[ad_1]

Advanced Micro Devices (NASDAQ: AMD) shares erupted higher in pre-market on Monday after OpenAI confirmed a multi-gigawatt GPU supply deal that could generate over $100 billion in revenue for the chipmaker in just the next four years.

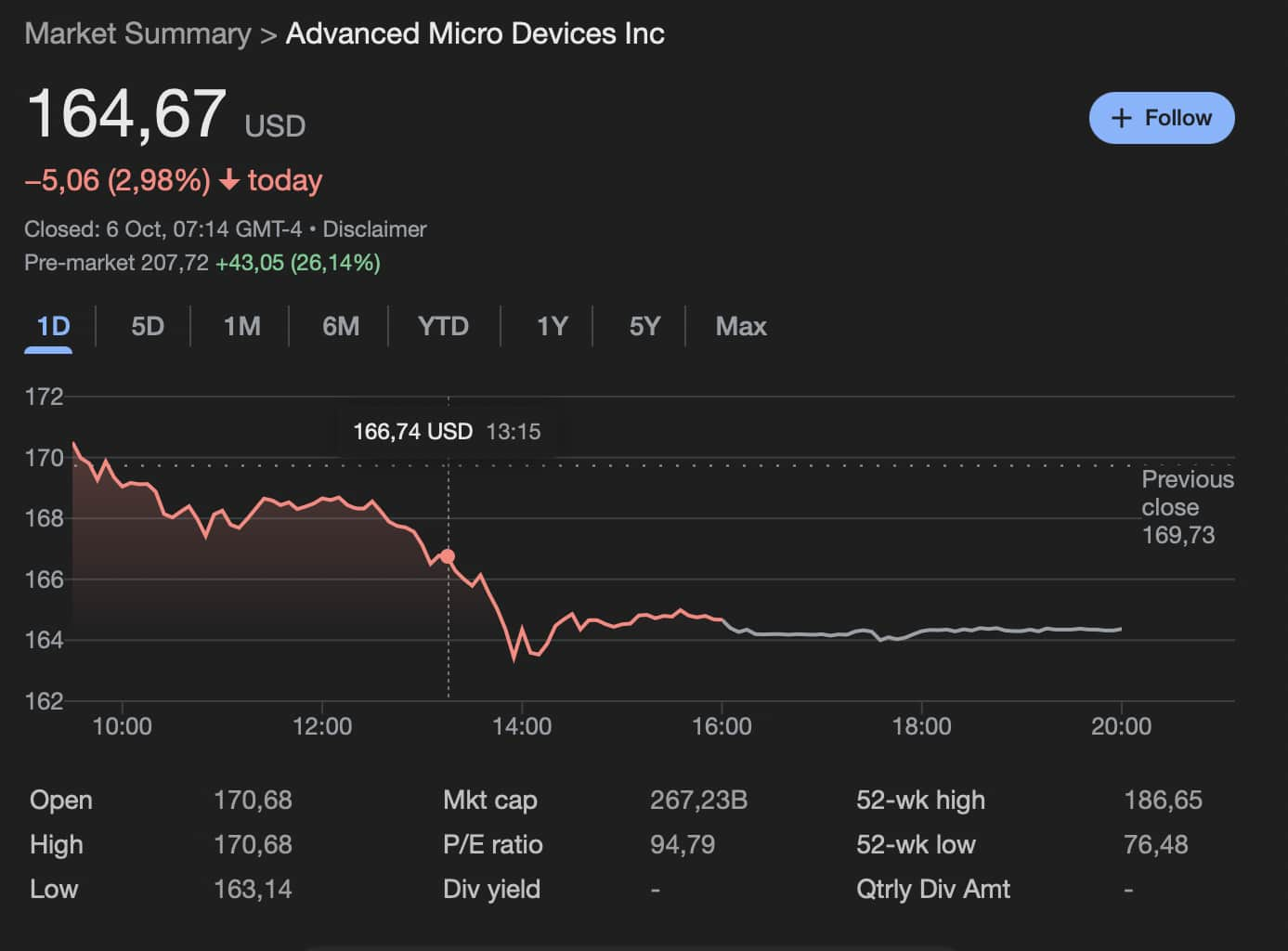

At its peak, the stock spiked more than 26% intraday, one of the sharpest single-day moves in AMD’s modern history, before settling near $207.

The agreement marks a transformative moment for Advanced Micro Devices. OpenAI will deploy up to 6 gigawatts of AMD Instinct GPUs, beginning with a 1 GW rollout in 2026, in a project that rivals Nvidia’s dominance of the AI compute market.

10% stake in AMD

As part of the deal, OpenAI also received a warrant allowing it to buy up to 160 million AMD shares at $0.01 each, representing roughly 10% of the company, contingent on deployment milestones.

The scale is breathtaking. A 6 GW infrastructure build implies tens of millions of top-end GPUs, massive energy draw, and unprecedented supply chain coordination. OpenAI, which is rapidly expanding its Stargate data center footprint, framed the partnership as critical to its long-term AI roadmap.

AMD stock price analysis

Markets responded immediately. AMD stock exploded from the mid-$160s to over $207 in less than two hours, a vertical line on the chart that underscored the sudden repricing. The surge pushed AMD’s valuation above $300 billion, a level few analysts had penciled in for 2025.

The timing comes as AI infrastructure demand accelerates and competitors circle. Nvidia remains the entrenched leader in high-end GPUs, but AMD’s Instinct series has quietly won credibility in hyperscale workloads.

Still, the frenzy comes with caveats. Execution risk is massive. Building multi-gigawatt GPU capacity is a logistical and engineering feat, requiring everything from custom cooling systems to stable power grids. OpenAI’s costs will be astronomical, and AMD will be under relentless pressure to meet deadlines. Meanwhile, Nvidia and custom chip startups are unlikely to stand still.

[ad_2]