[ad_1]

A wave of companies holding crypto on their balance sheet arrived in 2025. Driven by Trump’s pro-crypto policies, several traditional businesses bet big on crypto, whether through mergers or by going public in the US stock market.

However, it appears that “DATs” or Digital Asset Treasuries are losing momentum, as many are seeing their stock values plummet.

All About the Access

Big-time DAT names like Bitcoin’s MicroStrategy, Ethereum’s Bitmine, and Solana’s Forward Industries are down big the past month.

Investors seem to be hitting the sell button on these public companies when, not too long ago, they were darlings. DATs have certainly had a moment in 2025. But has that moment already come and gone?

The DAT craze likely got hot because they gave investors a venue to access crypto without ever having to fuddle with wallets, exchanges, or a myriad of chains, noted Jean-Marc Bonnefous, Managing Partner of Tellurian Capital.

“DATs, being listed companies, are a convenient, compliant, ready to use way for US institutional investors to buy crypto assets without any significant changes to their existing mandate and operational workflows,” Bonnefous told BeInCrypto.

All of this was initially sparked by MicroStrategy (NASDAQ: MSTR) back in 2020, when its CEO, Michael Saylor, during the pandemic-era money printing, decided to convert some of his company’s cash to BTC.

Strategy currently owns 649,870 bitcoin as of this writing, with an average cost of $74,430 per bitcoin.

MicroStrategy has 60% of all the BTC that DATs currently hold. Source: CoinMarketCap

However, some institutional investors may be experiencing buyer’s remorse on DATs now, as the market for both crypto and traditional assets is down.

Yet Strategy may fare better than its rivals with way less experience in the crypto treasury space.

“Strategy had decades of revenue, deep capital-markets relationships, and moved early enough to build a massive Bitcoin position that gave it credibility and cheap financing,” said Maja Vujinovic, CEO of ETH accumulator FG Nexus (NASDAQ: FGNX). “Newer DATs don’t have that advantage”.

Eyeballing the NAV and mNAV

Investors looking at newer DATs need to be examining Net Asset Value (NAV) and Market Cap to Net-Asset-Value (mNAV) as a key evaluation tool.

“NAV is the simple ‘what is the crypto worth today?’ number,” Vujinovic told BeInCrypto. “mNAV is what the market is willing to pay on top of that for the company’s strategy, credibility, and execution.”

