[ad_1]

Binance Research, the analytical arm of the world’s leading cryptocurrency exchange, plays a crucial role in dissecting the trends and potential futures of blockchain and decentralized finance (DeFi). Their recent report, “Breakthrough DeFi Markets,” delves deeply into the current state and evolving dynamics of the DeFi landscape, showcasing the rapid growth and innovative platforms sculpting the sector’s future.

DeFi TVL up 75% in 2024

DeFi TVL has increased by 75.1% in 2024

DeFi has witnessed a significant influx of capital in 2024, leading to a 75.1% increase in total value locked (TVL), which now stands at $94.9 billion. This growth benefits nearly every sector within DeFi, from stablecoins to on-chain derivatives. The yield markets have seen extraordinary expansion, growing 148.6% to reach a TVL of $9.1 billion. Pendle, known for its on-chain interest rate derivatives, showcases this surge with a staggering 1962% increase in TVL, which now stands at $4.8 billion.

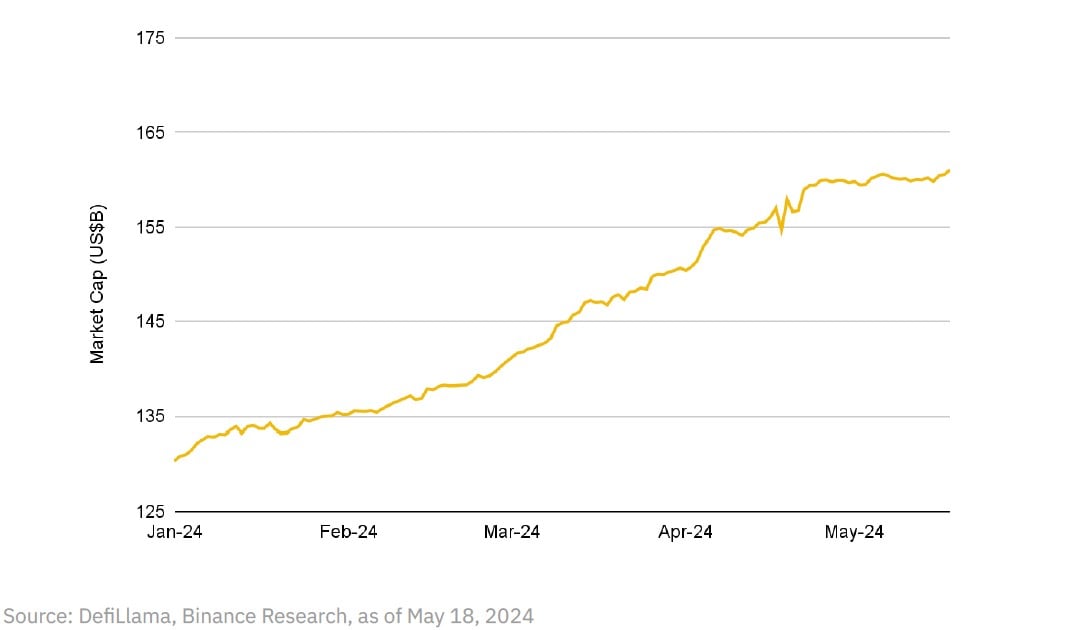

Stablecoin market cap continues to rise

Stablecoins are among the DeFi use cases that have achieved meaningful product-market fit, proving to be effective financial tools in both DeFi and CeFi. The stablecoin market cap has surged to US$161.1B, its highest in two years, driven by the current high-interest rate environment that has made the stablecoin business highly attractive.

The stablecoin market is dominated by centralized entities like Tether’s USDT and Circle’s USDC, which account for 90% of the market share. This dominance creates high barriers to entry for new players and illustrates that the stablecoin sector is far from perfectly competitive. While interest generated by stablecoins like Tether doesn’t benefit the holders, the demand for decentralized and yield-bearing stablecoins is increasing, driven by the availability of higher risk-free rates.

The solutions backed by RWAs and CDPs have faced challenges like capital inefficiencies and scalability issues. with its USDe steps in to fill this gap with a new approach, offering a yield-bearing stablecoin that avoids these pitfalls. If it continues to rise it might challenge the two centralized stablecoins.

