[ad_1]

The following is an opinion piece by Tom Howard, Head of Financial Products and Regulatory Affairs at CoinList.

Stablecoin Act drafts that would effectively ban Tether and other non-US stablecoin issuers from the US market due to offshore operations are circulating.

This approach is a significant policy error.

A robust global reserve currency thrives by exporting itself to foreign markets, not pulling it back home.

Attempting to force all USD-denominated stablecoins to reshore deposits to US banks ignores a critical monetary principle known as “Triffin’s dilemma,” which describes how exporting currency overseas strengthens international demand but risks domestic inflation if too much of that currency returns home.

While reshoring innovation is excellent economic policy, reshoring USD relates to monetary policy and is generally undesirable for the nation.

In fact, the stablecoin innovation represents an opportunity to export even more USD offshore and increase USD’s strength and liquidity as a global reserve currency.

But why can’t the above be achieved with US-based issuers?

The Market Wants Non-US Issued Stablecoins

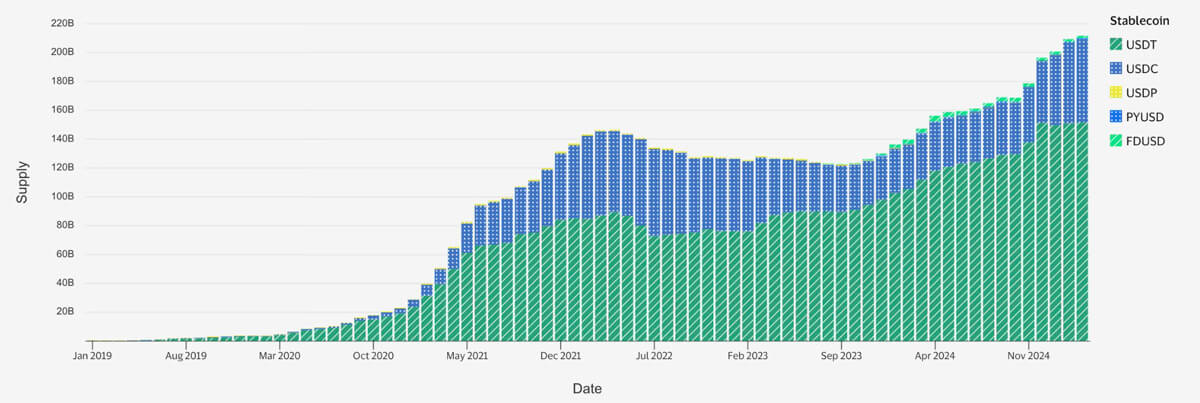

It is clear that USDT is the global stablecoin of choice in non-US markets, from Asia to Africa to Latin America. This is not for lack of effort by the number two competitor, Circle, which has made substantial efforts to compete in those markets.

In my user research building a stablecoin and stablecoin wallet, I found that US-banked stablecoins are often seen as a direct extension of the US government, while non-US stablecoins are seen as more autonomous. Practicalities aside, this is the perception on the ground.

Often, users opt into using stablecoins because their own government has been abusive with monetary or banking policy, and they have a strong fear of potential government abuses. They want access to USD but not exposure to US banking.

Those fears are only perpetuated by events as large as the perceived overuse of sanctions powers and the more common issues with money transfer freezing in cross-border or remittance payments.

Stablecoins give users more confidence that their money will be safe, and a substantial market has indicated in the actual usage data that they prefer non-US issuers over US issuers. This preference was apparent even before Tether started publishing audits of their reserves.

Tether likely recognizes that moving their system to fully onshore US banking would cause them to lose a substantial user base and open up a market opportunity for other market participants to fill that clearly demarcated demand.

What Does “Ban” Mean

A few different drafts are circulating, which have the potential to affect various types of bans.

Firstly, a non-US registered stablecoin would be banned from issuing the stablecoin from the US. This is, of course, the right thing to do; a US-issued stablecoin should absolutely be US-regulated!