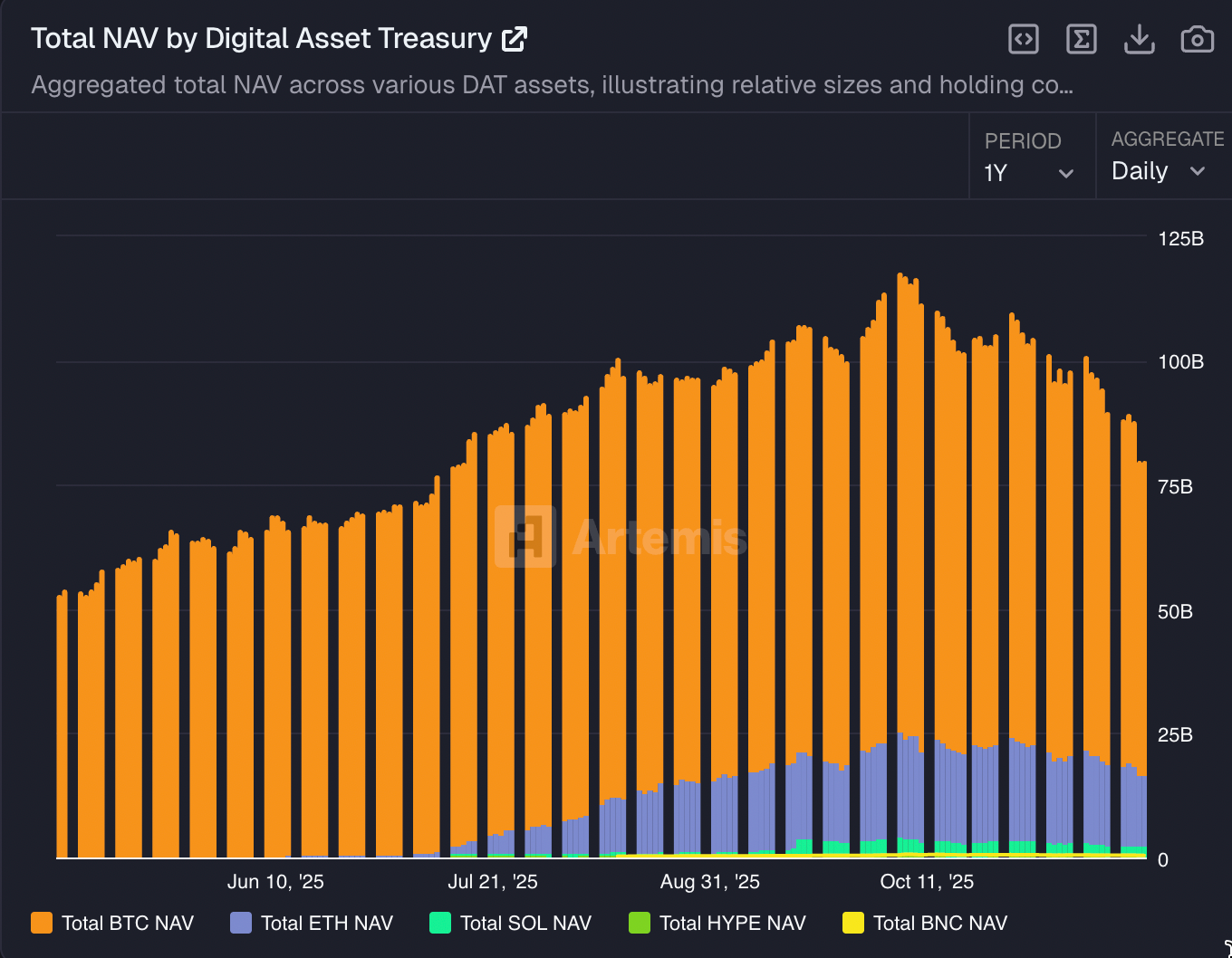

Total NAV across treasuries since May 1, when DATs started taking off. Source: Artemis

Interestingly enough, the peak of DAT mania in 2025 may have crested on October 10, around the time a massive wave of liquidations wiped out $19 billion in crypto market value.

It’s entirely possible that many investors didn’t understand the massive amount of leverage that happens in the crypto market.

Its largely globally unregulated nature allows traders to take 100x bets, which can cause sweeping auto-deleverages, as was the case on October 10.

Since then, NAV has declined from an October high of nearly $120 billion to less than $80 billion, according to data aggregator Artemis.

There is also an argument that investors do understand there’s a lot of leverage in crypto, and plain old greed is what caused the runup and subsequent rundown.

“DATs are seen as a leverage bet on the underlying assets’ ecosystems, allowing investors to potentially compound gains,” said Alex Bergeron of Ark Labs, a Bitcoin Layer-2 solution. “Obviously, this leverage creates an amplified price impact on the downside as well.”

DATs are Getting Diversified

Most DATs will need to do more than just hold crypto to run a revenue-producing business. That’s because if the valuation of the company is just based on NAV, they are going to trade at a discount.

There are expenses associated with running a company, such as operations and executive pay.

1/ I see a lot of bad analysis of DATs, or digital asset treasury companies. Specifically, I see a lot of bad takes on whether they should trade at, above, or below the value of the assets they hold (their so-called “mNAV”).

Here’s how I approach it.

— Matt Hougan (@Matt_Hougan) November 23, 2025

As a result, DATs have to get creative with their crypto to juice the mNAV.

Now, mNAV is the forward-looking market capitalization metric based not just on the value of crypto on a balance sheet, but on what investors are valuing the business at.

DATs will need to do things like issue debt on their crypto, which is the MicroStrategy playbook. Since it was introduced in 2020, it has amassed a $55 billion stockpile.

And that’s probably what will allow Strategy to survive long-term: In the world of DATs, it’s an O.G. holder of bitcoin.

