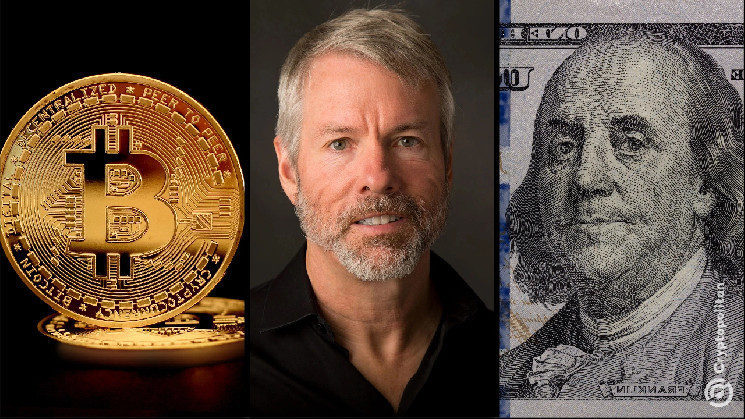

MicroStrategy’s executive chairman Michael Saylor has spent the past four years hammering one message home: buy Bitcoin and never sell it. As Bitcoin shattered the $100,000 milestone for the first time this week, Saylor took the opportunity to double down on his aggressive investment strategy.

“Every day for the past four years, I’ve said buy Bitcoin, don’t sell the Bitcoin. I’m going to be buying Bitcoin at the top forever,” he told Market Domination hosts Julie Hyman and Josh Lipton. His approach is brutally straightforward: convert spare capital into Bitcoin, hold it long-term, and ignore the noise.

“Just keep buying Bitcoin,” Saylor said. He emphasized treating Bitcoin as a long-term capital asset, perfect for money you won’t need for at least four years—or better yet, ten.

Dollar-cost averaging into Bitcoin quarterly and sweeping long-term savings into the crypto is Saylor’s go-to move, regardless of short-term volatility. “Don’t get worked up over the swings,” he said.

MicroStrategy has evidently taken this philosophy to the extreme, transforming itself into what Saylor calls a “Bitcoin treasury company.” Since 2020, the company has been on a relentless buying spree, turning heads and dividing Wall Street.

Bitcoin breaks records, but MicroStrategy stumbles

Bitcoin hit an all-time high of $103,992 on December 4, a moment that crypto enthusiasts had long anticipated. MicroStrategy’s stock MSTR, which many view as a proxy for Bitcoin, also surged that day, reaching a peak of $543. But the celebration was short-lived.

By the next morning, MicroStrategy’s stock plummeted 28%, closing at $406. It dropped another 4.8% on Thursday, leaving investors questioning the strategy.

MicroStrategy’s market value hinges on its Bitcoin holdings, but its stock doesn’t always move in tandem with Bitcoin. Right now, the company’s shares trade at 2.3 times the value of its Bitcoin stash, a drop from the 3.4X multiple it boasted in November.

For bullish investors, this is a disappointment. Many hoped the stock would trade at a much higher premium, even reaching double digits.

Despite the volatility, MicroStrategy’s performance this year has been nothing short of dramatic. Its stock has skyrocketed 512% year-to-date, dwarfing Coinbase’s 84% gain and Robinhood’s 205% rise.

Yet, those numbers pale compared to Bitcoin’s recent surge. Investors betting on MicroStrategy to outperform Bitcoin were left hanging.

Critics argue the stock doesn’t provide the same upside as Bitcoin itself. Traders have also piled into leveraged MicroStrategy ETFs, amplifying both gains and losses. JPMorgan said earlier this week that leveraged ETFs have become a popular but risky way to bet on the company’s fortunes.

Trump’s victory fuels Bitcoin’s rise

The crypto market got a fat boost after Donald Trump’s November 5 election win. The president-elect’s crypto-friendly policies, including his decision to nominate Paul Atkins as chair of the Securities and Exchange Commission, sent Bitcoin soaring past $100,000.

Atkins has a track record of supporting digital assets, and his appointment has been widely interpreted as a green light for Bitcoin-friendly regulations.

Meanwhile, MicroStrategy wasn’t always a Bitcoin powerhouse. The company originally sold business analytics software. That changed in 2020 when Saylor began pouring company cash into Bitcoin.

Since then, the firm has pivoted entirely, branding itself as a bridge between traditional capital markets and the crypto economy. “Our job is to connect the two worlds,” Saylor said in a recent CNBC interview.

This hasn’t come without risks. While Bitcoin’s capped supply of 21 million coins appeals to Saylor, it hasn’t insulated MicroStrategy from criticism. Nearly 20 million Bitcoins have already been mined, leaving only 5% of the total supply remaining.

Saylor sees this scarcity as a major advantage, predicting 50% annual returns for the cryptocurrency. But skeptics question whether MicroStrategy can sustain its strategy.

MicroStrategy has increased its Bitcoin holdings by 60% since September 30. The firm’s average cost per Bitcoin has risen to $58,000, up from $39,000 earlier this year.

It should be noted that MicroStrategy bought fewer than 9,000 Bitcoins in 2022 when prices were low but ramped up its purchases as prices soared to record levels.

Saylor brushed off these concerns in an interview with Barron’s. “People think you’re going to dilute them, but our plan is to accrete them,” he said. The company measures this accretion using a metric it calls Bitcoin “yield.”

While not a yield in the traditional sense, it reflects the increase in Bitcoin held per share. This year, Bitcoin per 1,000 shares has jumped from 0.9 to 1.5, a 60% gain.

Volatility has been both a challenge and an opportunity. MicroStrategy’s stock is about 10 times as volatile as the S&P 500, according to Saylor. This volatility has allowed the company to issue convertible debt at attractive terms, including a zero interest rate and a high conversion price of $672—a 55% premium to its current market price.

And analysts remain bullish. Bloomberg claims that all eight firms covering MicroStrategy have issued buy ratings, a sign of continued confidence in Saylor’s strategy.

“You don’t need to understand how we do it. You just need to hold your Bitcoin and let us drive the price up,” he has said.

Land a High-Paying Web3 Job in 90 Days: The Ultimate Roadmap