Bitcoin (BTC) and gold lined up as the outperforming assets in 2024, on a mix of geopolitical uncertainty and still significant inflation. In former years, BTC outperformed, but gold had years of stagnant prices.

Bitcoin and gold are on track to outperform in 2024, standing ahead of other asset classes. Formerly, BTC was almost always ahead of the pack, with the exception of the deepest bear cycles. Often, BTC was also trading in an opposite direction to gold, which was considered a stagnant asset for ‘gold bugs’.

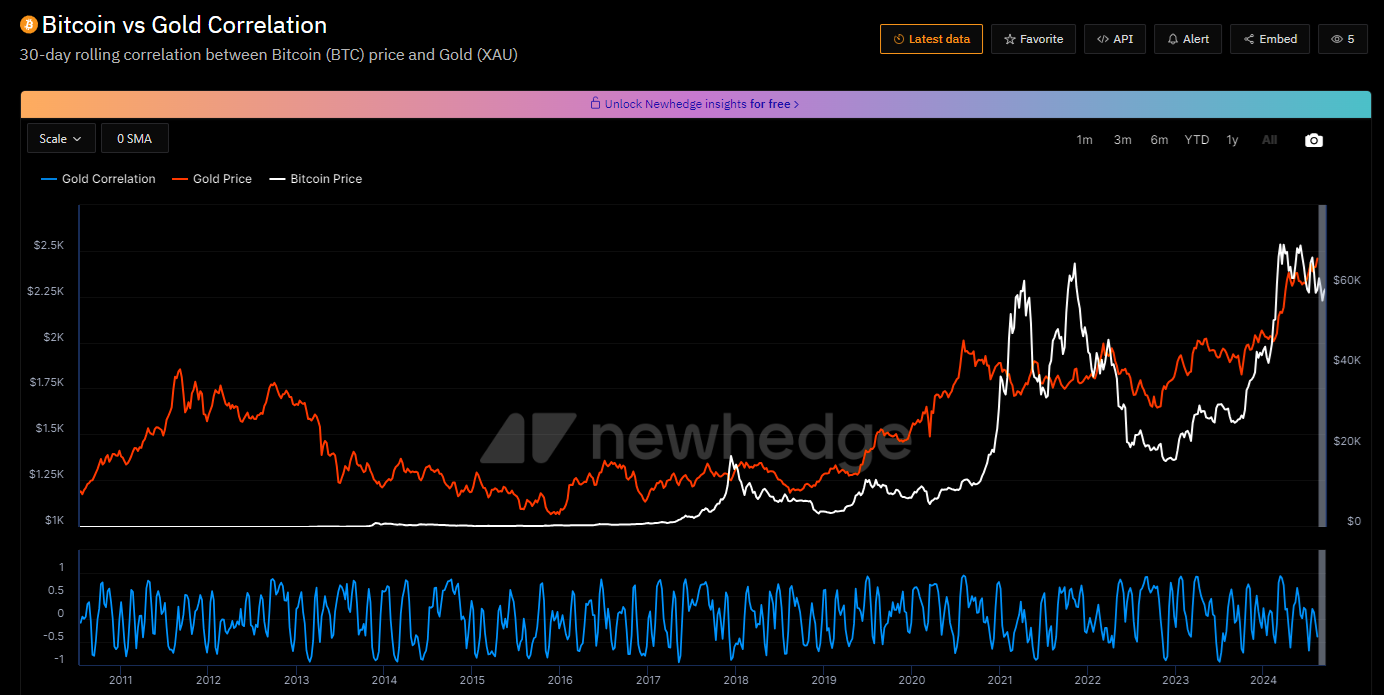

In 2024, however, a mix of global risks is raising both assets, as a hedge against inflation. BTC and gold prices emerged with a much stronger correlation since 2023.

Charlie Biello of the Creative Planning wealth management firm classified a selection of assets, showing BTC and gold took the #1 and #2 spots ahead of the pack. In his blog, Biello pointed out the most active asset classes and their dependence on inflation and cost of living.

BTC and gold outperformed in 2024, a correlation not observed in previous periods. | Source: Charlie Biello

For the first time since tracking the asset classes, both BTC and gold share the top gains. However, seeking out BTC and gold as a source of security was also the narrative in 2020, sparked by the Covid-19 pandemic.

BTC had gains of 302% net in 2020, while gold expanded by 24%, but enough to outpace other asset classes. During bull markets, BTC generally outperforms all other classes and only lags behind during its drawdown periods.

While some of the data suggest cost of living and food inflation are decelerating, BTC and gold still hold their appeal. Wage growth in real terms still has to catch up, but there is demand for assets that outperform the housing inflation.

Gold expects positive performance after Fed eases interest rates

Gold has a historically inverse relationship to gold prices, as a potential store of value. The US Federal Reserve performed a larger-than-expected rate cut of 50 bps, setting the interest rate ceiling at 5%.

BTC and gold both performed better than other asset classes and rallied together. | Source: Newhedge

This is also the first interest rate cut since 2020 when the rate was cut as low as 0.25%. From 2022 to 2024, inflation-fighting rate hikes lifted the rate to its peak of 5.50%, retained for more than a year. Since the year 2000, gold has outperformed after each rate-cutting cycle of the Fed.

After the news of the Fed rate cut and a further prediction of rate easing in 2026, gold briefly touched $2,600 per Troy ounce on the spot market.

When it comes to choosing BTC or gold, the argument from sound money actually sides with BTC. Gold is constantly adding new stock from growing production. The appeal of gold in 2024 is for its potential to rally faster than other assets. At the same time, the BTC price denominated in gold has grown almost constantly.

BTC dipped on selling the news

The BTC market expected a rate cut but did not rally after the actual larger-than-expected easing. BTC dipped again to $59,745.11, mostly due to insider factors and selling pressure.

Bearish traders pressured BTC, with selling orders pushing the price under the $60,000 range. It is uncertain if BTC can perform in a manner similar to the 2020 rate-cut season. However, the rally from lows under $4,000 at that time was much easier, and the rate was near historical lows.

BTC is also pressured by expectations of a weak September close. The leading coin also starts its rallies at around 170 days after each halving event. The current sideways choppy trading is happening 151 days after the halving, setting the more active bull market for October.

BTC is also growing its dominance after the 2022-2024 stagnation. The dominance is now at 57.2% of the total crypto market capitalization. Growing dominance shows funds are mostly flowing into BTC, as the most liquid and reliable asset.

BTC also gains support from the long-term accumulation and taking coins off exchanges. Traders remain cautious due to attempts to attack leveraged positions, but the overall trend is for holding while waiting for a bigger breakout. BTC still faces expectations of rallying to a new high in the last months of 2024.

Cryptopolitan reporting by Hristina Vasileva