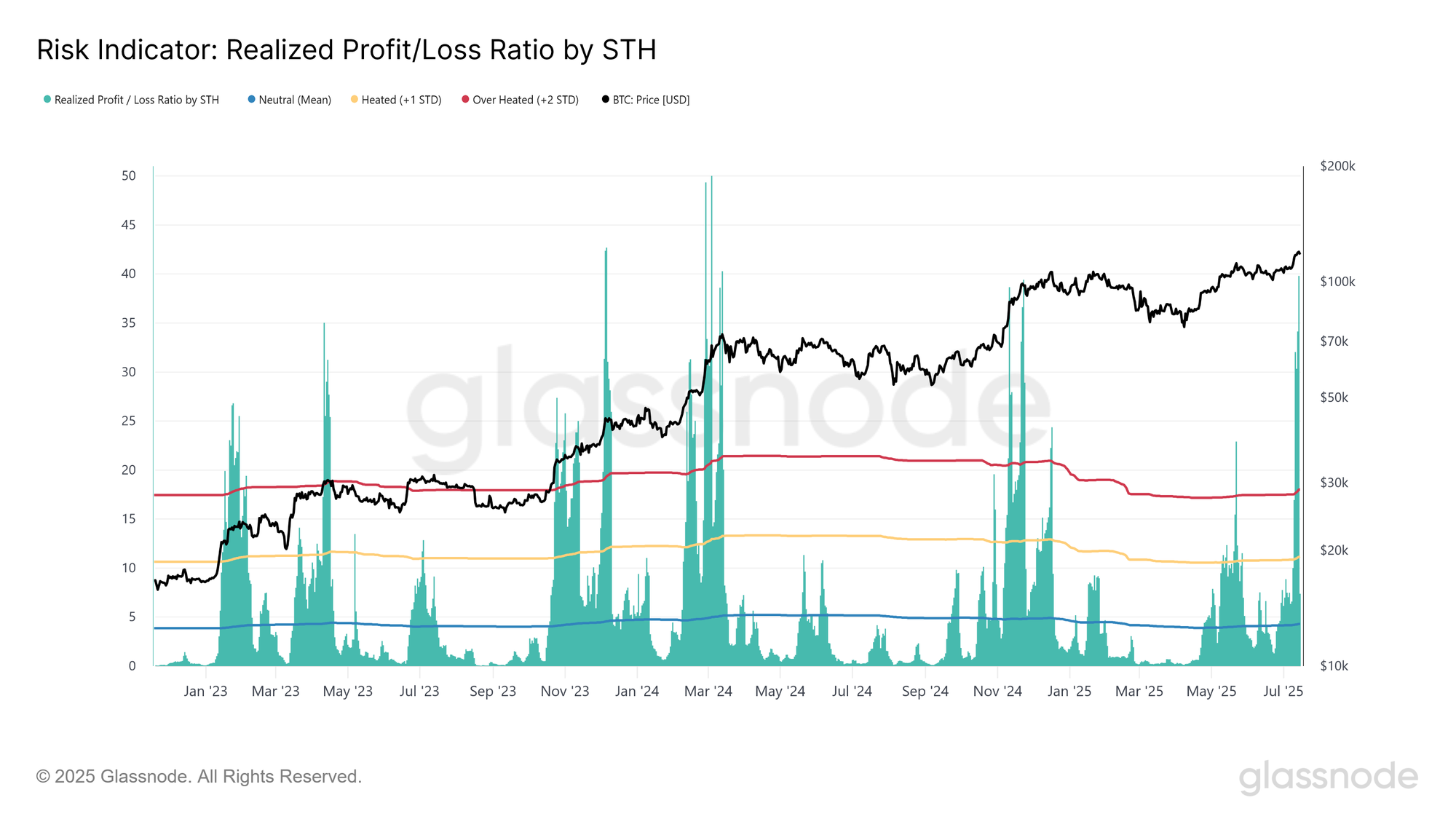

What usually follows is a wave of profit spending, and guess what? We’re seeing that too. The Percent of Spent Volume in Profit for short-term holders is now above its +1 standard deviation band, which has been a clear warning sign in the past. That metric fired off right before the 2024 peak, and we’re now seeing the first major round of heavy profit-taking since that time.

It doesn’t stop there. The Realized Profit to Loss Ratio also went nuclear recently. It spiked to 39.8, miles above the +2 SD line, and while it’s cooled back to 7.3, that’s still extremely high for any bull cycle.

Source: Glassnode

This is what you get when the market becomes a casino. Everyone’s up big, and everyone’s ready to sell.

And yet… the demand hasn’t died. Not even close.

Bitcoin spot ETFs are on a heater too. Institutional investors added around 20,000 BTC just this week, and that makes it seven weeks in a row of positive inflows. So even though short-term holders are selling into strength, the big players are still buying the dip, and not in small amounts either.