[ad_1]

Having spent over a decade immersed in the cryptocurrency space, I’ve seen countless projects make grand promises—many touting revolutionary returns and cutting-edge decentralized technology. Today, however, a trend has emerged where “Bitcoin DeFi” or “BTCfi” projects present themselves as decentralized marvels using slick dApps, crypto lingo, and smart contracts. Yet behind the scenes, centralized actors may lurk. This is my warning to you: When extended processing times, timelocks, and opaque fee structures become the norm, the risk isn’t just a small loss—it could be everything.

Lessons from Centralized Failures: BlockFi, Celsius, and FTX

The Cost of Centralization

History in the crypto space is littered with cautionary tales of centralized platforms that promised high yields and ended up devastating investors’ portfolios. BlockFi, Celsius, and FTX each started by offering attractive returns on your digital assets. However, their centralized nature meant that when liquidity dried up or market conditions shifted, these platforms couldn’t keep their promises.

What Happened with BlockFi, Celsius, and FTX

- BlockFi and Celsius: Both platforms built their reputations on the promise of steady, high returns. Yet, when the market turned, their centralized structures—relying on lending, rehypothecation, and other risky strategies—failed spectacularly. Investors saw not just reduced returns, but total loss of their deposits.

- FTX: FTX offered high yield on a centralized platform, luring in investors with promises that eventually proved unsustainable. The collapse of FTX wasn’t just about losing some money—it was about losing everything that was entrusted to a platform that lacked transparency and robust risk management.

The harsh lesson from these cases is clear: when you entrust your funds to centralized platforms, you’re not just risking fees or delays. You’re risking the total loss of everything you put in.

The Trend of BTCfi Projects: Decentralization in Name Only

How BTCfi Projects Mislead Investors

Many new Bitcoin DeFi or BTCfi projects today mimic decentralized platforms through the use of dApps, crypto jargon, and smart contracts. But the reality is that these projects often hide centralized operations under the hood:

- Admin Control: Many projects require admin keys to execute certain functions. This means that behind the facade of automation, there are human decisions influencing the outcome.

- Trading Your Assets: To manage liquidity and ensure that they can cover redemptions, some platforms engage in trading activities with your Bitcoin or pegged assets. They may even have to close positions to release funds. In such cases, what appears as a technical processing delay might be a sign of deeper financial risk.

- Musical Chairs with Your Funds: The analogy of musical chairs is apt. When a system requires centralized control, and positions need to be closed to satisfy withdrawals, not everyone is guaranteed a chair when the music stops. If too many users try to access their funds simultaneously during a market downturn, there may not be enough liquidity—or the system may fail entirely.

Spotlight on SolvBTC: The Red Flags of Timelocks and Processing Delays

What SolvBTC Promises

SolvBTC is one such platform that presents itself as a decentralized yield generator for Bitcoin. With its clean, user-friendly interface and promises of automated yield generation, it appears to be an attractive opportunity for anyone looking to earn a passive income on their Bitcoin holdings.

The Hidden Costs Behind the Slick Interface

However, a closer look at SolvBTC reveals several troubling details:

