[ad_1]

Binance has cemented its position as the dominant force in the centralized crypto derivatives (CeX) market, surpassing rivals such as Bitget, Kraken, Coinbase, and Bitfinex.

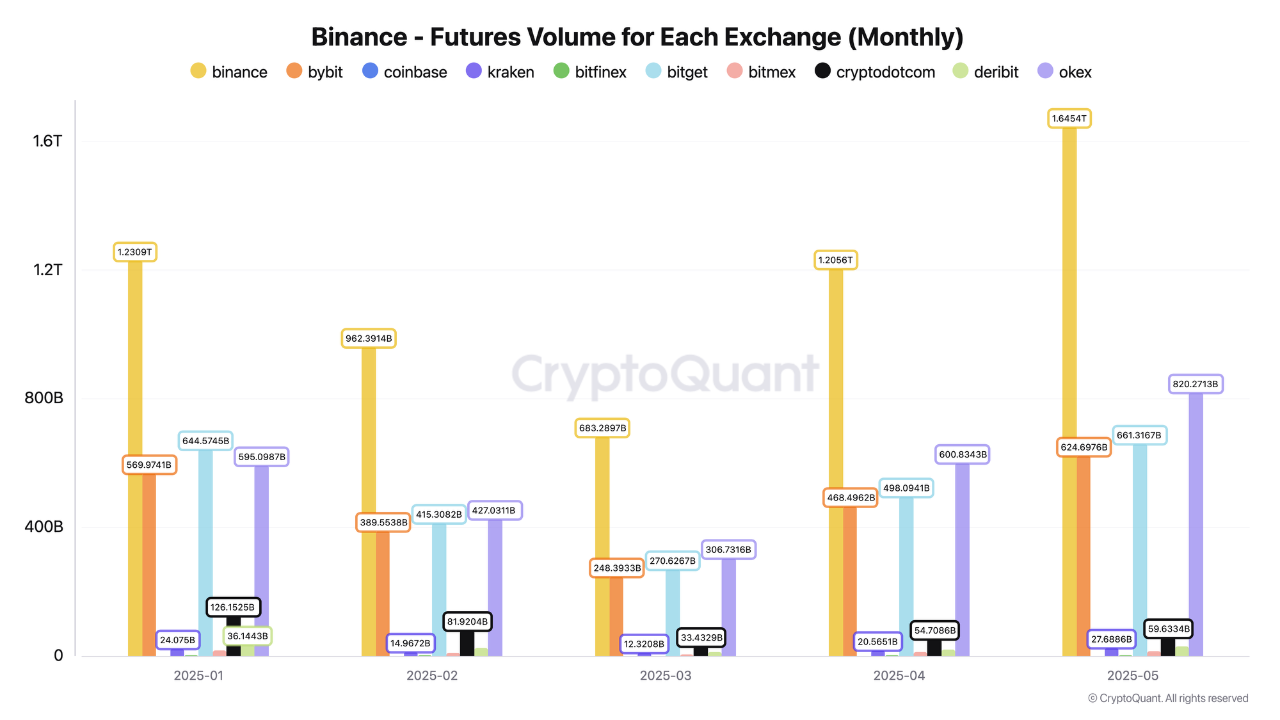

According to report from crypto analyst Darkfost, shared via CryptoQuant, Binance’s record-breaking performance in May 2025 illustrates a rising wave of speculative activity that is helping drive Bitcoin’s bullish momentum.

Record Monthly Futures Volume Surpasses $1.6 Trillion

In May, Binance reached a new milestone, recording over $1.6 trillion in monthly futures trading volume—the highest seen this year. This remarkable figure reflects a surge in market engagement and growing confidence among traders, particularly those seeking high-leverage exposure to crypto price movements.

Darkfost points out that this spike in volume is often symptomatic of renewed risk appetite and growing bullish sentiment, especially in periods of strong upward trends. It also underscores why Binance continues to serve as a bellwether for market sentiment and investor positioning.

Compliance and Market Leadership

Despite its speculative edge, Binance continues to maintain regulatory compliance, notably with the European Union’s MiCA framework—widely considered one of the world’s most comprehensive crypto regulatory regimes. This alignment with strict guidelines adds a layer of credibility and reinforces the platform’s appeal to both retail and institutional traders.

Speculation or Stability? The Double-Edged Sword of Derivatives

While the surge in futures trading volume signals heightened interest, Darkfost also emphasizes the inherent risks associated with leverage-driven speculation. High open interest in futures markets can lead to rapid liquidations, triggering volatile price swings and compounding the risk of short-term instability.

Still, the data paints a clear picture: speculation is back at the forefront, and Binance is leading the charge. Observing ongoing trends in futures activity will be key to understanding market behavior in the weeks ahead, especially as crypto traders weigh opportunity against volatility.

[ad_2]