Trump backed $ABTC just dropped its first earnings as a public company. This “not just a miner, not just a treasury” company is now targeting 50 EH/s to power its BTC-focused growth strategy.

The following guest post comes from BitcoinMiningStock.io, a public markets intelligence platform delivering data on companies exposed to Bitcoin mining and crypto treasury strategies. Originally published on Nov. 20, 2025, by Cindy Feng.

While much of the Bitcoin mining sector is pivoting toward AI and HPC infrastructure, American Bitcoin (Nasdaq: ABTC) is taking a very different approach: it is trying to scale into a top-tier Bitcoin miner, grow a sizeable BTC treasury, and still insists it’s not just a miner or a passive BTC vehicle. The core question, however, is whether economics justify their ambitions when many peers are trying to pivot away from bitcoin mining.

Let’s take a close look at their first quarterly results as a Nasdaq-listed company.

Current Bitcoin Mining Status

The company only came into existence on 31 March 2025 and listed on Nasdaqon 3 September. In that short window it moved quickly.

By the end of the third quarter, it reported ~25 EH/s of installed capacity with an average fleet efficiency of 16.3 J/TH. A major contributor is the exercise of a purchase option for roughly 14.8 EH/s of new miners at the Vega site in Texas. Management talks indicate a roadmap toward ~50 EH/s.

Screenshot from its investor presentation (page 12).

