Bitcoin’s (BTC) April 2024 halving cut block rewards from 6.25 to 3.125 BTC, compressing the hash price and forcing Bitcoin miners to reconsider their business model.

Instead of waiting for fee markets to rescue margins, the largest operators started signing contracts to lease infrastructure to AI tenants.

Core Scientific committed 500 megawatts to CoreWeave for $8.7 billion over a 12-year period. Cipher locked in 168 MW with Fluidstack for $3 billion over a decade, with Google backstopping obligations.

These deals depend on the calculation that the same inputs powering SHA-256 ASICs can generate more revenue per megawatt-hour when pointed at high-performance compute.

The question is how much non-Bitcoin revenue miners need to reduce sell pressure on treasuries, what happens to the network’s hashrate if capacity migrates, and which operators have the balance sheets to execute.

Bitcoin miners control cheap power, industrial sites, cooling infrastructure, and operations expertise, which is everything AI compute needs.

The revenue curves differ: mining ties earnings to hash price and coin price. AI colocation delivers contracted dollar revenue per kilowatt-month. What matters is the margin comparison in dollars per megawatt-hour, and unit economics favor hosting when the hash price compresses.

Security budget under pressure

Hashprice measures the revenue of miners per petahash per day. When it falls, miners shut off machines or sell Bitcoin to cover fiat expenses.

The network’s security budget equals the block subsidy plus fees in BTC terms, but its dollar value has become more volatile after the halving.

The brief fee surge when Runes launched during the halving block demonstrated how on-chain demand can influence the hash price, but outside those spikes, fees have been modest.

Power costs are fixed in dollars, and revenue comes in Bitcoin. When the hash price hovers at $50 per petahash per day, a modern fleet running Antminer S21-class machines at 17.5 joules per terahash generates approximately $119 per megawatt-hour.

Subtracting a $50 per MWh power price, the cash margin sits at $69 per MWh. The model is operational, but barely.

Bump the hash price to $75 per petahash per day, and revenue climbs to $179 per MWh, yielding $129 per MWh in cash margin.

The delta between survival and profitability is narrow and hinges on factors miners can’t control: BTC price, network difficulty, and fee velocity.

AI hosting offers a way out: dollar-denominated contracts that don’t fluctuate with the hash price, locked in over multi-year terms, utilizing the same infrastructure that runs ASICs.

Where Bitcoin miners meets AI

Bitcoin miners and AI operators require the same infrastructure: affordable power, proximity to substations, industrial cooling, fiber-optic interconnects, and expertise in maintaining uptime.

Core Scientific’s CoreWeave deal implies a hosting fee of roughly $121 per kilowatt-month. Cipher’s Fluidstack contract runs about $149 per kW-month.

These are signed contracts with creditworthy counterparties, not aspirational projections. The revenue structure typically separates hosting fees from power costs, as the tenants reimburse power consumption while operators earn a fixed rate per kilowatt.

That shifts commodity risk to the tenant and converts miner revenue into infrastructure-as-a-service.

Rack rates between $120 and $180 per kW-month translate to a facility revenue intensity of roughly $139 to $208 per megawatt-hour, assuming a power usage effectiveness of 1.2.

Because power is passed through, much of that revenue is allocated to cash flow after non-power operating expenses.

Compare that to SHA-256 mining at $75 per petahash per day, where the revenue intensity is $179 per MWh, but every dollar of power cost is deducted upfront.

The hosting model removes Bitcoin price exposure and fee volatility, replacing it with multi-year visibility. For miners with debt, that cash flow profile is financing-friendly.

Unit economics and treasury policy

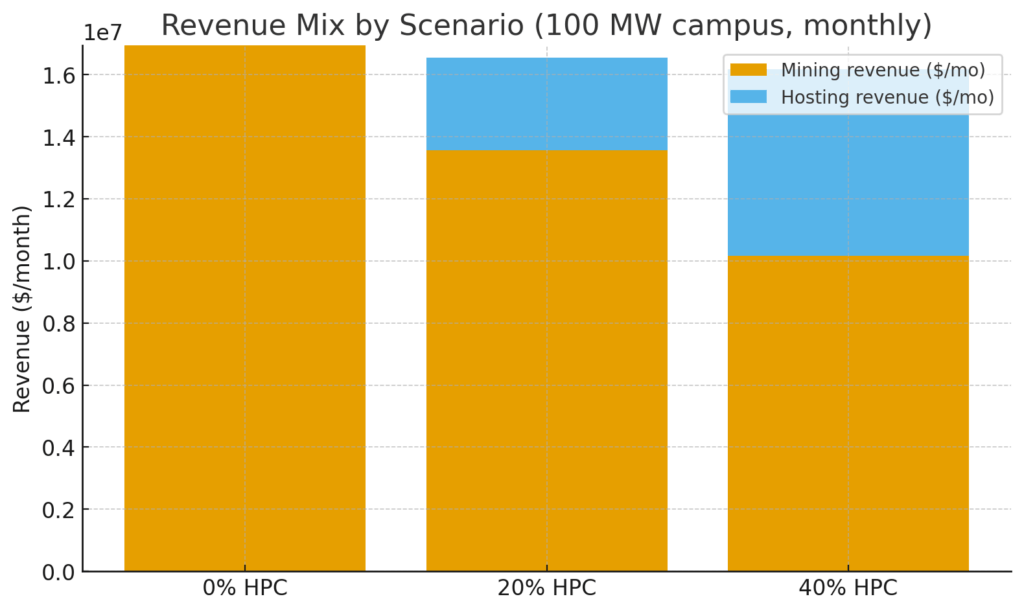

A 100-MW site running SHA-256 at $75 per petahash per day and a $50 per MWh power cost generates approximately $129 per megawatt-hour in cash margin, which is roughly $11.3 million annually.

