[ad_1]

As Bitcoin reaches the $102K price target, bulls face a critical decision. Will the BTC price continue its upward momentum toward $106,888?

Bitcoin has finally surpassed the psychological $100,000 mark, riding a seven-day bullish streak. Peaking at $102K, will the BTC price continue to $106,888, or is this a trap for bulls at a crucial resistance point?

Bitcoin Price Analysis

With seven consecutive bullish candles on the daily chart, BTC has reclaimed the six-figure price milestone. Last night’s 4.02% surge formed a massive bullish engulfing candle, breaking through the key threshold.

The BTC price trend reached a 24-hour high of $102,760, hitting the price target as predicted in our previous article. However, the substantial overhead supply has led to a minor pullback, with the current Bitcoin price sitting at $101,637.

This pullback is testing the broken resistance trendline of a rising channel pattern. The overnight recovery resulted in a bullish breakout of the rising channel, but the short-term pullback raises concerns about a potential bearish reversal. This could be a bullish trap for traders betting on the breakout rally.

The overnight surge has pushed the 4-hour RSI line into the overbought zone. Additionally, the bullish gap between the 50 and 100 EMA lines has widened after the recent crossover.

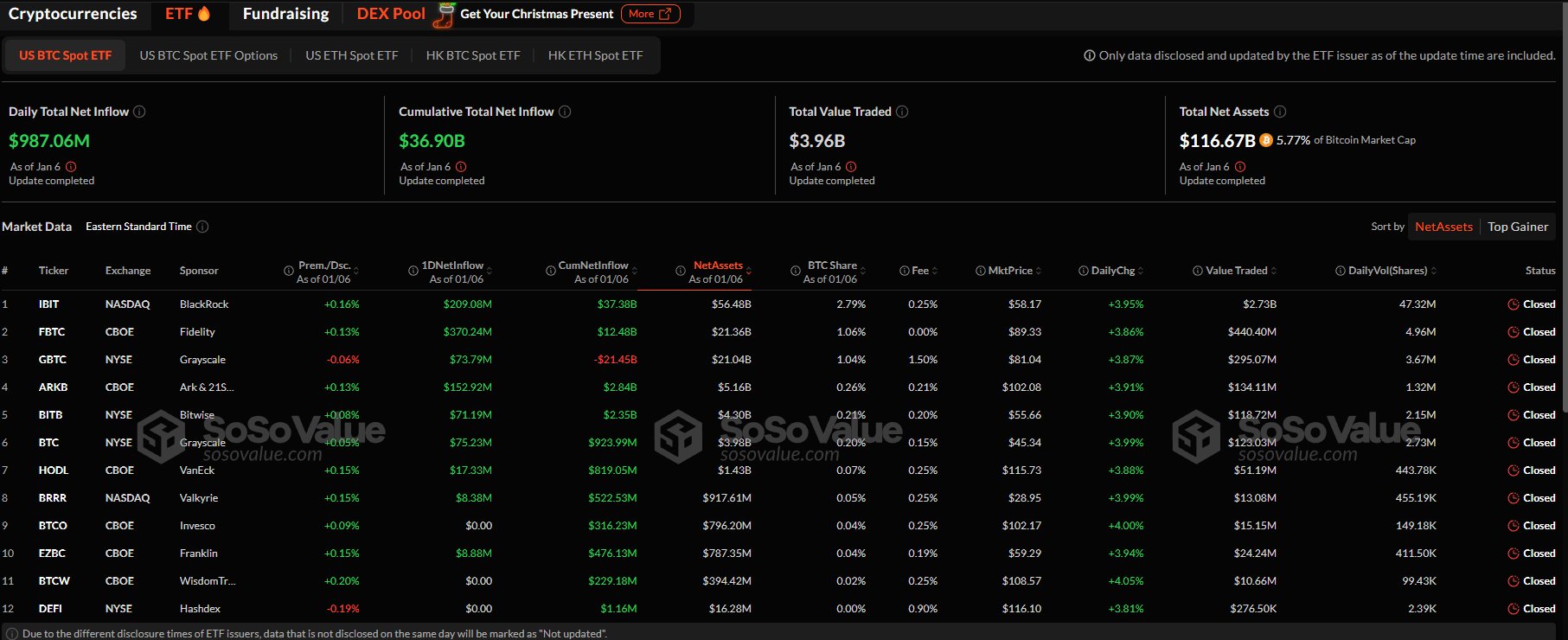

Bitcoin ETF Inflows Reach $987M

Amid the overnight recovery, institutional support for Bitcoin has resulted in massive inflows. On January 6, the U.S. spot Bitcoin ETFs registered a daily net inflow of $987.06 million.

Bitcoin ETFs

Additionally, most of the inflows came from Fidelity and BlackRock, acquiring $370.24 million and $209.08 million, respectively. The total net assets under the institutions have risen to $116.67 billion, representing 5.77% of the Bitcoin market cap.

Bitcoin Bulls Dominate the Derivatives Market

As the bullish trend breaks to the $100,000 mark, the Bitcoin open interest has risen significantly by 2.20% to reach $65.24 billion. The long-to-short ratio over the past 24 hours remains bullish at 1.0227%.

Bitcoin Derivatives

The OI-weighted funding rate has risen to 0.0044%. Over the past 24 hours, total liquidations amounted to $51.80 million, primarily from the bearish side. Short liquidations accounted for $40.06 million, while bulls experienced a liquidation wave of $11.74 million. This data suggests that the derivatives market remains highly bullish, signaling a continuation of the uptrend.

BTC Price Targets

Technical indicators reflect the overnight surge in buying pressure. However, the short-term pullback casts a shadow over the uptrend’s potential.

From an optimistic perspective, a post-retest reversal could see Bitcoin targeting $106,888. However, a close below $101,306 (the immediate support) could lead to a retest of the $100,000 mark.

[ad_2]