Bitcoin’s price over the past sixty minutes ranged from $96,318 to $97,286, with a market capitalization of $1.92 trillion and a 24-hour trade volume of $70.59 billion, while intraday trading spanned from $96,318 to $102,614. Tuesday’s dump follows the U.S. crypto czar telling the press the President asked him to “evaluate” a strategic bitcoin reserve.

Bitcoin

Bitcoin’s current price action reflects a clear bearish trend across multiple timeframes, with persistent selling pressure evident in the technical indicators. On the one-hour chart, bitcoin has been making lower highs and lower lows, struggling to reclaim the $98,500 to $100,000 resistance zone. The relative strength index (RSI) sits at 43.6, signaling neutral momentum, while the Stochastic at 37.0 reinforces the lack of strong buying pressure. Meanwhile, the commodity channel index (CCI) at -137.3 suggests a potential buying opportunity, but the momentum oscillator at -7,496.0 and the moving average convergence divergence (MACD) level at 272.2 both indicate a strong sell signal.

BTC/USD via Bitstamp 1H chart on Feb. 4, 2025. BTC tapped an intraday low of $96,318.

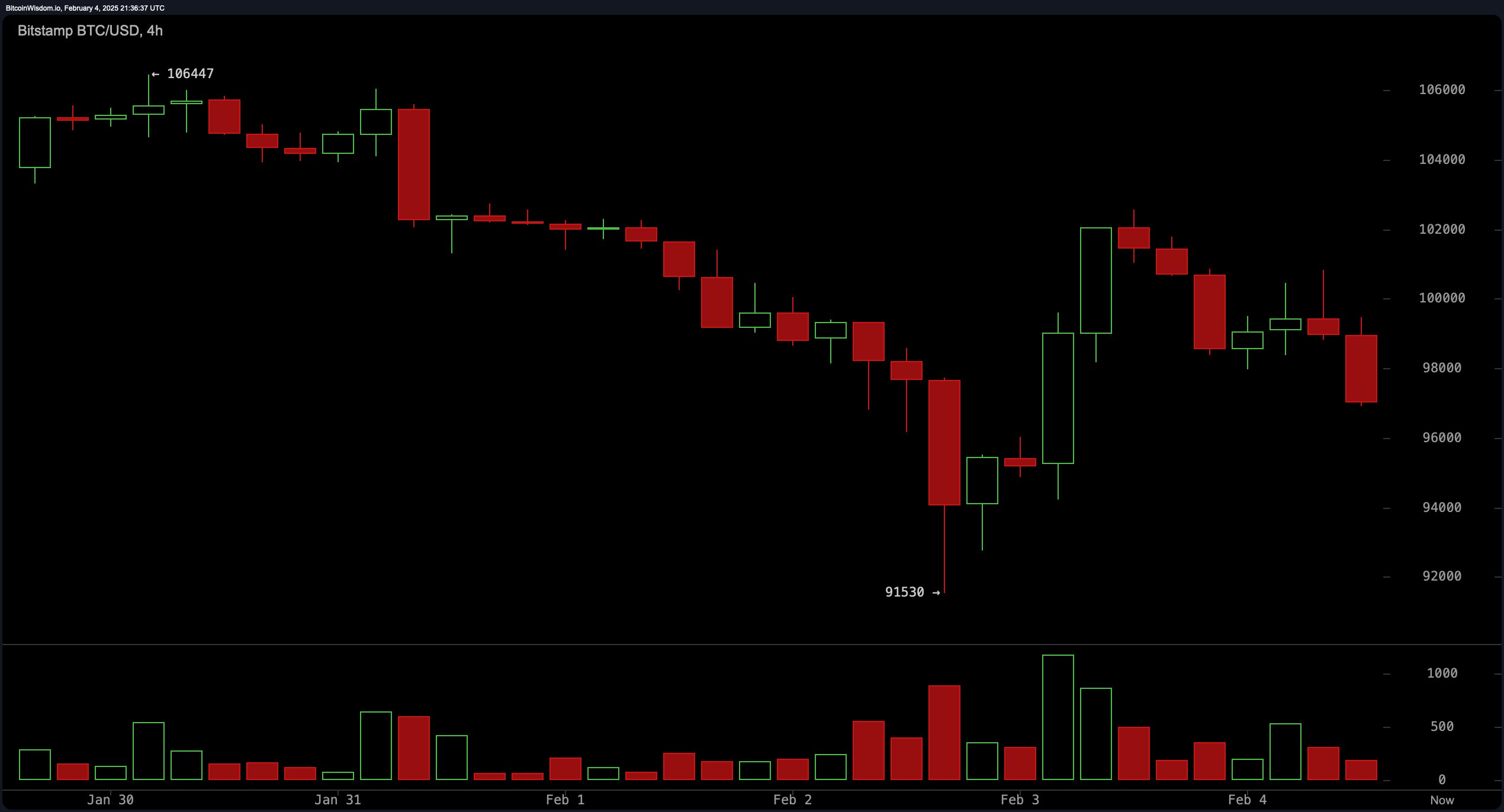

The four-hour chart continues to paint a bearish outlook, with bitcoin failing to hold above key resistance zones at $102,000 to $104,000. The exponential moving average (EMA) and simple moving average (SMA) across short-term periods, including 10, 20, and 30, are all signaling sell pressure, suggesting a continuation of the downward trend. The average directional index (ADX) at 18.2 remains neutral, indicating that the current trend has yet to gain significant strength in either direction. However, support at $91,500 remains a crucial level to watch, as a break below this threshold could trigger further downside momentum.

BTC/USD via Bitstamp 4H chart on Feb. 4, 2025.