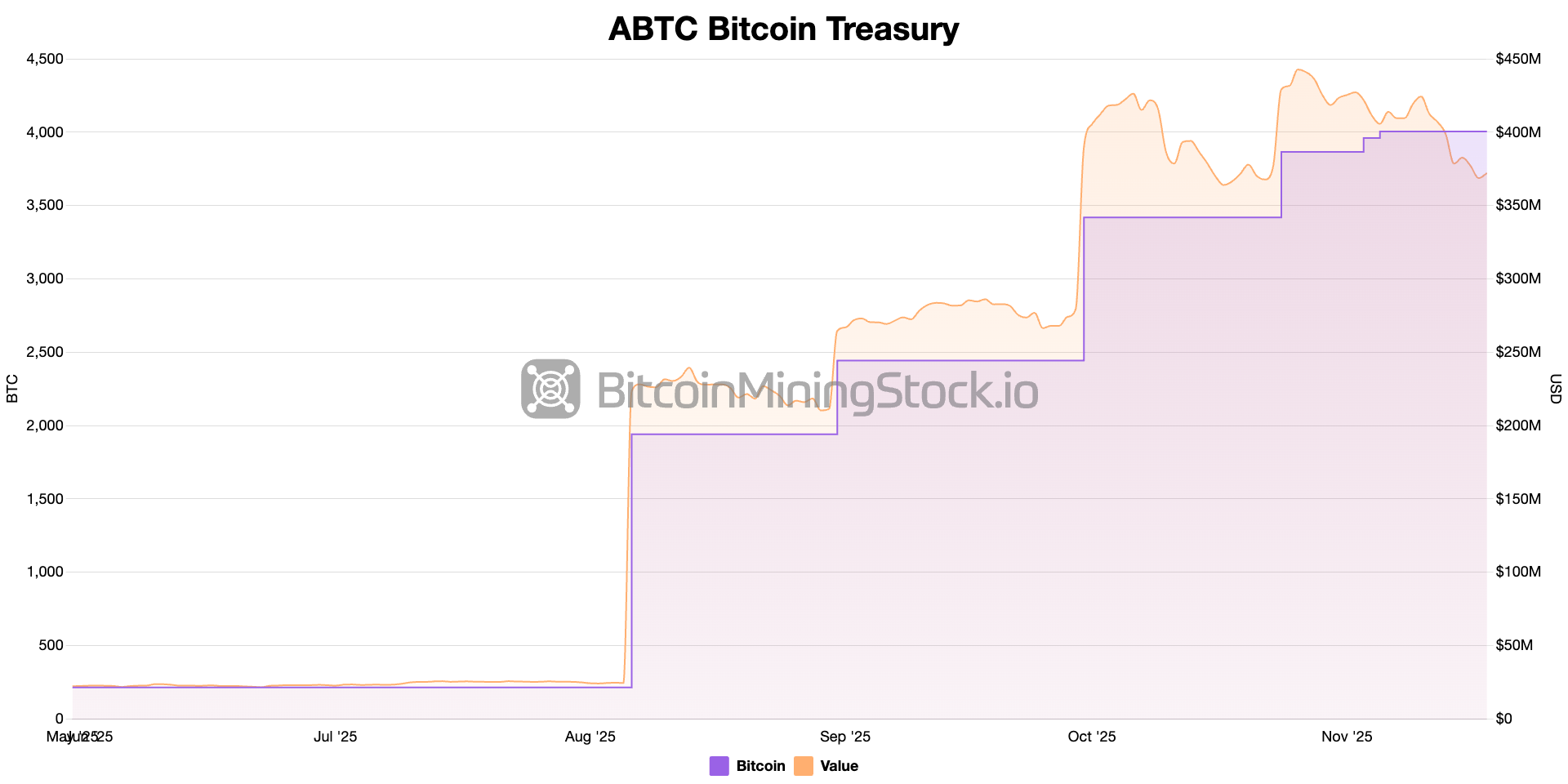

Over the same short window, it has grown its Bitcoin reserves from zero on 1st April to 3,418 BTC as of 30th September (at the time of writing, that number reached 4000 BTC+). Management translates that to 371 satoshis per share and highlighted that BTC per share has risen by about 50% since listing. They openly want the market to focus on Bitcoin per share as the primary value lens rather than just revenue or headline hash rate.

Taken together, American Bitcoin is taking a deliberate, concentrated bet on scaling Bitcoin mining and BTC holdings, not pivoting away from them.

Asset-Light Model Is Their Magic Recipe

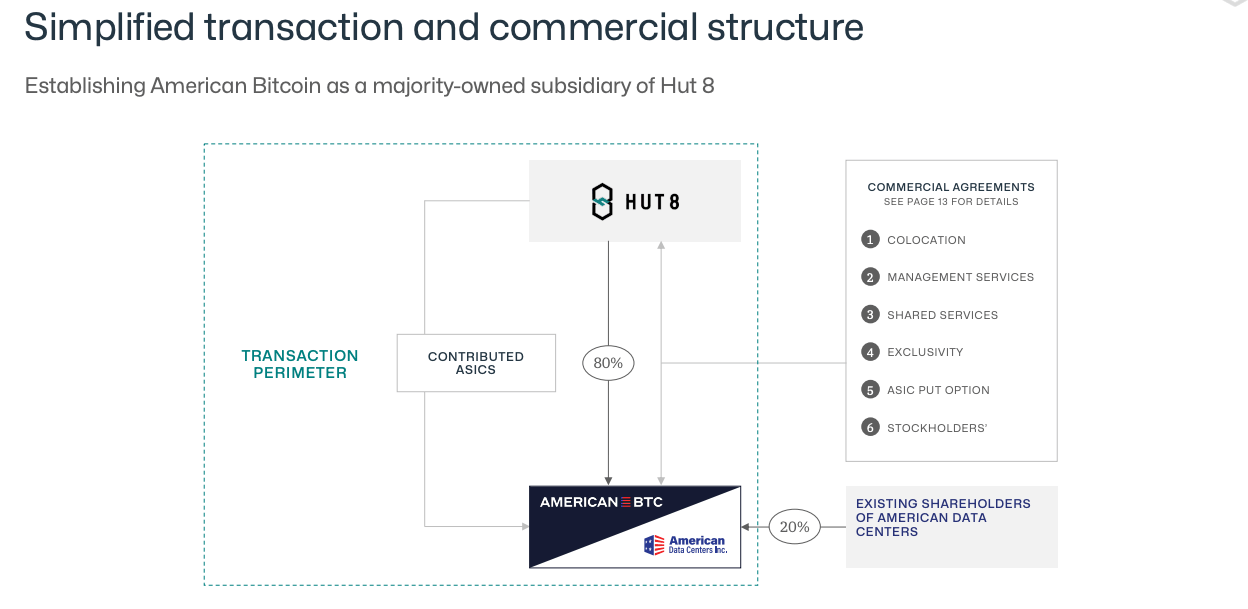

Uniquely, American Bitcoin’s bitcoin mining operations are tied to its partnership with Hut 8. The company does not own any main pieces of infrastructure. Hut 8 develops and operates the sites, negotiates with utilities, and provides the physical environment for the miners. American Bitcoin buys and finances the ASIC fleet, pays hosting and service fees, and concentrates its own capital on miners and Bitcoin rather than substations and buildings. In the third quarter, management said their SG&A was about 13% of total revenue, which is a reasonably lean cost base and consistent with the claim that not owning the infrastructure helps keep fixed overhead down.

Relationship between Hut 8 and American Bitcoin (screenshot from Hut 8 presentation, page 11).

