[ad_1]

Bitcoin (BTC) is becoming more difficult to mine after increasing competition in the past ten days. The next difficulty adjustment may make the network even more competitive.

The Bitcoin (BTC) difficulty index is near an all-time high, after a small readjustment at the end of January. The next difficulty readjustment points to an increase of 4.71%, further pressuring miners to allocate more resources or shut down their operations to await more favorable difficulty conditions. The behavior of miners and their readiness to produce coins under all conditions may sighal whether the price of BTC will continue its upward trek, or face more selling pressure.

In the past few days, the mining profit/loss sustainability metric shifted to ‘underpaid’, based on Cryptoquant data. Since 2022, miners had periods of underpaid mining, which did not stop them from building more data centers. However, this also meant miners were strategic about their selling, trying to make the best of local market tops.

The Bitcoin mining capitulation theory has been tested over four halvings already. In all of Bitcoin’s history, miners have not abandoned the network, or led to block production stalling. However, beyond a certain point, miners may accelerate their selling and put more pressure on the price of BTC.

The effect of mining capitulation may clear out inefficient miners, leading to the replacement of equipment and a new equilibrium of expenses and block rewards. The price per difficulty is currently in a transition zone, where miners may continue stretching their efforts for a while, but may soon shift to selling.

Bitcoin mining remains competitive for bigger operations

Just before the difficulty readjustment, mining rates jumped again to over 992 EH/s. Big pools and mining operations showed no signs of diminishing their attempts to solve blocks. However, some miners continue to compete even as the potential earnings margins are small.

The upcoming difficulty adjustment may lead to a period of slower mining, in a bid to create more favorable conditions. However, some mining operations may also try to inflate the hashrate and make the less competitive mining facilities capitulate.

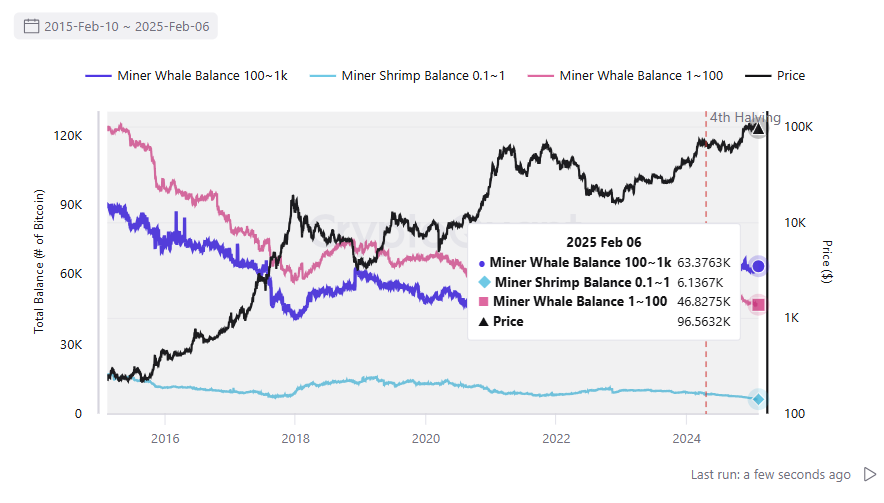

Bitcoin average mining costs are at $86,000, while BTC traded above $97,000. The effect of mining difficulty will be different for various pools and solo mining data centers. Even now, whale miners can afford to retain more of their coins, while small-scale operations are selling faster.

Small-scale miners are selling faster, while whale operations can afford to hold BTC. | Source: Cryptoquant

The trend of shrimp and small-scale miners selling accelerated in the last days of 2024, when BTC made its trek above $100,000.

Will miner capitulation cause a price bottom?

Miners retain up to 1.91M coins, with daily fluctuations from selling and new production. The decision to sell during a capitulation event will deplete reserves accrued during previous halving periods.

A miner capitulation event, even if not dramatic, can signal the end of a market drawdown. The current signs of miners slowing down their activity and selling may translate into a BTC buy signal in the coming weeks.

BTC already went through one small capitulation event in the summer of 2024, followed by a similar historical buy signal. Miner behaviors are seen as relatively predictable, and a way to gauge the way forward for spot coin buying.

In early 2025, BTC still had a relatively successful performance in January. For some miners, the expenses for mining one extra BTC were still lower than the market price, while also offering future value in case of an ongoing bull market in 2025.

Despite the mix of challenging mining conditions, BTC is still not flashing a Hash Ribbon indicator. The appearance of a hash ribbon signals the active phase of miner capitulation, where conditions really spark a round of selling.

For the last time, a short capitulation signal appeared in October 2024, immediately offset by the year-end rally. The appearance of a hash ribbon also coincides with periods of more dramatic market drawdowns. The period of miner capitulation, however, is also an indicator that the drawdown is over and a local low has been found. After that, both traders and miners return to equilibrium and may start a new bullish cycle.

[ad_2]