Binance Research, the research branch of the crypto exchange Binance, has just published the report “Blockchain Payments: A Fresh Start“, in which it analyzes the role of blockchain technology in the changing world of digital payments.

The study highlights how payments accompanied by blockchain are up to 50 times cheaper compared to traditional electronic ones, as well as significantly more flexible.

Binance Pay, the payment platform of the eponymous crypto exchange, has recorded a 71% increase in volumes in 2023. This highlights a greater proactivity of users in making crypto payments compared to previous years, thanks to the development of new Web3 infrastructures.

Let’s delve deeper into the topic below.

The transformative potential of blockchain technology according to Binance: fast and accessible digital transactions

In its latest report “Blockchain Payments: A Fresh Start“, Binance Research explores the innovative role of blockchain technology in the digital payments ecosystem.

Currently, the digital transactions sector appears as one of the most important in the world, with an estimated revenue of 2.83 trillion dollars in 2024.

This is an industry experiencing strong growth, with targets projecting total revenues to reach 4.7 trillion dollars by 2029, with a compound annual growth rate (CAGR) of 10.8%.

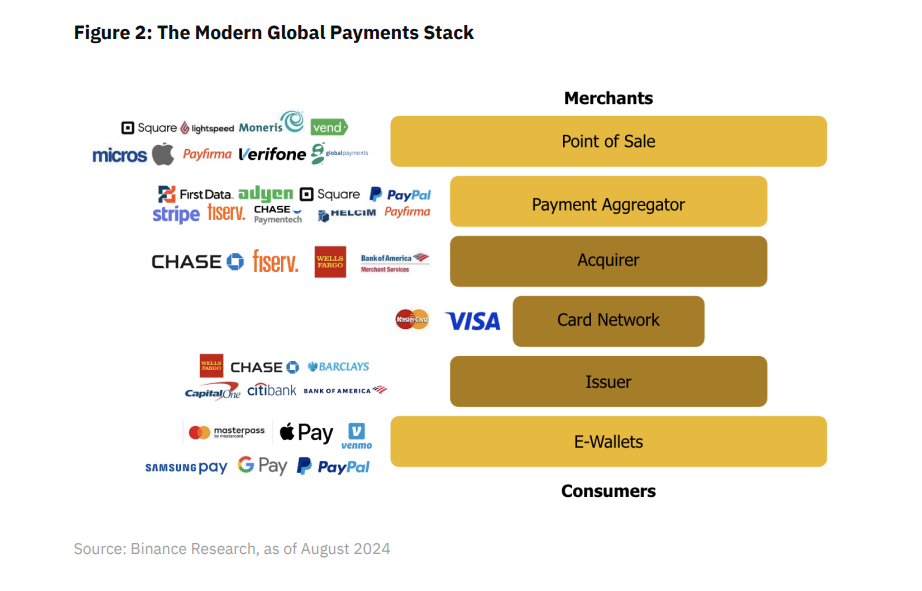

Much of the value stored by digital payments, as noted by Binance, is monopolized by the use of debit and credit cards globally.

Suppliers such as American Express, JCB, Mastercard, UnionPay, and Visa have led to a constantly growing trend in card transactions over the past 9 years.

Since 2014 the CAGR is 15.1%, as shown in the figure.

Despite the growth trajectory, the payments sector is still tied to technological infrastructures that are about 50 years old.

The growing landscape of actors involved in the management of capital flows has resulted in numerous intermediaries being inserted between the trader and the consumer.

The inefficiency of legacy systems to which fintech solutions remain anchored, makes the world of payments increasingly inefficient and governed by various fees.

According to the report by Binance, the average cost to send 200 dollars through traditional methods is about 6%, or 12.70 dollars. Instead, transactions that leverage the blockchain stack are 50 times more economical, confirming their disruptive potential.

The implementation of blockchain also greatly reduces the need for fiduciary intermediaries, simplifying the connection between the interested parties.

Not only that, the absence of a traditional banking structure in favor of decentralization makes payments increasingly accessible, especially in areas of the so-called “unbanked”.

The same major operators like Visa and Mastercard are also aware of these advantages and are trying to get a foothold in cryptographic practices.

At the same time, Binance Pay is at the forefront in providing users with more efficient and faster solutions for international money transfers.

The different infrastructural stacks of payments on blockchain

Let’s now see what, according to Binance, are the infrastructural solutions that blockchain technology provides in electronic payment processes.

The strong reduction of intermediaries and the costs associated with them necessarily goes through the implementation of atrustless connection trustless between merchant and consumer.

We can distinguish 4 different stacks that leverage the potential of the blockchain in payments: settlement layer, asset issuer, on/off ramp and application interface.

