[ad_1]

The Depository Trust & Clearing Corporation (DTCC), which handles the settlement of most securities transactions in the United States, has announced changes to collateral valuation that will be implemented starting April 30, 2024. DTCC has made it clear that it will not provide collateral or extend loans for exchange-traded funds (ETFs) that involve Bitcoin or other cryptocurrencies.

DTCC will not allocate any collateral for BTC ETFs

The introduction of spot Bitcoin ETFs has sparked increased attention from institutional investors in this investment product. In just three months since their launch, the U.S. Bitcoin ETFs have accumulated an impressive $12.5 billion in assets under management (AUM).

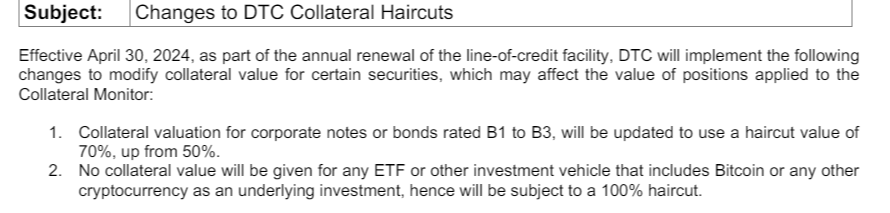

Despite that, DTCC has announced that starting April 30, 2024, there will be changes to collateral values for certain securities during the annual line-of-credit facility renewal. These changes may have an impact on position values in the Collateral Monitor.

This notice, released on April 26, implies that exchange-traded funds and similar investment instruments that have Bitcoin or other cryptocurrencies as underlying assets will no longer have any collateral value assigned to them. As a result, their collateral value will be reduced by 100%.

Source: DTCC official announcement

As part of the changes, there will be a 70% reduction in evaluated market price for bonds rated B1 to B3 when used as loan collateral, which is an increase from the previous 50%. This adjustment presents challenges for businesses, requiring them to provide additional collateral in order to sustain current loan levels.

However, according to a post by crypto market analyst K.O. Kryptowaluty, it was clarified that this would only be applicable to inter-entity settlement within the Line of Credit (LOC) system.

The DTC system, or Depository Trust Company, is a key component of the financial infrastructure of the United States, acting as the central securities depository. DTC is part of a larger organization called the Depository Trust & Clearing Corporation (DTCC)

what you write…

— K.O Kryptowaluty (@KO_Kryptowaluty) April 27, 2024

A Line of Credit is a borrowing arrangement between a financial institution and an individual or entity that enables the borrower to access funds up to a predetermined credit limit. The borrower has the flexibility to access these funds whenever necessary and usually only pays interest on the borrowed amount.

As per Kryptowaluty, the use of crypto ETFs for lending and as collateral in brokerage activities will remain unaffected, subject to the risk tolerance of individual brokers. The analysts entreated crypto investors to “tl;dr: Ignore the baseless panic; there’s nothing substantial happening.”

The effects of the decision on the crypto market

The news has had a tad negative effect on the crypto market, especially Bitcoin. All weekend negative sentiment considered, Bitcoin is currently worth $62,978.86, a 2.2% slip in the last 24 hours.

In addition, the global crypto market cap sits at $2.44 Trillion, a 1.9% drop in the last 24 hours. As of today, BTC’s market cap sits at $1.24 Trillion. This represents a Bitcoin dominance of 50.8%. Lastly, Stablecoins’ market cap sits at $161 Billion. This is a 6.6% share of the total crypto market cap.

DTCC’s stance on crypto ETFs differs from that of other traditional players. Clients of Goldman Sachs have shown a renewed interest in the crypto market this year, prompted by the approval of spot Bitcoin ETFs.

BNY Melon, a well-established bank with a long history, has expressed its interest in gaining exposure to Bitcoin ETFs. The recent submission of BNY Mellon’s Form 13F to the SEC has attracted considerable interest within the global crypto community.

The bank’s investments in BlackRock and Grayscale Bitcoin ETFs highlight the significance of cryptocurrencies in the traditional financial sector, both locally and globally.

After a successful introduction of Bitcoin ETFs, there has been a recent downturn in overall inflows. Over the past 3 days, several ETF issuers have experienced substantial outflows in their spot Bitcoin ETFs.

According to James Sayffart, a dedicated ETF analyst at Bloomberg, the ETF market had a bad week. There was a net outflow of $218 million from spot Bitcoin ETFs in the U.S. on April 25, following a previous day’s outflow of $120 million.

Rough day across the board for the Cointucky derby and the #Bitcoin ETFs yesterday. 5 ETFs saw outflows for a total of -$217 million. Franklin was only ETF with an inflow at $1.9 million. pic.twitter.com/9NF9iXi2GN

— James Seyffart (@JSeyff) April 26, 2024

Grayscale’s GBTC ETF experienced a significant outflow of $82.4197 million in a single day. Based on data from Farside investors, the current historical net outflow for GBTC amounts to a significant $17.185 billion.

[ad_2]