The same 100 MW leased to an AI tenant at $150 per kW per month yields a facility revenue intensity of approximately $174 per MWh.

If the tenant covers power, the operator retains most of that as margin. The hosting structure delivers materially higher cash flow per megawatt when the hash price weakens or power prices rise.

Treasury policy matters. MARA Holdings has held as much as 52,000 BTC and at times sold none. Riot Platforms sold 465 BTC in September 2025 for approximately $52.6 million to fund expansion. CleanSpark grew its treasury above 13,000 BTC while continuing to build out.

All face the same fiat expense base: power bills, debt service, and payroll. Hosting revenue changes the equation. If a miner generates $15 million annually from AI colocation on 100 MW, that’s $15 million that doesn’t require selling Bitcoin.

The treasury can stay coin-denominated without starving cash operations. When hashprice compresses, that buffer allows miners to ride out weak environments without forced sales, thereby dampening the sell pressure that typically follows halvings.

Less BTC being sent to exchanges from miner wallets means less marginal supply.

Hashrate migration and network effects

If a meaningful share of hashrate migrates to AI hosting and isn’t backfilled, network hashrate falls until difficulty retargeting restores equilibrium.

The security budget in BTC remains unchanged, blocks still produce 3.125 BTC plus fees, but the cost-to-attack can rise with a lower hashrate.

The flip side is mechanical. A lower network hashrate means a higher hash price for remaining miners, assuming a constant Bitcoin price and fees.

In a scenario where 10% of global hashrate shifts to AI hosting over 18 months and network hashrate drops by roughly 10%, difficulty adjusts downward, and hash price for remaining miners rises proportionally.

Miners who stayed on SHA-256 capture that upside, while those who pivoted to AI lock in contracted dollar revenue.

The trade-off is between Bitcoin exposure and the certainty of cash flow. Fees complicate the analysis. If fee markets activate through Runes, layer-2 settlement traffic, or payment volume, the hash price can climb quickly.

Miners who transitioned from SHA-256 to AI hosting miss out on that upside. AI contracts provide downside protection but cap participation in fee-driven revenue surges.

The optimal strategy depends on each miner’s cost structure, balance sheet, and view on Bitcoin’s fee trajectory.

Who wins and what could break

Operators with very low power costs, expandable interconnects, and capital flexibility screen best. Core Scientific’s pivot to HPC hosting after bankruptcy restructuring shows how a balance sheet reset enables strategic repositioning.

Cipher’s Google-backed deal demonstrates the importance of creditworthy counterparties. Bitdeer, Iris Energy, TeraWulf, and CleanSpark have all signaled their intention to utilize HPC, reflecting the industry’s growing recognition that AI demand can monetize stranded power capacity.

Risks are real. GPU cycles could shift, leaving miners with capital expenditures sunk into infrastructure that loses value. Contract counterparty risk is a concern for smaller AI startups that lack robust balance sheets.

Grid politics surrounding large loads are intensifying in Texas, where ERCOT’s interconnect queue is long and capacity additions are lagging behind demand growth.

Miners who lease interconnect capacity to AI tenants may struggle to scale back if Bitcoin’s economics improve.

Interconnect queues matter more than public discussion acknowledges. A miner with 200 MW of contracted power and grid interconnect approval can pivot between SHA-256 and HPC based on economics.

A miner waiting in ERCOT’s queue can’t monetize the site until approvals clear, which can take years. Miners that moved early captured optionality that late movers lack.

What to watch in 2026

For the next year, it would be wise to track power purchase agreement announcements, ERCOT interconnect milestones, miner guidance on non-BTC revenue mix, and fee velocity on Bitcoin.

ERCOT’s capacity reports frame the scarcity backdrop in Texas, where most large-load action concentrates. Interconnect capacity is becoming the binding constraint.

Fee trends will determine whether staying on SHA-256 delivers comparable returns to AI hosting. If Runes or Layer 2 traffic drives sustained fee growth, hashprice could stabilize above $100 per petahash per day, making mining competitive with hosting on a risk-adjusted basis.

If fees stay muted, the hosting model wins on cash flow certainty. Miners are hedging: keeping some capacity on SHA-256 while converting a share to AI hosting, preserving optionality until the market reveals which model dominates.

The strategic question isn’t whether miners become AI companies, but it’s how they allocate finite interconnect capacity, power contracts, and balance sheet resources between competing uses.

The miners that win can execute on both: maintaining SHA-256 operations when the hash price justifies it, scaling AI hosting when contracts pencil out, and preserving flexibility to shift between models as the economics evolve.

What’s at stake is whether the Bitcoin mining industry retains its single-use identity or becomes a multi-tenant power monetization layer that happens to secure a blockchain.