The world’s largest cryptocurrency Bitcoin (BTC) extends its rally further to more than 6% in the last 24 hours with the BTC price shooting past $52,400. The Bitcoin price rally this week has helped it overtake some of the top giants like Tesla with its market cap topping $1 trillion.

Bitcoin Price Surges Past $52,000 Mark, Ethereum Tops $2,800

In the latest crypto market rally, Bitcoin (BTC) has surged past the $52,000 threshold, currently quoted at $52,371, marking a significant 5.9% increase within a 24-hour period. some market analysts are already predicting another 40% rally in Bitcoin to hit new all-time highs by March 2024.

Meanwhile, Ethereum (ETH) has also experienced a notable uptick, breaking through $2,800 to reach $2,816, reflecting a 6.89% surge within the same timeframe. Joining Ethereum, the top ten altcoins have also rallied anywhere between 5-10%.

Market data from CoinGlass reveals a substantial liquidation of $225 million across the entire cryptocurrency market within 24 hours. Of this total, $45.15 million corresponds to liquidated long orders, while $180 million corresponds to liquidated short orders. This surge in liquidations underscores the heightened trading activity and volatility within the crypto market during this period of price escalation.

One major factor behind the Bitcoin price rally is the heavy inflows into spot Bitcoin ETFs. The single-day inflows in the newly launched Bitcoin investment vehicles in the US crossed $600 million a day before.

BTC Price Action Going Ahead

In a recent analysis, crypto analyst Michael van de Poppe highlighted Bitcoin’s remarkable surge, breaking through the $51,000 mark to establish a new yearly high. Expressing surprise at the market’s strength, van de Poppe suggested a potential peak in the range of $54,000 to $58,000 before the upcoming halving event.

Courtesy: Michael van de Poppe

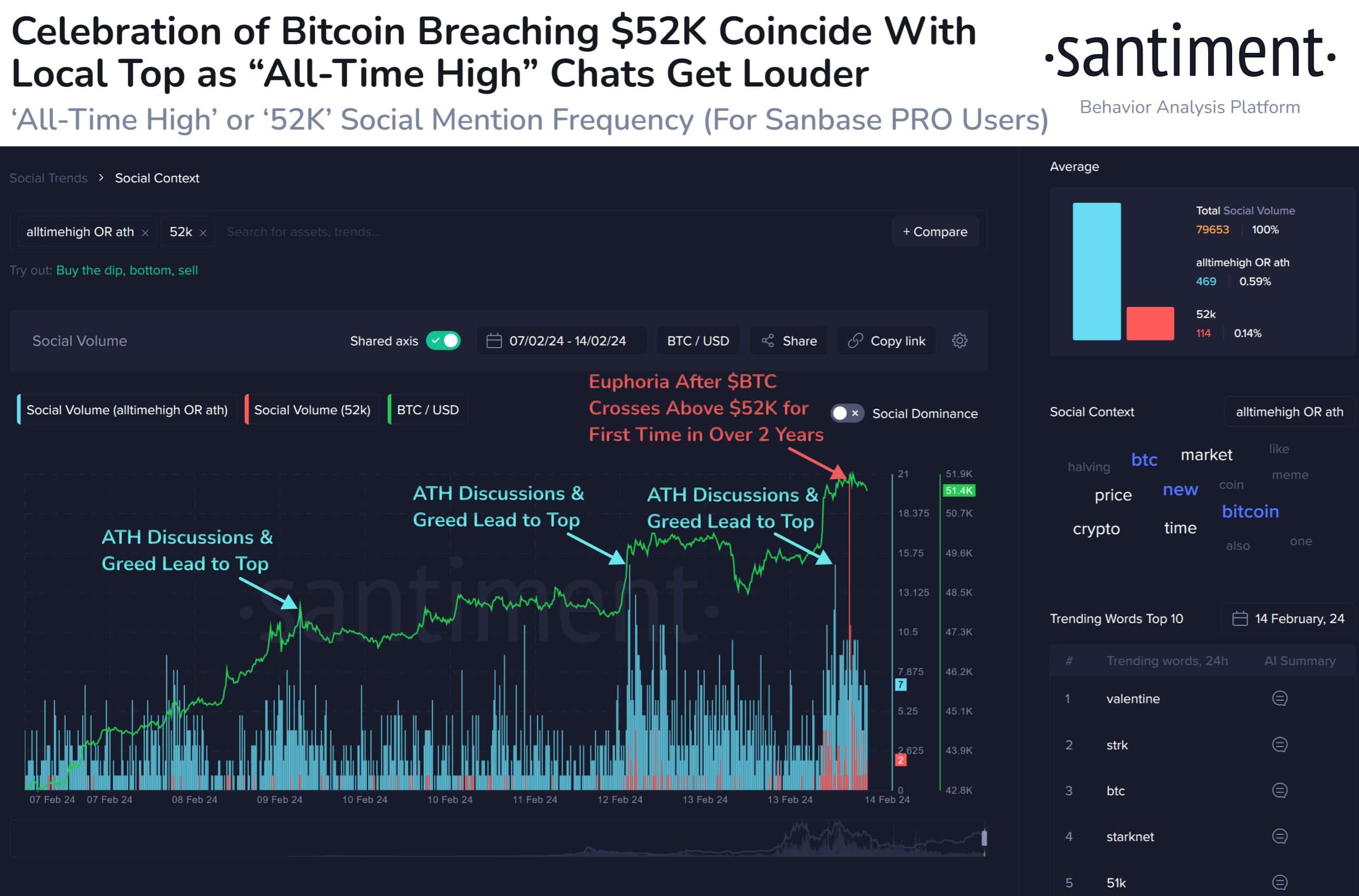

According to insights from on-chain data provider Santiment, Bitcoin has once again surged past the $52,000 mark, marking a significant milestone not seen since December 3rd, 2021. However, analysts are urging caution as excessive celebrations following such thresholds often precede temporary market peaks.

Courtesy: Santiment

During this bullish cycle, historical data suggests that exuberant sentiments expressed by traders on social media, especially regarding the likelihood of reaching all-time highs, have sometimes coincided with local tops forming shortly after.