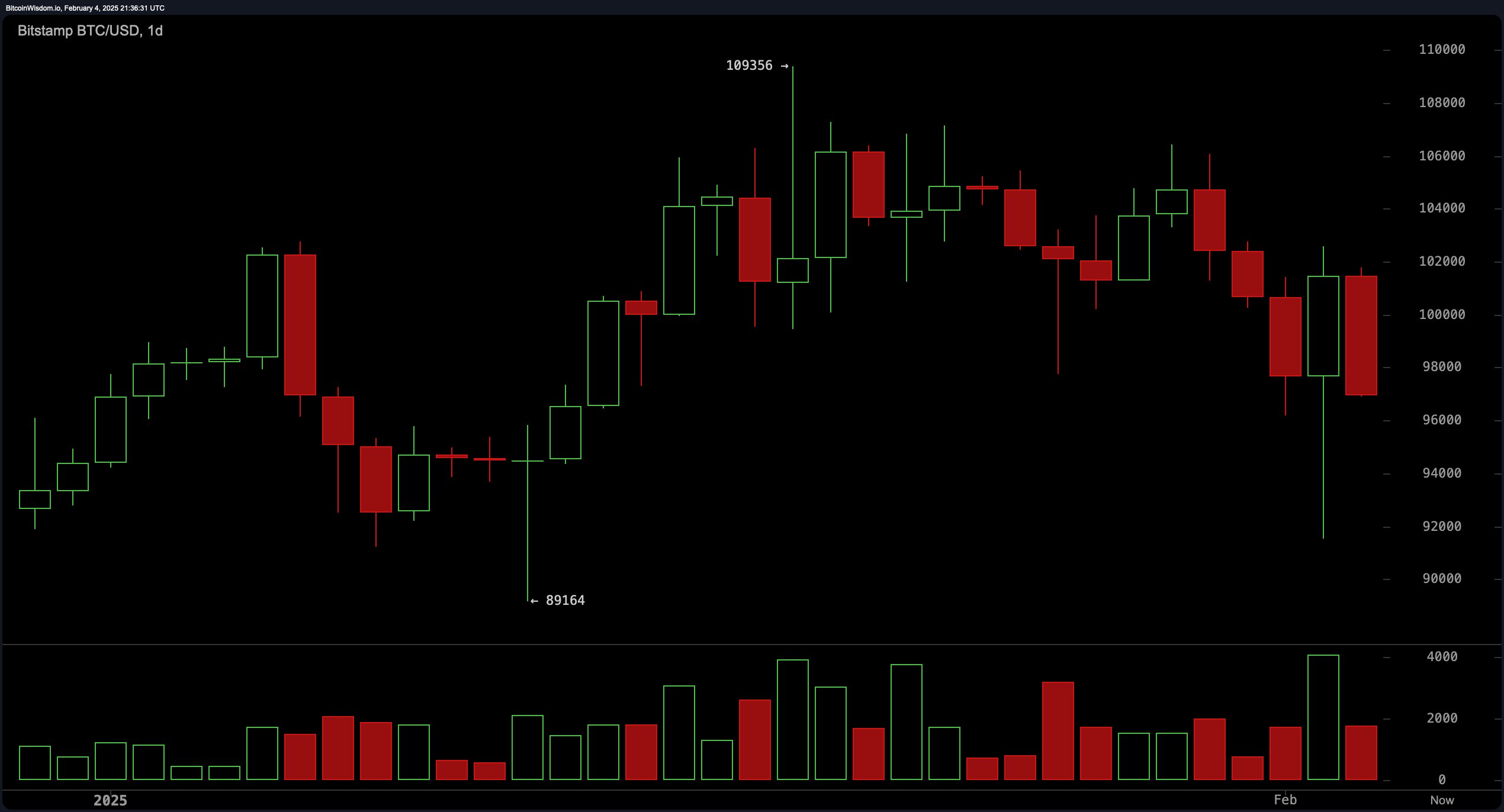

From BTC’s daily chart perspective, bitcoin’s inability to sustain above $100,000 has led to a sharp decline, with a strong rejection from the $109,356 resistance level. The increasing bearish volume suggests that sellers are in control, and the recent drop to $96,000 points to further potential weakness. The simple moving average (SMA) and exponential moving average (EMA) at 50, 100, and 200 periods highlight a mixed sentiment, with shorter-term averages reflecting a sell signal while longer-term moving averages indicate buying support. The simple moving average (SMA) 200 at $78,214.5 and the exponential moving average (EMA) 200 at $83,242.3 could serve as significant support levels if the decline continues.

BTC/USD via Bitstamp 1D chart on Feb. 4, 2025.

Overall, bitcoin remains under pressure, with technical indicators showing that bearish sentiment dominates the market. The failure to reclaim psychological resistance levels above $100,000 suggests that any relief rallies could be short-lived unless buyers step in with strong volume. Traders should watch for potential rebounds around $91,000 to $94,000, where historical support exists, while resistance at $98,500 to $100,000 remains a critical zone for potential short entries. The current trend favors a cautious approach, as downward momentum continues to weigh on price action.

Bull Verdict:

While bitcoin remains under short-term pressure, the presence of strong long-term support at the 100-period and 200-period moving averages suggests that a potential rebound could occur if buyers step in around $91,000 to $94,000. If bitcoin reclaims $100,000 with strong volume, it could regain bullish momentum and attempt to retest the $109,000 resistance level.

Bear Verdict:

Bitcoin’s failure to hold above key resistance levels, combined with consistent sell signals across multiple timeframes, suggests that bearish momentum remains dominant. The lack of strong buying pressure and continued lower highs point to a potential drop below $91,500, which could accelerate selling toward long-term support levels near $83,000 to $78,000 if market sentiment does not improve.