Money market protocols have experienced notable growth in TVL

Money market protocols have exhibited remarkable growth, as evidenced by the surge in Total Value Locked (TVL), which has seen an impressive increase of 47.2% in 2024, reaching a notable $32.7 billion. This sector is primarily dominated by major players such as , , and innovative platforms like MakerDAO’s SparkLend. These key protocols have significantly shaped the landscape by integrating synergistic products that enhance user engagement and financial liquidity. The dynamics within the money market sector are shifting, with an increasing demand for using a broader range of long-tail assets as collateral.

Prediction markets have reached a record high in TVL

The prediction markets, although smaller in scale compared to the previously mentioned markets, have hit a record $55.1 million in TVL. The growth in this sector is primarily driven by the increase in activities surrounding the upcoming U.S. elections. This uptick signifies a growing interest in leveraging blockchain for real-world event wagering, forecasting, and speculating on the outcome of future events.

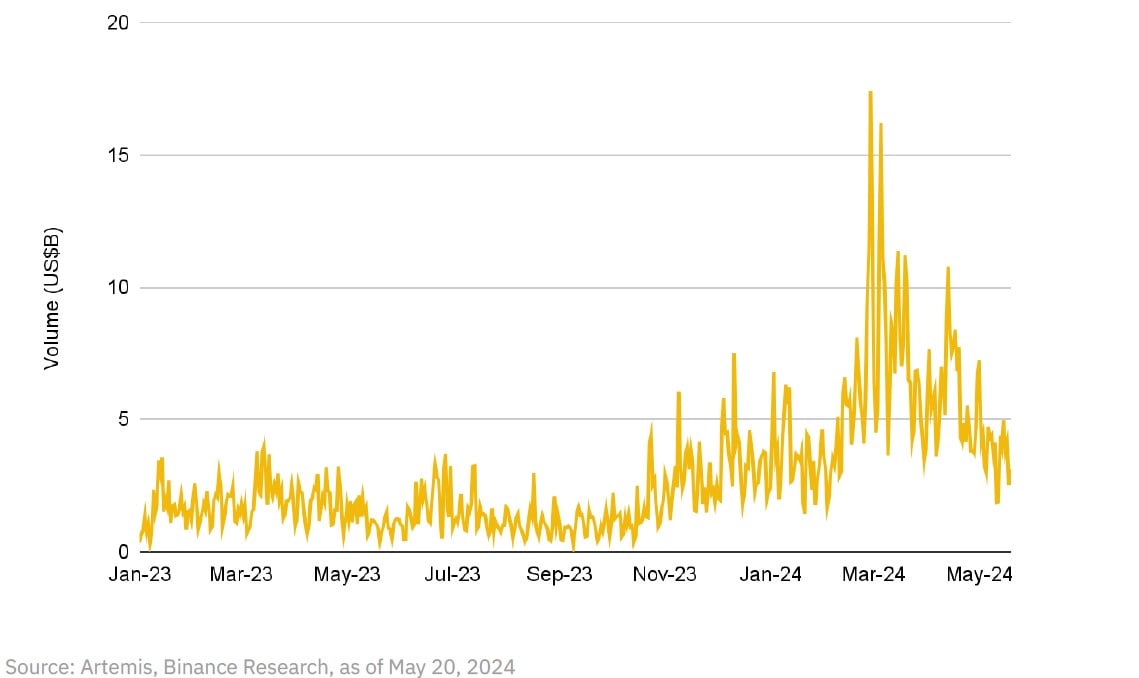

Derivatives market shows significant resurgence

On-chain derivatives have also seen a notable surge in activity. The average daily volumes have increased from $1.8 billion last year to $5.4 billion this year. Among others, Hyperliquid has emerged as a significant player, capturing 18.9% of the market share and becoming the second largest by trading volume behind dYdX. This highlights the evolving sophistication and utility of derivatives in the DeFi space, providing more complex financial instruments and risk management tools to participants.

Wrapping up

Binance Research’s “Breakthrough DeFi Markets” report presents a bullish outlook on the future of decentralized finance. It underscores the sector’s robust growth trajectory and the continuous innovation that drives it forward. DeFi is set to expand its influence to more mainstream financial applications, potentially transforming the global financial landscape.

[ad_2]