Following 400%+ price pump of JELLY caused by a market manipulation incident on Hyperliquid, Binance and OKX capitalized on the volatility by listing JELLY futures, while Hyperliquid delisted the token’s perps, facing backlash over centralization concerns.

After the recent market manipulation incident on Hyperliquid (HYPE) involving the Jelly Jelly (JELLY) token, the derivatives exchange decided to delist JELLY and reimburse affected users. Shortly after, Binance listed JELLY futures, followed by OKX.

This was likely a move to seize the opportunity created by the token’s extreme price swing, which made it highly attractive for speculative trading. On March 26, the price of JELLY spiked from around $0.0095, where the exploiter opened his short position, to a high of $.0.050, marking approximately 426% increase. Given that high volatility drives trading volume, both exchanges stand to profit considerably from trading fees on JELLY perps.

Source: Arkham Intelligence’s X

However, some believe Binance and OKX’s move isn’t just about potential profit from fees, but also about wiping the competitor. One user even called it a “pure move to try and bury a competitor,” comparing it to Binance’s alleged role in FTX’s collapse, adding it “rewrites the history of what happened to FTX.”

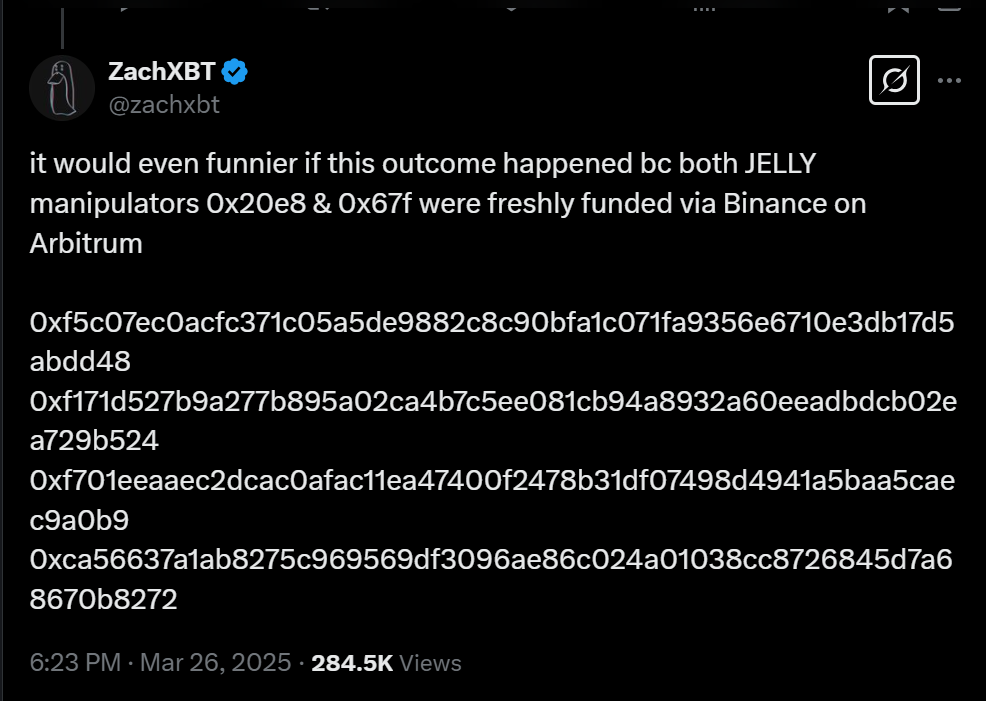

Interestingly, blockchain investigator ZachXBT pointed out that the two accounts linked to the manipulation 0x20e8 and 0x67f were funded via Binance.

Source: @zachxbt

Meanwhile, the price of JELLY has retraced to $0.020, according to CoinGecko.

You might also like: Hyperliquid removes JELLY amid market manipulation accusations, promises refunds

The manipulation incident

According to Arkham Intelligence, the trader in question opened three accounts: two holding long positions worth $2.15 million and $1.9 million, and a third with a $4.1 million short position, effectively balancing out the longs. The total amounted to $7.17M.

Hyperliquid just got exploited. What happened?

A trader deposited $7.167M on 3 separate Hyperliquid accounts within 5 minutes of each other. He then made leveraged trades on an illiquid coin, JELLYJELLY.

However, he ended up losing money, and is down almost $1M unless… pic.twitter.com/uNyMwLS5Sc

— Arkham (@arkham) March 26, 2025

Then, the trader aggressively bought JELLY on decentralized exchanges. Since liquidity on DEXes is low, their buying activity quickly drove JELLY price up. After the token’s price increased by over 400%, the $4.1 million short position was supposed to be liquidated. However, the liquidation was too large to be executed immediately, so it was transferred to HyperLiquid’s automated market-making vault, the Hyperliquidity Provider. At the same time, the trader quickly withdrew funds from their other two accounts with unrealized profit from the JELLY 400%+ price increase as a result of their DEX buying activity. According to Arkham, the trader managed to withdraw $6.26 million, with ~$900K still remaining in the accounts.

At this point, HyperLiquid caught on to what was happening and restricted the trader’s accounts to reduce-only mode, freezing their ability to withdraw funds. With withdrawals blocked, the trader then started selling JELLY on the market.

This selling helped them recover some of the funds, but it didn’t fully salvage their position because HyperLiquid then closed the market at $0.0095, the same price at which they opened their short trade. As a result, all floating PnL on the first two accounts were wiped.

According to Abhi, founder of Web3 company AP Collective, said that if Hyperliquid didn’t close the position, it would’ve faced full liquidation if JELLY reached $150M market cap.

After the incident, Hyperliquid’s decided to delist JELLY perpetuals. The decision was made by a consensus between Hyperliquid’s validators, sparking outrage from crypto community due to centralization concerns. Arthur Hayer said that HyperLiquid clearly wasn’t able to handle the situation with JELLY and that it’s time to stop pretending that HyperLiquid is a decentralized platform.

$HYPE can’t handle the $JELLY

Let’s stop pretending hyperliquid is decentralised

And then stop pretending traders actually give a fuck

Bet you $HYPE is back where is started in short order cause degens gonna degen

— Arthur Hayes (@CryptoHayes) March 26, 2025

Echoing his sentiment, Bitget CEO Gracy Chen commented:

“The decision to close the $JELLY market and force settlement of positions at a favorable price sets a dangerous precedent,” Chen said. “Trust—not capital—is the foundation of any exchange […] and once lost, it’s almost impossible to recover.”

You might also like: Bitget CEO says Hyperliquid could become FTX 2.0 amid JELLY incident