[ad_1]

Arthur Hayes has dropped part three of his essay series, and it’s exactly what you’d expect—raw, technical, and unapologetically direct.

Titled “KISS of Death,” the essay tears into President Donald Trump’s financial strategy, the Federal Reserve’s shenanigans, national debt manipulation, and what it all means for crypto investors.

The core theme? Debt, liquidity, and control. The essay rips through the dynamics between Scott Bessent at the Treasury, Jerome Powell at the Fed, and Trump’s economic playbook.

Trump’s debt game and Powell’s role

Arthur kept it real: He reminded readers that Trump is a real estate guy. He builds empires with cheap debt and bold claims. That’s exactly how he’s running America—no interest in actually cutting spending, no love for belt-tightening. Instead, Trump is doubling down on debt-fueled expansion.

“Trump isn’t here to be Herbert Hoover. He’s here to be FDR,” Arthur says. FDR printed money and spent his way out of economic collapse.

Trump, Arthur argues, will do the same. If Trump had any intention of letting the market purge bad credit, he would let a 1930s-level depression wipe everything clean. He won’t. Printing money keeps the game going, said Arthur.

The key question is who controls that money flow? Enter Scott Bessent (Treasury Secretary) and Jerome Powell (Federal Reserve Chair).

“Bessent was appointed by Trump 2.0, and judging by his past and present interviews, he very much shares the same world view as the Emperor. Powell was appointed by Trump 1.0, but he is a turncoat traitor. He defected over to the side of the Obamas and Clintons,” said Arthur.

Arthur added that:

“Powell destroyed the little bit of credibility he had left by enacting a jumbo rate cut of 0.5% in September of 2024. The US economy, which was growing above trend and still contained the embers of inflation, didn’t need a rate cut.”

Arthur also points out that Powell is stuck. The Fed is supposed to fight inflation, but it also can’t let the economy implode. If debt repayments get too expensive, Powell will be forced to cut rates and restart money printing, even if he doesn’t want to.

Debt restructuring and the global game

In his essay, Arthur lays out the numbers. The US is drowning in debt. If nothing changes, interest payments will eat everything. The Treasury needs to extend loan maturities and lower rates, a decision called “terming out the debt.” That’s just a fancy way of saying, “delay the problem and make it cheaper.”

That’s exactly what Bessent wants. He’s on record saying the US needs a new debt profile. The problem? Restructuring debt on a global scale is a nightmare. The US owes money to China, Japan, and Europe. They all have their own agendas. The process will be slow, painful, and political, said Arthur.

But that’s not the immediate concern for crypto investors. What matters short-term is liquidity. Powell controls that. Powell has four main levers to manipulate money supply:

- Reverse Repo Program (RRP) – Controls short-term cash movements.

- Interest on Reserve Balances (IORB) – Pays banks to hold cash instead of lending it.

- Fed Funds Lower Bound – The minimum rate banks charge each other.

- Fed Funds Upper Bound – The maximum rate before the Fed steps in.

Arthur’s point is that Powell can flood the market with dollars anytime. The Fed can buy debt, lower rates, and print money at will. If Trump forces a recession, Powell will have no choice but to loosen the money tap.

Trump’s strategy: Force a recession, print money, pump crypto

Arthur doesn’t play guessing games. He lays out a direct path: “Fed-Recession Law: If the US economy is in a recession or the Fed fears the US economy will enter one, it will cut rates and or print money.”

“At a fundamental level, Pax Americana and the global economy it lords over is debt-financed. Large businesses fund the expansion of future production and current operations by issuing debt. If the cash flow growth slows considerably or outright declines, the eventual repayment of the debt is called into question. That is problematic because liabilities for corporations, in large part, are assets for banks,” said Arthur.

Trump maneuvers Powell to ease financial conditions by causing a recession or convincing the market that one is right around the corner. To stave off a financial crisis, Powell will then do some or all of the following: cut rates, end quantitative tightening (QT), restart quantitative easing (QE), and/or suspend the Supplemental Leverage Ratio for banks purchasing US Treasury debt securities.

Enter Elon Musk’s D.O.G.E – the Department of Government Efficiency. Their job? Cut waste, fire government workers, and kill fraudulent payments. D.O.G.E is already hitting numbers:

- 400,000 federal employees expected to be laid off by the end of 2025.

- Jobless claims in Washington, D.C. are spiking.

- D.C. home prices dropped 11% in early 2025.

- Government contract cancellations are accelerating.

