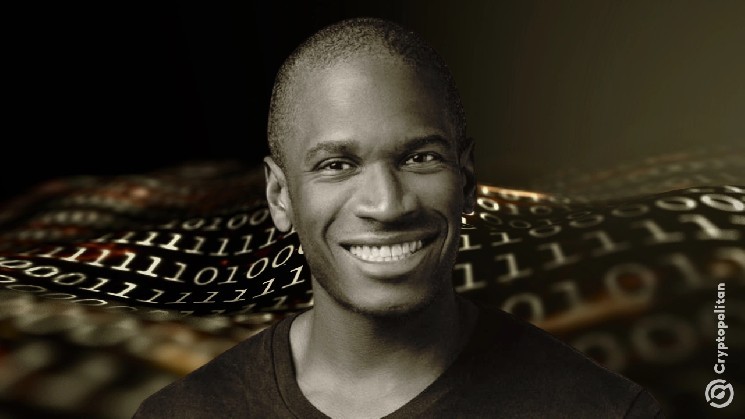

America’s ruling class is about to get cut off by the very system they helped build. Arthur Hayes, writing in his latest essay Buffalo Bill, says the rise of artificial intelligence, the decay of U.S. dollar supremacy, and the full deployment of stablecoins will erase the need for debt-ridden college grads chasing prestige jobs.

According to Arthur, this group’s reliance on lifelong payments to pay off “worthless credentials” is exactly what made them useful. But now, he says, “America’s gots dat AI,” and the elite will be replaced by machines that don’t ask for Ivy League degrees or six-figure bonuses.

Arthur compares U.S. Treasury Secretary Scott Bessent to the Silence of the Lambs killer, giving him a new nickname: “Buffalo Bill.” Not because he skins people, but because he’s set to kill off the Eurodollar system, an offshore financial ghost network that’s been floating trillions outside U.S. control since the Cold War.

Arthur says Scott has no idea how much money lives in the Eurodollar system or where it flows. But one thing’s clear: none of it is buying his Treasury debt. That’s why he’s about to push a new plan to force that capital into on-chain stablecoins that feed directly into the American debt engine.

Bessent targets Eurodollars, dumps risk into stablecoins

The U.S. allowed the Eurodollar system to flourish decades ago because of strict capital controls and Cold War politics. Over time, that created a $10 to $13 trillion pile of offshore dollars. Arthur calls it “a force with which to be reckoned,” but says Buffalo Bill is done reckoning.

The plan is to take that money and reroute it through dollar-backed stablecoins like Tether’s USDT, which operate like narrow banks. These stablecoins accept dollars, buy short-term Treasury bills, and pocket the yield. If you deposit a million dollars, you get 1 million USDT. Tether invests the cash in risk-free government debt. That’s it.

Arthur explains that Bessent doesn’t need to raise rates or fight the Fed. If a stablecoin issuer needs to earn a return, they’ll buy whatever Treasury debt is available, no matter the yield. “The stablecoin issuer becomes a price-insensitive buyer of Buffalo Bill Bessent’s dogshit paper in (expletive) SIZE,” Arthur writes.

That gives Scott control over the entire front end of the U.S. yield curve and makes the Fed completely irrelevant. If Powell refuses to play ball, Bessent will just go around him.

Even foreign governments can’t stop it. Arthur says Bessent will hit back at countries like the Philippines if they try to block stablecoins. If President Bongbong Marcos moves against Meta or its payment systems, Scott can retaliate by freezing his family’s offshore wealth.

“I don’t think Bongbong is itching for round two,” Arthur writes, reminding readers of Imelda Marcos’s RICO trial over New York real estate.

America’s global control plan merges finance, tech, and sanctions

At the same time, social media giants like WhatsApp are being turned into wallets. Arthur imagines a world where everyone in the Global South receives and sends USDT through these apps.

“The central bank has effectively lost control of the money supply,” he says, warning that it’s impossible to stop without shutting down the internet. VPNs, addictive UX, and Trump administration protection mean regulators will lose. He claims Trump already threatened tariffs against the EU for trying to block U.S. tech companies over privacy and competition laws.

Arthur calculates that $34 trillion in capital, from Global South deposits and Euro-poor Europeans, is now up for grabs. If even a chunk of that moves into stablecoins, Bessent gets the buyer base he needs to keep printing debt. Arthur writes: “It puts the dollars on its skin, or it gets the sanctions again.”

Arthur believes once this flood hits stablecoins, it’ll pour straight into DeFi apps. First, there’s staking. Fernando, a fictional Filipino click-farmer, stakes 1,000 USDT on PDAX for 2% yield. He gets back psUSDT, an interest-bearing version of the token.

That psUSDT becomes collateral in DeFi. He can trade it, borrow against it, and use it in derivatives. When he unstakes, he receives 1,020 USDT, paid out from Tether’s NIM.

Next comes spending. Arthur backs Ether.fi Cash, a product that lets people spend stablecoins anywhere Visa is accepted. “The customer experience whether I use my Amex or Ether.fi cash card is the same,” he writes. He believes $ETHFI can 34x from current levels based on the forecasted growth of stablecoin vaults and revenue ratios pulled from JP Morgan’s filings.

Arthur ends his essay with yet another warning that President Trump isn’t interested in spending cuts or fiscal restraint. Scott Bessent is going to push stablecoins as fast as possible, and tech firms like Zuckerberg and Musk will spread them worldwide.

“There ain’t no Officer Starling around to stop him,” Arthur writes. He says Americans should expect new headlines soon: government officials pushing oversight on Eurodollars, forcing foreign governments to open markets for U.S. tech, and laws that make stablecoin issuers park all reserves in U.S. banks or T-bills.