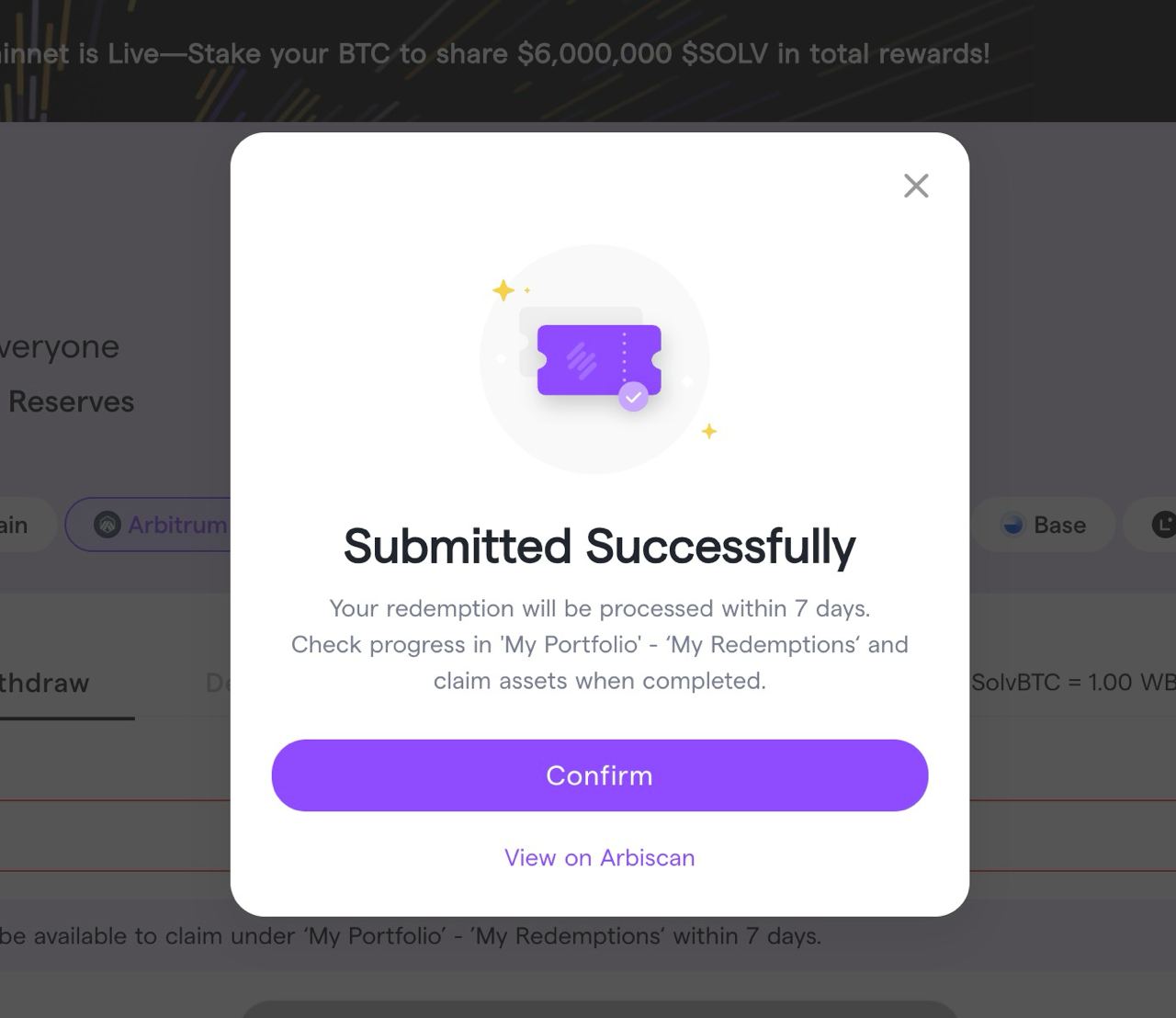

- Processing Times: Deposits and redemptions on SolvBTC can take weeks. In a truly decentralized, trustless environment, transactions should be swift—24/7 access is a cornerstone of cryptocurrency’s appeal. These processing delays are often explained as necessary for risk management, but in reality, they hint at manual oversight or centralized trading of assets behind the scenes.

- Timelocks and Locked Funds: When you stake assets that come with timelocks or prolonged processing times, you run the risk of being locked into a system at a moment when you need liquidity. In volatile market conditions, this inability to quickly access your funds could prove catastrophic.

