By Omkar Godbole (All times ET unless indicated otherwise)

Bitcoin’s (BTC) consolidation continues to take the wind out of the bull run in the broader market that had raised hopes for the so-called alt season marked by prolonged outperformance of alternative cryptocurrencies.

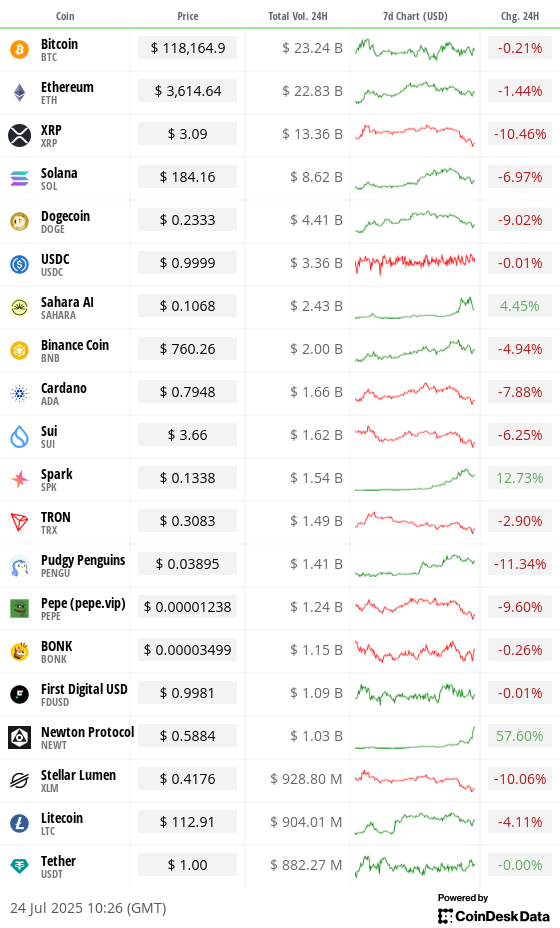

Over the past 24 hours, major altcoins have experienced a significant decline, led by a double-digit drop in the payments-focused XRP and an 8% slide in SOL. The CoinDesk 80 Index, which tracks the performance of altcoins, has dropped over 7% while the CoinDesk 20 Index, which is dominated by bitcoin and ether, has declined by 4%.

“The crypto market took a nosedive, losing almost 4% of its market cap over the last 24 hours. Without bitcoin’s growth, altcoins, which had been driving the market upwards in previous days, found themselves on sale. Forty-eight of the top 100 altcoins are losing double-digit rates over 24 hours, while only three are growing,” Alex Kuptsikevich, chief market analyst at FxPro, said in an email.

