[ad_1]

Binance, world’s leading crypto exchange, has achieved a major breakthrough in trading volume. Its cumulative spot and derivatives trading volume has exceeded 100 trillion U.S. dollars, according to CCData.

This proves Binance to be the dominant force in both spot and derivatives trading.

Binance makes history

This month, Binance achieved a significant milestone by becoming the first centralized exchange to surpass $100 trillion in combined spot and derivatives trading volume, marking a historic moment in the crypto industry.

OKX follows at a distant second with $24.9 trillion, while Bybit and Bitget rank third and fourth with $13.2 trillion and $10.9 trillion, respectively. HTX rounds out the top five with $10.2 trillion in trading volume.

Interestingly, despite ceasing operations in November 2022, FTX still holds the position of the sixth-largest exchange in terms of all-time trading volume. This underscores the magnitude of its trading activity prior to its collapse and its lasting impact on the industry.

Bitcoin returns surpass expectations

Bitcoin closed Q3 with a modest 1.00% gain, recovering after dropping below $50,000 in August. As we head into Q4, market sentiment has turned bullish, supported by historical data showing an average return of 49.9% in Q4 since 2014.

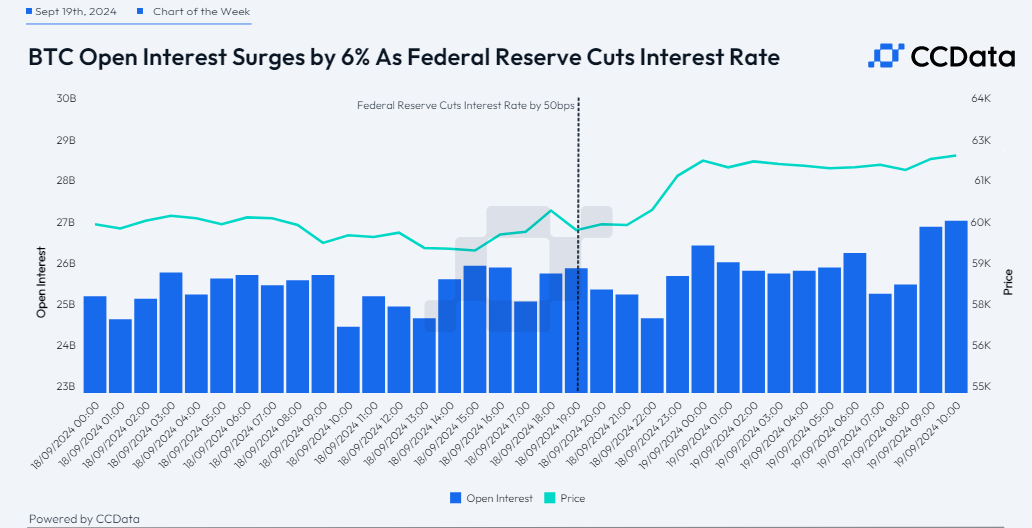

This optimism is reinforced by a shift in market dynamics following the Federal Reserve’s interest rate cut of 50 basis points. The cut boosted market activity, with Bitcoin’s aggregated open interest jumping 6% to nearly $27 billion.

Bitcoin’s price surged past $62,000, reflecting a strong bullish response, and altcoins followed suit, outperforming U.S. equities, which saw volatile movements.

This outperformance in the crypto market suggests that liquidity injections could follow, as the rate cut often indicates macroeconomic weakness after a multi-year tightening cycle. If further economic stimulus is required, risk-on assets like Bitcoin are expected to benefit most, with upward momentum likely to continue in the near term.

PEPE and FLOKI lead meme coin segment

In this week’s Coin of the Week (COTW) analysis, CCData reviewed the returns of the top 100 assets by volume, examining their performance since Bitcoin’s bullish momentum began in October 2023. This period marked the start of Bitcoin’s surge to new all-time highs, fueling the current bull market.

Notably, meme coins PEPE and FLOKI have led the market with impressive gains, boasting returns of 1,501% and 698%, respectively.

Solana also delivered strong performance, rising 599% despite its large market capitalization, further cementing its place as one of the top-performing assets.

On the other hand, some assets underperformed significantly. CRV (Curve), ATOM (Cosmos) and ARB (Arbitrum) saw declines of 39%, 32% and 30%, respectively, making them the weakest performers over the same period.

These results highlight the mixed outcomes for various tokens during this ongoing bull run.

[ad_2]