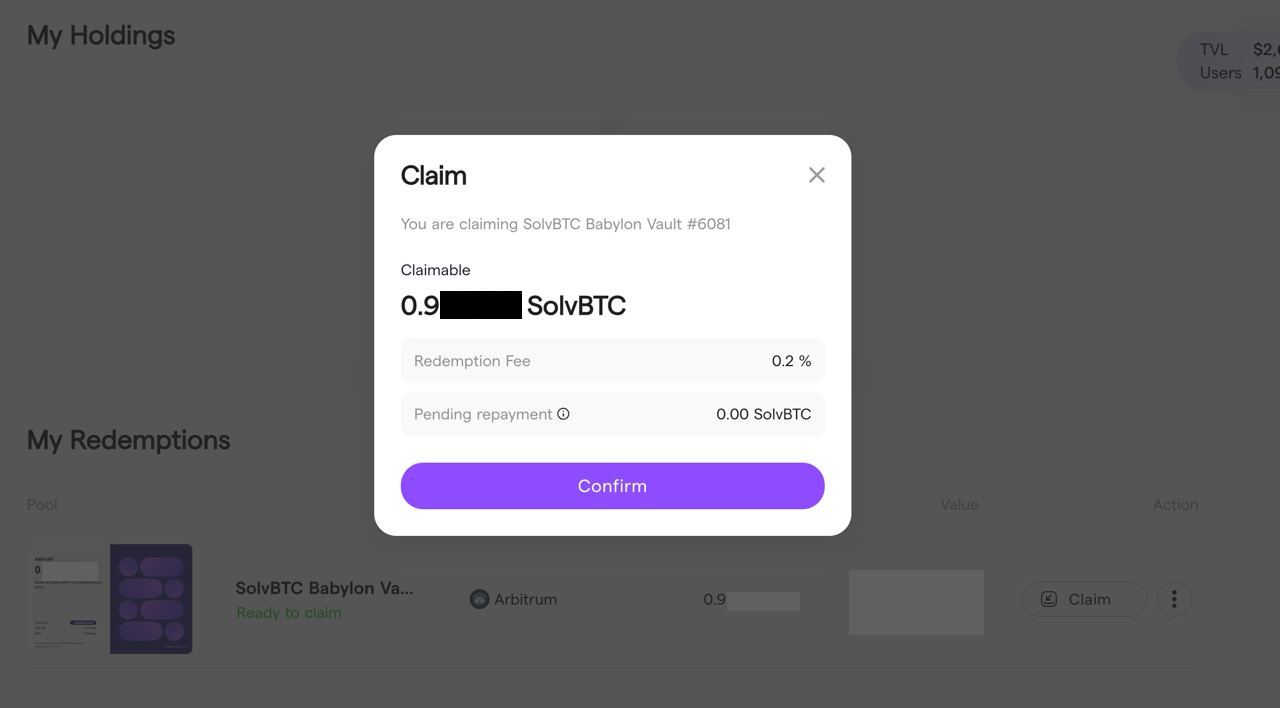

- Opaque Fee Structures: SolvBTC charges a 0.2% fee on withdrawals calculated on your entire deposit—not just on the yield. Over time, these fees can eat into your returns significantly. If you find yourself in a situation where you urgently need to withdraw your funds during a market downturn, such fees, combined with processing delays, can severely impact your financial flexibility.

How to Evaluate Bitcoin Yield and BTCfi Projects

Key Considerations Before You Commit

Before committing any significant amount of Bitcoin to yield or BTCfi platforms, ask yourself:

- Transparency: Does the platform clearly disclose how it generates yield? Are the fee structures and operational details transparent?

- Decentralization: Is the platform truly decentralized, or is there evidence of centralized control through admin keys or manual interventions?

- Liquidity and Accessibility: What are the processing times for deposits and withdrawals? If your funds are locked behind timelocks or processing delays, how will you access them in a crisis?

- Risk Management: Does the platform have robust risk management practices? Can it handle market downturns without liquidating positions at inopportune times?

The Role of Independent Resources

Navigating the myriad of Bitcoin yield and BTCfi projects can be daunting. That’s why independent resources like bitcoinlayers.org are invaluable. This website offers a clear breakdown of native layer 2 solutions versus side systems, holding builders accountable and providing a transparent overview of each project’s adherence to Bitcoin’s core values. Using such resources can help you distinguish between genuine innovation and projects that are merely using the language of decentralization to mask centralized risks.

Prioritize Security, Liquidity, and Self-Custody

In the rapidly evolving world of cryptocurrency, the promise of high yield and the allure of decentralized finance are potent, but they come with significant risks. Many Bitcoin DeFi or BTCfi projects may use the appearance of decentralization—through dApps, smart contracts, and fancy crypto lingo—to lure investors. However, behind that façade often lie centralized control mechanisms, processing delays, timelocks, and opaque fee structures that can lock your funds when you need them most.

[ad_2]