The Federal Reserve’s recent decision to cut interest rates has sparked renewed optimism in financial markets, particularly among cryptocurrency investors. The crypto market, which has been struggling to recover, saw Bitcoin prices rise ahead of the Fed’s announcement, fueled by hopes that lower rates could bolster digital assets. However, questions remain on whether these rate cuts, coupled with the anticipated Bitcoin halving event, will provide the much-needed boost to the broader crypto markets.

Bitcoin’s Response to Rate Cuts

Bitcoin, the world’s largest cryptocurrency, surged above $60,000 for the first time since last month as the Federal Reserve began its two-day meeting. The meeting concluded with the announcement of a

The anticipation of lower rates drove Bitcoin’s price to $60,477.98, with an intra-day high of $61,337. The surge came after a period of stagnation, with Bitcoin trading within a tight range since April. Even the recent halving event, which traditionally boosts demand by cutting mining rewards, failed to propel the cryptocurrency to new highs. Despite the initial positive market reaction, experts caution that while rate cuts can provide short-term relief, sustained gains may require additional catalysts.

How Fed Rate Cuts Affect Crypto-Centric Stocks

The prospect of lower interest rates has bolstered sentiment across various asset classes, including cryptocurrency-related stocks. The buy-the-dip strategy has gained traction as investors look to capitalize on the potential upside of growth-oriented assets. Several Bitcoin-centric stocks, such as Interactive Brokers Group, Inc., Robinhood Markets, Inc., CME Group Inc., BlackRock, Inc., and NVIDIA Corporation, have shown resilience amid market volatility, with analysts projecting continued earnings growth for these companies.

Interactive Brokers Group, for example, is expected to see an 18.4% growth in earnings this year, while Robinhood Markets’ forecast suggests a significant earnings increase of over 100%. Similarly, BlackRock, a pioneer in the Bitcoin ETF race, and NVIDIA, known for its graphics processing units that support crypto mining, are positioned to benefit from a favorable rate environment. Despite the positive outlook, these stocks remain sensitive to broader market movements and regulatory developments in the crypto sector.

Halving and Its Limited Impact on Bitcoin Prices

The Bitcoin halving event, a pre-programmed reduction in mining rewards, is historically viewed as a bullish signal for the cryptocurrency market. By reducing the supply of new Bitcoin entering circulation, halvings are intended to drive prices higher over time. However, the most recent halving did not deliver the expected price surge. Instead, Bitcoin’s value saw a notable decline, underscoring the complexities of market dynamics in the current environment.

Market participants often view halvings as a trigger for a supply shock that pushes prices upward. Yet, this mechanism is not foolproof, particularly when broader economic conditions, such as rising interest rates and regulatory uncertainties, exert downward pressure. The muted response to the halving suggests that while it remains an important factor, it alone may not be sufficient to counteract other market headwinds.

Broader Implications of Rate Cuts on Crypto and Commodities

The Federal Reserve’s decision to lower rates marks a pivotal moment for investors across asset classes, including stocks, cryptocurrencies, and commodities. Rate cuts are generally seen as a positive development for riskier investments like cryptocurrencies, as they reduce the opportunity cost of holding non-yielding assets. In a low-interest-rate environment, investors are more inclined to allocate capital to assets with higher growth potential, even if they carry greater risk.

The cryptocurrency market, in particular, has shown a mixed response. While the initial surge in Bitcoin and other major cryptocurrencies highlights the market’s sensitivity to monetary policy changes, sustained gains may depend on broader economic recovery and investor confidence. Recent history has shown that cryptocurrencies often mirror the directional sentiment of traditional asset markets, rising and falling in response to shifts in liquidity and risk appetite.

Investor Outlook and Market Uncertainty

Despite the immediate positive reaction to the Fed’s rate cuts, uncertainty looms over the long-term outlook for both traditional and digital assets. Market analysts are closely monitoring the Fed’s next moves, as any indication of a slower pace in rate reductions could dampen the current rally. Additionally, the broader economic backdrop, including employment data and inflation trends, will play a critical role in shaping market sentiment.

The halving event, while historically significant, may not be enough to sustain a prolonged uptrend in Bitcoin prices without additional support from macroeconomic factors. Investors are advised to remain cautious, as market conditions can shift rapidly. For those with a long-term investment horizon, the current environment may present opportunities to accumulate assets at discounted prices, though the path forward is far from certain.

The intersection of Federal Reserve rate cuts and Bitcoin’s halving event presents a complex landscape for investors navigating the crypto markets. While lower rates are expected to provide a temporary boost, the long-term impact on digital assets remains uncertain. As the market continues to adjust to the evolving economic environment, the effectiveness of these measures in supporting sustained growth will be closely watched by investors and analysts alike.