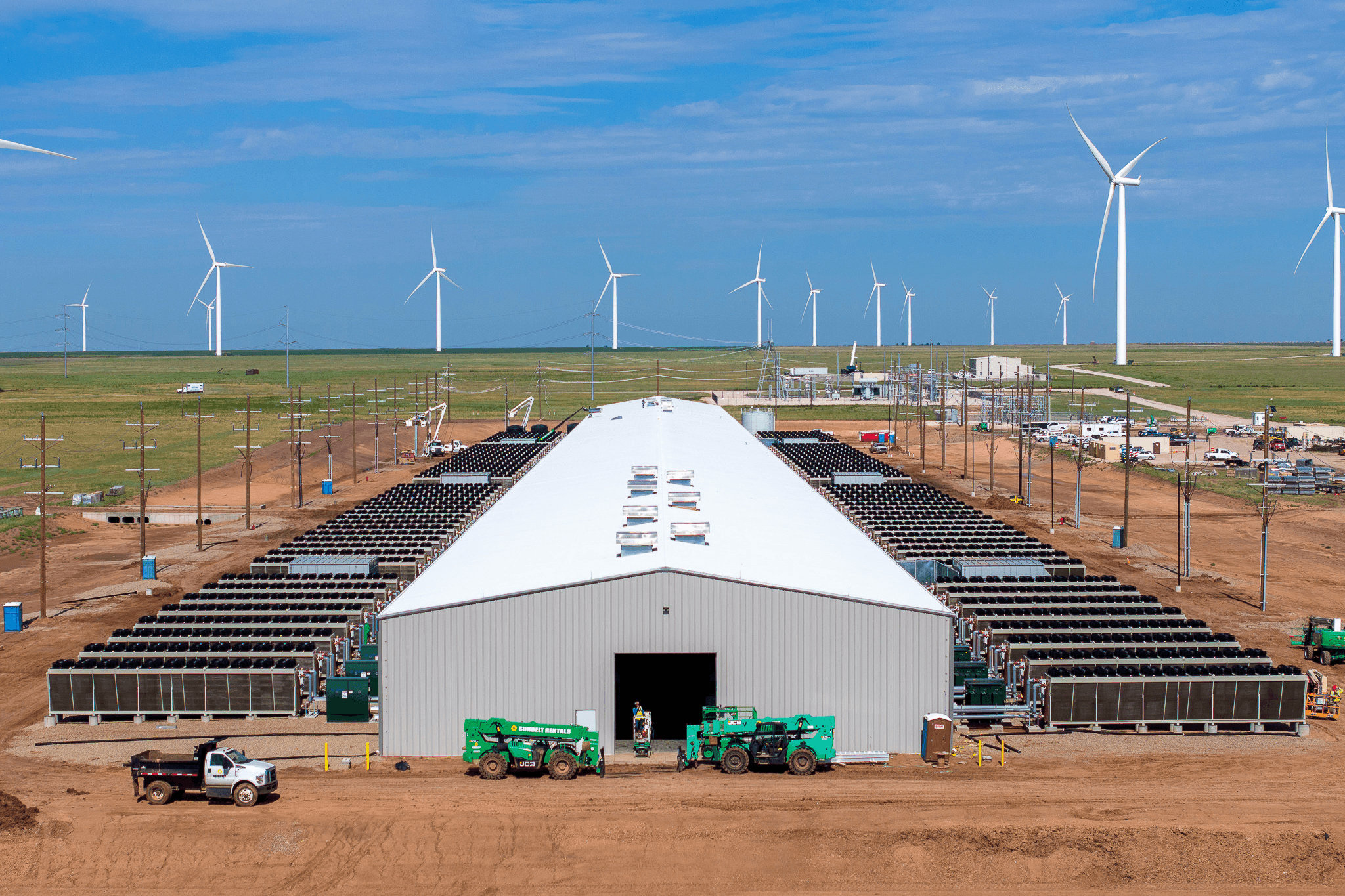

Vega in Amarillo is the flagship example. On Q3 earnings call, Asher Genoot mentioned that American Bitcoin now accounts for over 95% of the local co-op’s load and runs as a fully curtailable, behind-the-meter customer at a wind farm. When the grid needs to shed load during peak events, the mine can power down quickly. Management’s argument is that AI and HPC data centers can’t do that without disrupting customers, which gives Bitcoin mining a niche: it can soak up cheap, intermittent power and get out of the way when the grid is stressed. In some way, the Vega site is the template for how American Bitcoin believes it can keep its cost of production well below spot, even when competition intensifies.

