[ad_1]

- Bitcoin climbs above $85K amid falling exchange inflows and futures market outflows.

- Glassnode data shows bearish inflow crossover, signaling ongoing downtrend since mid-March.

- Futures traders reduce exposure, while low trading volume hints at weak momentum behind rebound.

Bitcoin surged above the $85,000 mark on Friday, but underlying market data points to reduced activity and increased caution among investors. While the price rebound indicates a short-term recovery, both spot exchange metrics and futures data suggest the market may be entering a consolidation phase or awaiting clearer signals before resuming a stronger trend. Analysts tracking inflow momentum and futures positioning highlight a cooling pattern contrasting with the price movement.

According to blockchain analytics firm Glassnode, Bitcoin’s exchange inflow momentum continues declining, adding signs of a broad downtrend that began in mid-March 2025. The report tracks the 30-day and 365-day simple moving averages (SMA) of inflow volume.

#Bitcoin $BTC exchange inflow volume momentum is a key metric for spotting strong entry points. For now, it’s signaling patience. We’re still waiting for the right opportunity to step in. pic.twitter.com/NSS1fZcHMl

— Ali (@ali_charts) April 19, 2025

A crossover has emerged with the 30-day SMA falling below the longer-term average, historically interpreted as a signal of weakening short-term momentum relative to the longer-term trend. The trend is marked visually by red-shaded zones on the chart, highlighting periods of downtrend activity.

Bitcoin has remained range-bound between $60,000 and $70,000 during the current phase, even as overall exchange inflows declined. The chart also shows reduced volatility in inflow bars, indicating a market lacking strong accumulation or distribution events.

This development suggests that investors are holding off on transferring coins to centralized platforms due to market uncertainty or an absence of short-term catalysts. Reduced inflow volume often aligns with lower price volatility and reflects a subdued trading environment. It may also indicate that the market is preparing for further correction or waiting for macroeconomic triggers before making big moves.

Futures Outflows Reflect Pullback in Leverage

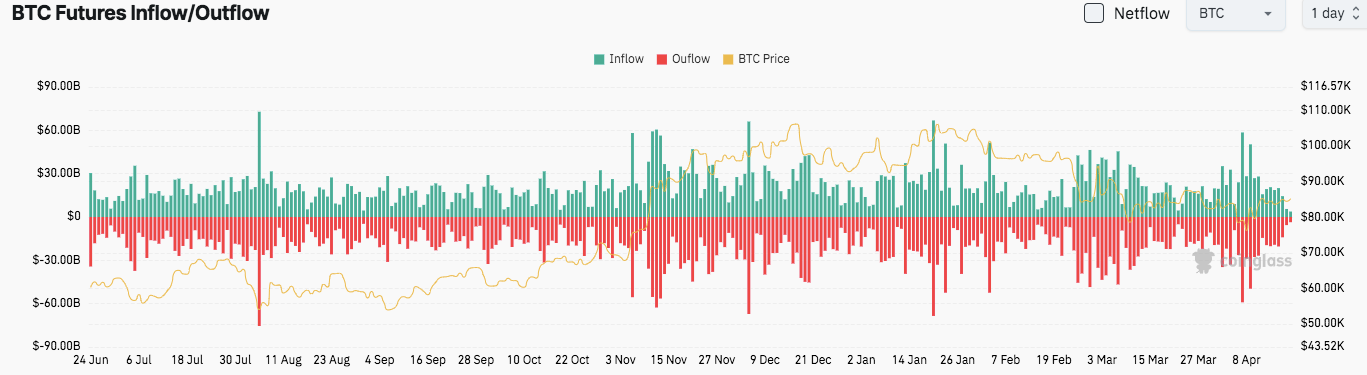

At the same time, according to the dynamics shown by CoinGlass, there is a constant outflow of cash from the Bitcoin futures market. The daily outflow has been increasing since the beginning of March, particularly in the first half of the month following Bitcoin’s drop in price to slightly above $ 110,000 in mid-March.

Source: Coinglass

Since November 2024 to February 2025, futures inflows dominated the busy period where Bitcoin was on the rise indicating more trader confidence and leverage on speculation. However, that sentiment has shifted, with notable outflows in mid-February and early April reflecting reduced exposure to leveraged positions.

Although minor inflow spikes re-emerged in late March, they failed to surpass the outflows, confirming a net decline in futures positioning. The change suggests traders await improved technical or macro signals before reentering the market with larger contracts.

Bitcoin Rebounds on Low Volume

Despite subdued market dynamics, Bitcoin recovered to $85,176.24 during the time of writing, marking a 0.69% gain over 24 hours, as reported by CoinMarketCap. The price had consolidated near $84,600 in the previous session before a breakout occurred early Friday. However, the rally was accompanied by a sharp decline in 24-hour trading volume, down 35.13% to $13.4 billion.

Source: CoinMarketCap

The drop in volume suggests the move may have been influenced by thinner liquidity rather than strong demand. Bitcoin’s market capitalization remains at $1.69 trillion, with a circulating supply of 19.85 million out of a fixed 21 million.

[ad_2]