Another ban is on “for use” of an unregistered stablecoin. This could mean anything from use via payment providers to trading on exchanges to person-to-person transactions. Such a ban restricts the market from choosing what it’d like to use, has negative externalities internationally, and could even be unenforceable.

The third type of ban would be exclusion from any financial services with US entities. In this case, non-compliance would require US financial institutions to offboard all activities, including purchasing US treasury bonds. In Tether’s case, this would be a divestment of over $100B in US treasury bonds.

Any Sort of Ban Would Backfire

- Reduced USD Liquidity Globally: Trading bans would reduce a stablecoin’s liquidity against the dollar. This would harm users through increased transaction costs and weaken global demand for USD.

- Inflation Risks: reducing foreign bank USD holdings risks increasing inflation at home

- Geopolitical Risks: foreign adversaries could capitalize on unfilled market demand to create USD stablecoins backed by non-USD assets

Reshoring Foreign Bank USD Reserves

If forced to relocate reserves to US institutions, Tether would import significant volumes of USD back into the US, potentially exacerbating domestic inflation. Meanwhile, international demand for offshore USD tokens would persist, prompting competitors to fill Tether’s void overseas quickly.

When USD is pulled back from international circulation to domestic banking, it increases the lending supply of domestic banks, which can contribute to inflation.

This also reduces the USD holdings of foreign banks, which are critical to international USD liquidity and help increase foreign trade. It also creates more buyers for US treasuries as those banks invest their deposits in risk-free offerings.

Aside from Tether, other issuers could increase the USD market in particular segments. For instance, countries like Cambodia are infamous for having a “dollarized” economy. That is, they have issued their own currency, yet the economy actually runs on USD transactions, predominantly in cash.

If a company or bank in such a country wanted to have a digital dollar to increase USD adoption within that economy, stablecoin innovations would be a great way for them to achieve this. It is unlikely that such stablecoins would be operating under the same standards as the US or EU Stablecoin regulators; however, it would still be advantageous for the US to encourage those stablecoins to exist as it increases foreign bank USD reserves.

Adversaries Could Displace USD

As Tether and other stablecoin businesses have found, the market for non-US-issued stablecoins is significant.

A ban on non-US issuers could create opportunities for foreign adversaries to supplant the US dollar by offering USD-denominated tokens backed by foreign currencies, gold, or other assets.

This would effectively eat up USD demand while displacing the USD supply, which, if it got large, would substantially weaken the US Dollar.

China is already actively developing financial alternatives to the USD, as demonstrated by the recent deals with the Saudi government for a $100B USD-denominated bond backed by Chinese Yuan (RMB).

If presented with a market opportunity, China could introduce a USD-denominated stablecoin backed by gold or RMB that they fully controlled. Other countries could take advantage of the opportunity as well.

US policy should, in fact, encourage more USD holdings in foreign bank reserves to strengthen the USD worldwide.

A Better Path Forward

Amending the Stablecoin Act to create exemptions for foreign-issued stablecoins would avoid these pitfalls.

Allow these stablecoins to operate, trade, and be utilized within the US, but clearly label them as unregistered, higher-risk alternatives compared to fully US-regulated stablecoins. Empower the US-registered stablecoins to have benefits commensurate with their reduced risks.

Such an exemption:

- Encourages global innovation to serve offshore USD demand.

- Enhances USD’s global usage without importing inflationary pressures.

- Keeps market-based competition alive, letting consumers choose based on transparent risk disclosures.

This could be accomplished by either explicitly excluding foreign-issued stablecoins from the “payment stablecoin” definition or even by carving out a lighter registration process that only requires disclosures but not the higher standards (or benefits) that come with a US-approved stablecoin.

By allowing regulated coexistence rather than outright banning stablecoins like Tether, the US can strategically bolster the dollar’s global position, safeguard against inflationary risks, and encourage continued innovation in financial technology worldwide.

[ad_2]