Sophisticated investors and high-net-worth individuals often use over-the-counter desks to execute trades without directly affecting the spot-market price.

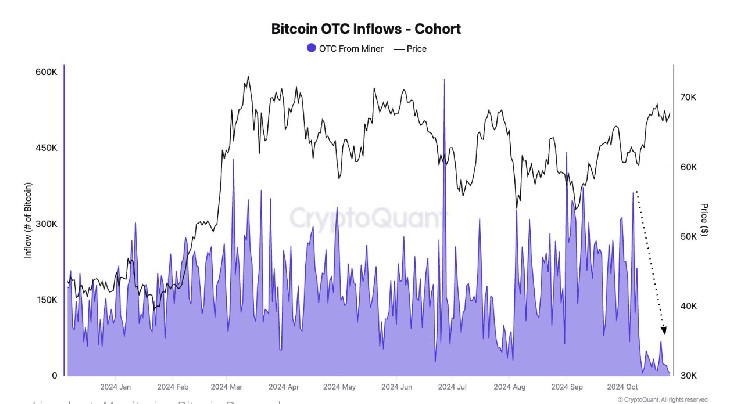

In the past five months, OTC desks have seen a rise of over 200,000 BTC, one of the highest levels recorded in recent years.

As bitcoin (BTC) approaches a record high, sophisticated investors appear to be taking steps to trade without influencing the price in the spot market.

At about $72,300 as of noon in Europe, the largest cryptocurrency by market value is less than 2% below the $73,798 record set in March, according to CoinDesk Indices data. Bitcoin has jumped about 14% this month, on track for the biggest one-month gain since March.

A remarkable feature of this recent bitcoin run is that over-the-counter (OTC) desks, which allow two parties to trade directly without disclosing information to the wider market, now hold 416,000 BTC ($30 billion) compared with an average of less than 200,000 BTC during the first quarter, according to CryptoQuant data.

OTC desks are primarily used by institutions or high-net-worth individuals who prefer to avoid having their transactions appear on crypto exchange order books, allowing them to transact large quantities without affecting the market price. The growing flow to OTC desks is one reason the bitcoin price has been trending in a sideways channel for the past seven months.

With an abundance of bitcoin on OTC desks, the U.S. spot-listed exchange-traded funds (ETFs) could make purchases without affecting the spot price.

Even Tuesday’s record daily purchases by the bitcoin ETFs represent just 2% of the total bitcoin balance on OTC desks. During the first quarter, with bitcoin posting an all-time high shortly after the ETFs received regulatory approval, the share of inventory ranged between 9% and 12%.

The total OTC desk balance, however, has held pretty steady since the beginning of September. The 30-day change is just 3,000 BTC, down from a June high of 92,000 BTC. During the first quarter, the pent-up demand led to a negative 30-day change in OTC desk balances, which helped propel the asset to its record high.

For bitcoin to go higher this cycle, daily inflows into OTC desks need to start reducing, as is observed currently. Daily inflows into OTC desks have declined to the lowest levels this year. CryptoQuant notes that in October, OTC desks averaged around 90,000 bitcoin, a reduction of 52% compared with the first three quarters of the year.

If demand for BTC continues accelerating amid low inflows into OTC desks, this could propel bitcoin to new highs.