“With Strategy’s diversified approach, they’re ahead of many other DATs,” said Jesse Shrader, CEO of Amboss, a provider of Bitcoin Lightning Network data and shareholder in DATs. “But followers may be able to focus their efforts more tightly around fruitful endeavors or build their own pioneering strategy in novel areas like low-risk yield opportunities.”

Newer DATs will need to find revenue sources from their pile of cryptocurrency to boost that forward-looking mNAV valuation.

For example, DATs will need to lend crypto out, use derivatives, stake for yield, or find ways to acquire more digital assets at a discount. And a savvy public markets team could figure this out long-term for some opportunistic DATs.

Continuing “Risk-Off” Tailwinds

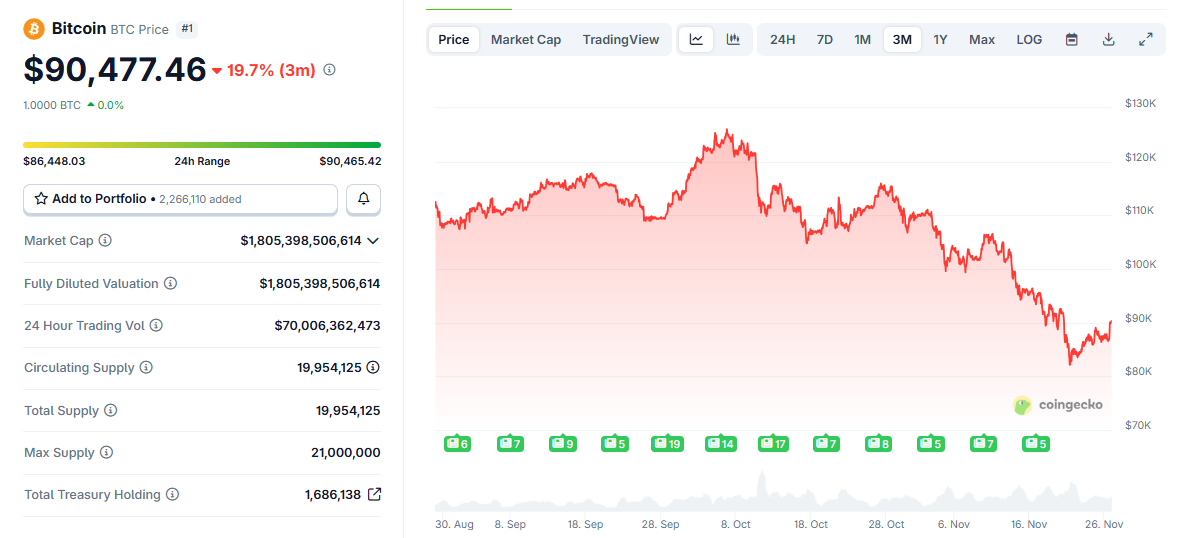

The crypto market is not in good shape when compared to the breathless times of May and June when DAT mania began its frenzy.

In fact, with BTC changing hands around $90,000, the price is back to where it was in May when all of this began.

Bitcoin 3-Month Price Chart. Source: CoinGecko

There’s some concern that a “risk-off” environment is taking place in the markets right now. This is a phenomenon where investors start to take market assets off the table, selling the easy-to-sell and moving into cash.

Crypto, and its subsequent DATs, appear to be victims of a risk-off environment.

“Listed equities are easy to buy and sell so these new marginal buyers of crypto assets will add to the already quite volatile ‘risk on’-risk off’ moves in the market,” Tellurian Capital’s Bonnefous said.

Surely, some DATs will survive.

Yet there may be a period of pain. There might even be some mergers or other consolidations, as investors get into tune with which of these companies can successfully keep floating well above NAV with sound business practices.

“The next generation of winners will be DATs that build real businesses: Staking income, smart hedging, tokenization and disciplined treasury management,” added FG Nexus’ Vujinovic.

The post Are Digital Asset Treasuries (DATs) Just a Fading Fad? appeared first on BeInCrypto.

[ad_2]