Impact on the Market so-far

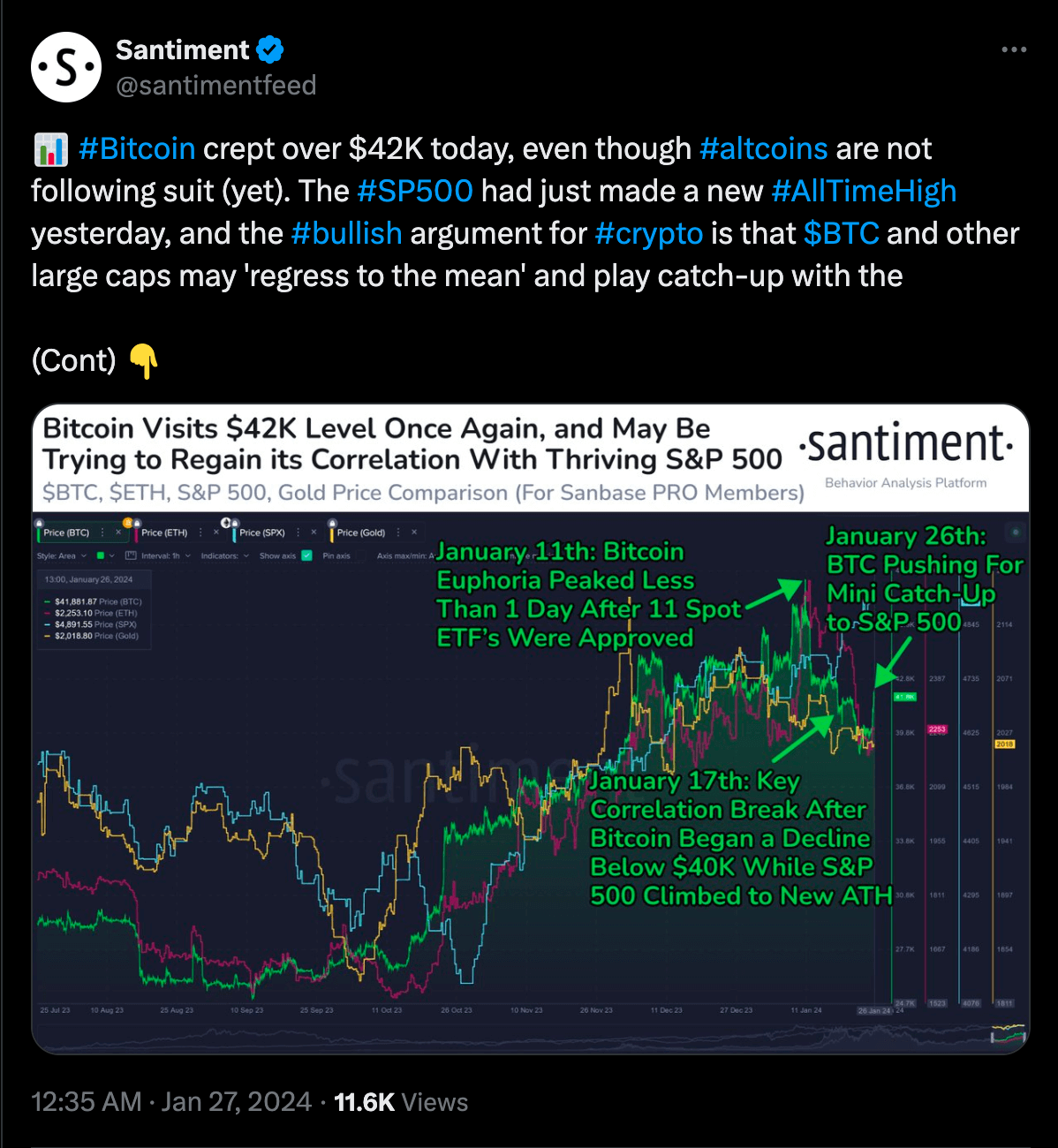

Bitcoin has been navigating a volatile landscape throughout the first half of 2024, reflecting broader economic shifts and investor sentiment. As of early this year, Bitcoin’s price has seen dramatic fluctuations, ranging between $38,000 and $49,000, with a current level of approximately $42,000. These movements have mirrored the anticipation surrounding key macroeconomic events, particularly decisions by the United States Federal Reserve (Fed).

Bitcoin’s price volatility aligns with the broader financial market’s reaction to the Fed’s monetary policy actions. The Federal Open Market Committee (FOMC) meeting at the end of January played a pivotal role in shaping market sentiment, as the Fed’s stance on interest rates continues to exert a significant influence on crypto markets. This has led to a cautious environment where traders are closely monitoring price levels and preparing for potential new trends in Bitcoin’s value.

The Fed’s decisions on interest rates have been a crucial determinant of Bitcoin’s performance and overall market stability. Recently, the market widely expected the Fed to maintain current interest rates, with an overwhelming 98% probability of no change during the January FOMC meeting. However, this decision marked only a brief pause in a broader monetary policy narrative that continues to weigh heavily on investor behavior.

In mid-2023, the impact of Fed decisions on Bitcoin was clearly visible. On the day of an anticipated rate hike, Bitcoin prices hovered near $29,200, with traders bracing for typical FOMC-induced volatility. Analysts expected the Fed to increase rates by 25 basis points, which was widely seen as a foregone conclusion. However, what drove market dynamics was not just the rate hike itself but the commentary from Fed Chair Jerome Powell, which added an extra layer of uncertainty.

Investors closely monitored the Fed’s forward guidance, as any indication of further hikes or pauses significantly influences market behavior. The market’s collective reaction often manifests as a rapid reallocation of capital, with traders seeking to adjust their positions based on perceived economic stability or risk. Bitcoin, known for its high volatility, often mirrors these broader market shifts but at amplified levels.

The correlation between Bitcoin and other financial indicators, such as the U.S. Dollar Index (DXY), also highlights the interconnected nature of global markets. In times of Fed-induced market shifts, the DXY’s movements are scrutinized, as its strength or weakness can inversely impact Bitcoin. For instance, a declining DXY often correlates with a surge in Bitcoin prices, as investors seek refuge in alternative assets amidst perceived dollar weakness.