The global crypto market has lost more than $1 trillion in just six weeks, marking one of its sharpest downturns since October.

According to analysts, the slide is not due to weak fundamentals, but heavy leverage and large institutional withdrawals.

The total market capitalization of cryptocurrencies now sits about 10% below levels recorded after the $19 billion liquidation event on October 10. This decline comes despite the absence of major negative news or regulatory setbacks.

Political commentary has even trended positively. For instance, just days ago, U.S. President Donald Trump said he wants the United States to become “number one in crypto.”

Nevertheless, Bitcoin has still fallen 25% in the past month, showing a clear disconnect between sentiment and price performance.

Analysts Identify Structural Issues Behind the Selloff

A research note from The Kobeissi Letter attributes the decline to structural pressures, rather than weakening fundamentals. The downturn began in mid-October, when institutional investors pulled capital from major crypto funds.

Data from CoinShares shows $1.2 billion in outflows during the first week of November alone. These outflows hit the market at a time when leverage was already extremely high.

-

Weekly Crypto Asset Outflows

Excessive Leverage Triggers Repeated Liquidations

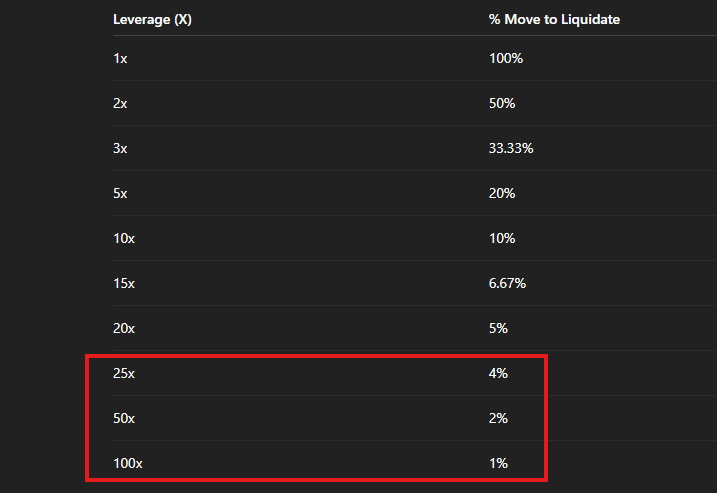

Leverage remains a defining feature of the crypto market. Crypto traders often use leverage as high as 20x, 50x, or 100x. Consequently, even a 2% price move can force liquidations. This, in turn, creates chain reactions when large numbers of traders simultaneously unwind their positions.

On October 10, forced selling reached $19.2 billion, which produced Bitcoin’s first $20,000 daily candlestick. Since then, volatility has remained elevated.

Moreover, the market has logged three separate liquidation days above $1 billion in the last 16 days. In fact, daily liquidations over $500 million are now routine, particularly when trading volume is low.

-

Daily liquidations in the Crypto Market

Sentiment Deteriorates as Fear Takes Hold

The Crypto Fear & Greed Index has dropped to 10, a level labeled “Extreme Fear.” This matches the low recorded in February 2025, even though Bitcoin remains up 25% from the trough in April.

Analysts say leverage is amplifying emotional swings among traders, therefore making sentiment unstable and prone to sudden reversals.

Bitcoin and Gold Break from Their Usual Pattern

Furthermore, the Kobeissi Letter notes a major shift in correlations between Bitcoin and Gold. Since the October 10 liquidation wave, Gold has outpaced Bitcoin by 25 percentage points in a single month. This, in turn, marks a clear break from earlier trends, when both assets moved higher together amid strong inflows.

The pain extends beyond Bitcoin. Ethereum has fallen 8.5% this year and dropped 35% since October 6. Analysts describe this as a severe downturn, especially since other risk assets have rallied in the same period.

Analysts See a Reset Rather Than a Fundamental Breakdown

Despite the sharp decline, The Kobeissi Letter argues that fundamentals in the cryptocurrency have improved. The firm believes the market is undergoing a structural reset, driven mainly by leveraged positions being forced out.

Accordingly, analysts say leverage and liquidations, rather than fundamentals, explain the current instability. They expect conditions to stabilize once excess risk is flushed from the system. In their view, the market may be nearing a bottom.