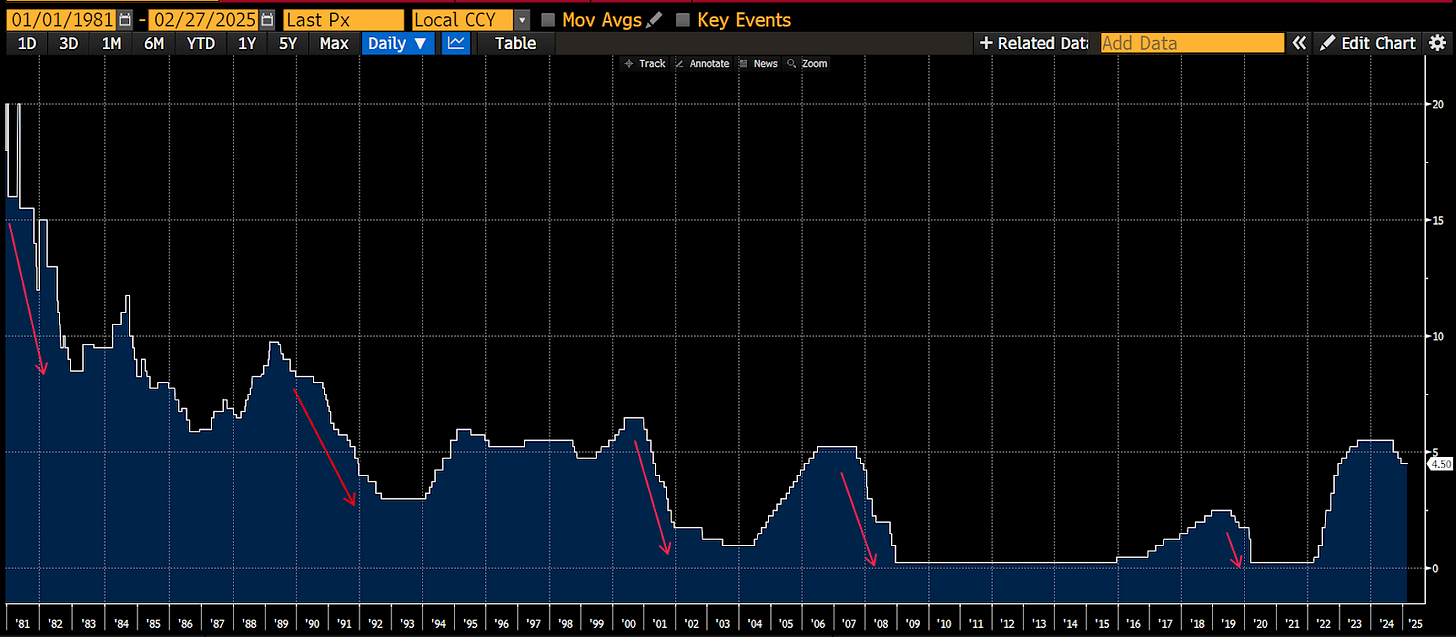

Arthur calls it “killing the chicken to scare the monkey.” Mass layoffs send a message: the free ride is over. The more the market panics, the more Powell feels pressure to cut rates and print money. Why? Every US recession since 1980 has led to rate cuts. Arthur pulls historical charts:

- Red arrows = every time the Fed cut rates due to a recession.

- Every single one led to a liquidity flood.

- Every single one pumped asset prices.

How big will the money printing be?

Arthur does the math. The potential stimulus? Between $2.74 trillion and $3.24 trillion.

Breakdown:

- Rate Cuts: $1.7 trillion in liquidity

- Ending QT: $540 billion added

- Restarting QE + Bank Leverage Loophole: $500 billion to $1 trillion

For comparison: COVID-era stimulus was $4 trillion. Arthur predicts DOGE-induced money printing could hit 80% of that.

What does that mean for Bitcoin?

- Bitcoin did a 24x from $4K to $69K in 2020-2021

- Bitcoin’s market cap is bigger now, so let’s call it a 10x

- $3.24 trillion printed could send BTC to $1M

Meanwhile, Trump keeps teasing a “US Strategic Crypto Reserve.” If the US starts buying Bitcoin, the market could go insane. Problem: The government has no spare cash. The only way this happens is if:

- Congress raises the debt ceiling.

- Gold gets revalued to match market prices.

The market jumped on Trump’s tweet, but Arthur calls it a dead cat bounce. Bitcoin hit $110K before Trump’s inauguration. It crashed to $78K as liquidity dried up. Arthur sees two possibilities:

- Stock market dumps 20-30%, Powell panics, prints, BTC rips higher.

- A big financial player collapses, forcing emergency liquidity.

Either way, Bitcoin moves first. Arthur’s call? “Buy the dip, no leverage, and wait for the Fed’s next move.”

The legendary trader finished his essay by making it clear that he “firmly believes we are still in a bull cycle, and as such, the bottom at worst will be the previous cycle’s all-time high of $70,000. I am not certain whether we will get that low. One positive dollar liquidity signpost is that the US Treasury General Account is declining, which acts as a liquidity injection.”

[ad_2]