Vega Site (photo credit: Hut 8).

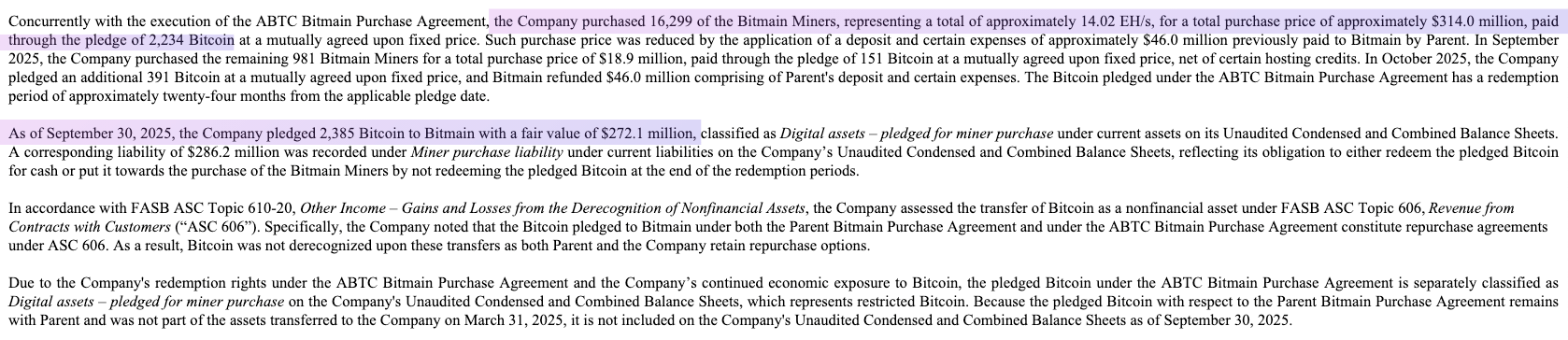

On top of that sits a financing twist. Instead of paying for miners entirely in cash, American Bitcoin has structured the Bitmain deal in a way that a large block of its Bitcoin is pledged as collateral against new ASICs purchases.

The combination of outsourced infrastructure, flexible power, and BTC-backed equipment financing is the real mechanism behind the 50 EH/s ambition.

What Q3 Tells Us about the Economics of This Model?

The first quarter as a public company gives a small but useful test of the core thesis.

For Q3 2025, American Bitcoin reported $64.2 million in revenue. The cost of revenue was $28.3 million, implying a 56% gross margin. That figure already includes both power and Hut 8’s colocation fees. On the call, management noted that if you isolate just real-time energy costs versus the value of Bitcoin mined, the effective margin would be closer to 69%. While that’s a non-GAAP measure, it aligns with the company’s narrative: with next-gen hardware deployed at a flexible wind-powered site, they claim to mine Bitcoin at roughly half the cost of buying it on the open market.

Profitability metrics remained resilient despite Bitcoin price volatility. The company booked a $5.5 million mark-to-market loss on BTC holdings, yet net income still edged up to $3.5 million. Adjusted EBITDA almost doubled to $27.7 million. For a business that did not exist twelve months ago, this is a credible first showing.

On the balance sheet, there’s a clear capital strategy at play. To expand hash rate, American Bitcoin has used a BTC-pledged structure to finance miner purchases at Vega, rather than relying entirely on cash. As of quarter-end, 2,385 BTC out of 3,418 BTC were pledged as collateral under these arrangements. In other words, the same Bitcoin that underpins the “accumulation” story is also being used to drive forward hash rate growth.

Pledged Bitcoins for ASICs (more details on page 21, 22).

These results can’t prove that the model will be robust through a full cycle. But for now, they do show that the asset-light structure can deliver healthy margins while growing both hash rate and BTC holdings.

Final Thoughts

American Bitcoin’s first quarter as a public company shows fast execution and credible early economics. Its asset‑light model has delivered solid gross margins and allowed the business to scale quickly without carrying the heavy infrastructure burden typical of traditional miners. The real test, however, will be whether this “not just a miner, not just a treasury” approach can hold up, especially if the Bitcoin price tumbles.

For investors watching the story unfold, tracking progress toward 50 EH/s and continued sats‑per‑share accretion will be important. But perhaps also seek answers to some of questions: How will the company manage risk in a downturn with two-thirds of its Bitcoin encumbered as collateral? What happens if Hut 8’s development pipeline stalls? And to what extent will equity issuance and BTC-backed financing remain viable as market conditions evolve….. Answers to these questions will help shape a more clear thesis of your own.