- The settlement level is constituted by level 1 of cryptographic networks such as Bitcoin, Ethereum and Solana, which provide the function of selling blockspace for external requests. Added to these are the various second-level solutions, which exploded from 2023 onwards, improving payment speed by relying on smarter infrastructures. We can imagine this level as the blockchain alternative to the network of banks that make up the current payment system.

- Following the issuer level is represented by organizations responsible for the creation, management, and redemption of stablecoin, cryptocurrencies with a value pegged to a fiat currency. These issuers, as Binance reminds us, often operate with business models based on balance sheets similar to those of banks. They accept deposits from customers and invest in low-yield funds such as U.S. Treasury securities. They generate profit from the spread or net interest margin.

- There are then the on/off ramp levels that act as a technological bridge for the transition between stablecoin, crypto, and banking systems fiat. Their business models are typically driven by capital flow, earning a small percentage of the total volume in dollars. Currently, the on/off ramp level is usually the most expensive part of crypto payments. Popular providers like Moonpay charge up to 1.5%, while Binance Pay is building a cheaper level.

- Finally, the last level is that of the application interface which represents the front-end part displayed to the customer to advance encrypted digital payments. Various applications offer simple and intuitive user interfaces to allow less educated users to exploit the potential of the blockchain without knowing technicalities. Their business models generally can include a hybrid model of platform fees and transaction-based fees.

The strong expansion of the Binance Pay platform

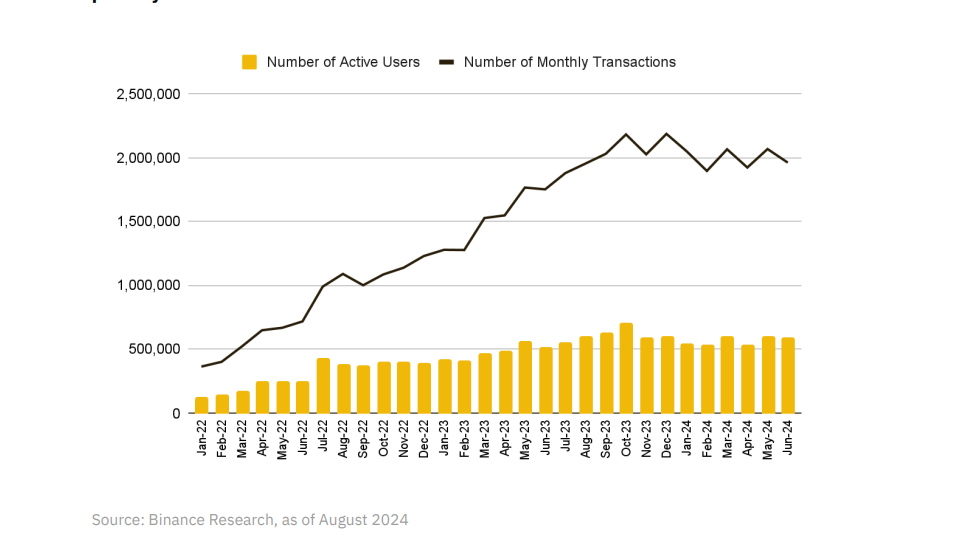

In a context of growth for the blockchain payment sector, the Binance Pay payment platform is observing a strong adoption of its services.

The eponymous branch of the crypto exchange has seen an increasing demand for cross-border transactions, which are faster and more convenient thanks to the blockchain.

In particular, in the first half of 2024, Binance Pay recorded a 43% increase in active users compared to the second half of 2023. In the same period, transaction volumes grew by 9%, reflecting the strong demand for cryptocurrency-based payments.

A year earlier the platform had grown by another 71% in terms of volumes, also marking a record at 77 billion dollars.

The stratospheric numbers do not end here: since 2022 Binance Pay has also significantly increased the number of monthly transactions.

We are talking about an increase of almost 5 times the transactions of the previous year, counting 13.5 million users globally and 1.96 million transactions.

Among the markets where Binance is most present, we find South Asia, Eastern Europe, the Middle East and North Africa (MENA), and Latin America.

Regarding the success of Biance Pay, the CEO of Binance Italy Gianluigi Guida, spoke in a press release about the factors that have incentivized such performance.

The expert specifies that the reason for the positive numbers is to be found in the potential of blockchain technology and the financial revolution that is underway.

“Blockchain technology is revolutionizing the global financial landscape, introducing new levels of efficiency, inclusivity, transparency, and accessibility. The growing adoption by traditional institutions, as demonstrated by initiatives from global players, is confirmation of a structural change. Blockchain is not an alternative to traditional finance, but a complement, capable of integrating and enhancing existing infrastructures. This scenario represents a new era for the digital economy, with benefits for users and businesses worldwide”.