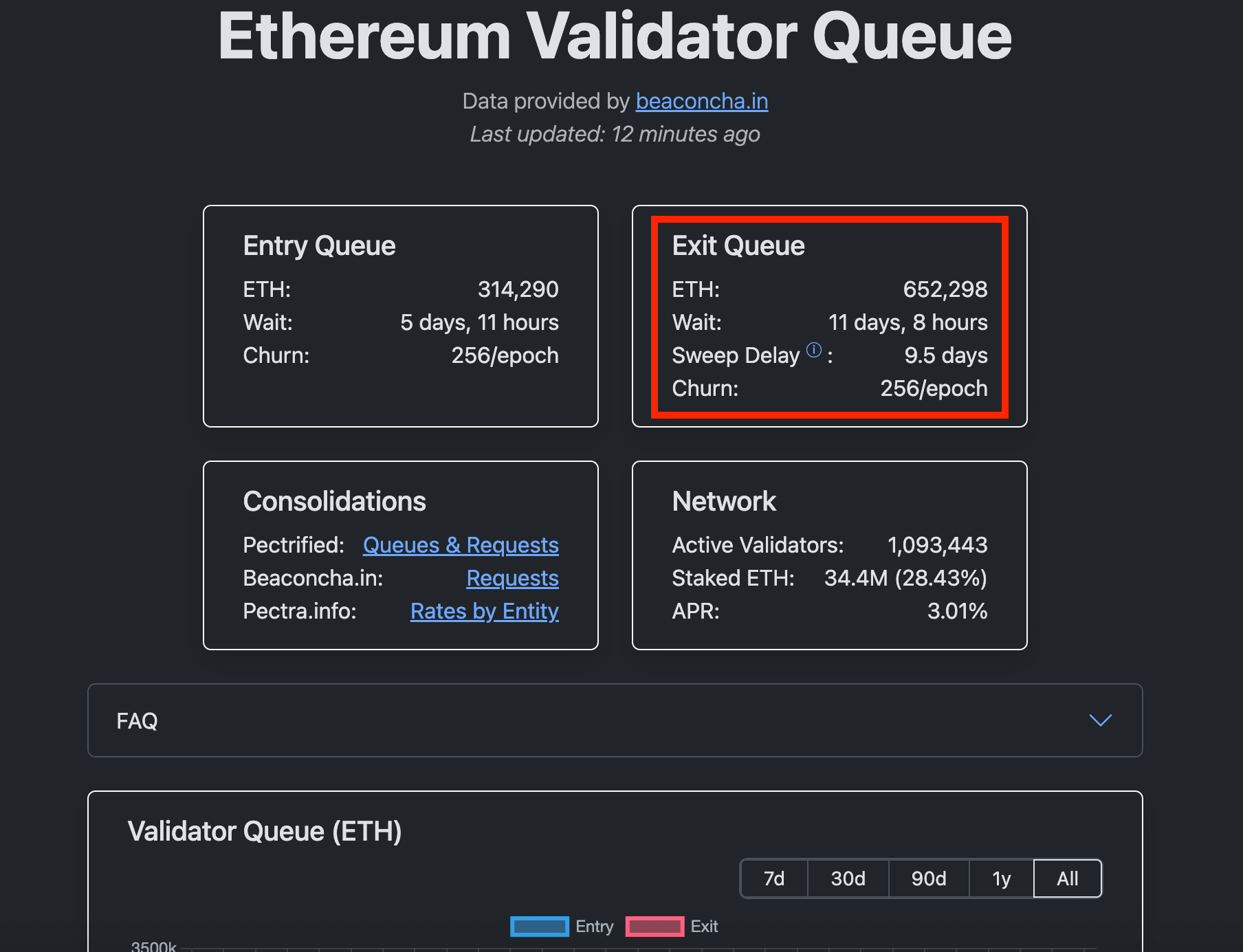

Amid all this, social media is abuzz with posts about some $2 billion worth of ether waiting to be unstaked, with over 475 Ethereum validators awaiting exit. (check chart of the day section). Some are drawing parallels with January 2024, when large unstaking marked a temporary price top.

The latest surge in unstaking appears to be driven by the soaring ether borrowing rates on decentralized platforms like Aave, which have diminished the appeal of looping strategies designed to boost ether staking yields.

Typically, these strategies involve users depositing liquidity staking (LST) or liquid restaking tokens (LRT) as collateral on platforms like AAVE and borrow ETH. The borrowed ETH is again converted to LRT and LSTs and redeposited, creating a loop. The strategy works when staking yields are greater than borrowing costs.

However, with borrowing costs on the rise, the loop is likely being reversed, leading traders to rush to repay loans, exit LST/LRT, and reclaim ETH.

“The real trigger is soaring ETH borrowing rates since July 16 (peaking at 18%). This forced mass unwinding of ETH leverage loops on Aave, as negative yield spreads crushed profitability. Traders rushed to repay loans, exit LST/LRT positions, and reclaim ETH — causing depegs and queue congestion,” pseudonymous observer Degen Station noted on X.

It added that arbitrageurs are now scooping up LSTs and LRTs at a discount to redeem them for ether, worsening the issue, while demand for new staking remains strong. To cut to the chase, the large queue for unstaking is not necessarily a bearish signal.

In other key news, Tether CEO Paolo Ardoino said that the company is planning to re-enter the U.S. with stablecoin offerings for payments, interbank settlements, and trading.

In traditional markets, major currencies traded flat against the U.S. dollar, except for the risk-sensitive AUD/USD pair, which crossed above resistance at 0.66. Traders were closely watching for signs of sustainability as failure could be a harbinger of broad-based risk aversion.

Stay Alert!

What to Watch

- Crypto

- July 28: Starknet (STRK), an Ethereum layer-2 validity rollup (zk-rollup), launches v0.14.0 on mainnet.

- July 31, 12 p.m.: A live webinar featuring Bitwise CIO Matt Hougan and Bitzenship founder Aleesandro Palombo discussing bitcoin’s potential as the next global reserve currency amid de-dollarization trends. Registration link.

- Aug. 1: The Helium Network (HNT), now running on Solana, undergoes its halving event, cutting annual new token issuance to 7.5 million HNT.

- Aug. 15: Record date for the next FTX distribution to holders of allowed Class 5 Customer Entitlement, Class 6 General Unsecured and Convenience Claims who meet pre-distribution requirements.

- Macro

- July 24, 8:15 a.m.: The European Central Bank will announce its interest rate decision, with President Christine Lagarde’s press conference following 30 minutes later. Livestream link.

- Main Refinancing Operations (MRO) rate Est. 1.9% vs. Prev. 2.15%

- July 24, 9:45 a.m.: S&P Global releases (flash) July U.S. data on manufacturing and services activity.

- Composite PMI Prev. 52.9

- Manufacturing PMI Est. 52.6 vs. Prev. 52.9

- Services PMI Est. 53 vs. Prev. 52.9

- July 24, 4 p.m.: President Donald Trump will visit the Federal Reserve headquarters, highlighting his public disagreements with Chair Jerome Powell and Fed monetary policy.

- July 25, 8:30 a.m.: The U.S. Census Bureau releases June manufactured durable goods orders data.

- Durable Goods Orders MoM Est. -10.8% vs. Prev. 16.4%

- Durable Goods Orders Ex Defense MoM Prev. 15.5%

- Durable Goods Orders Ex Transportation MoM Est. 0.1% vs. Prev. 0.5%

- Aug. 1, 12:01 a.m.: New U.S. tariffs take effect on imports from trading partners that failed to reach agreements by the July 9 deadline. These increased duties could range from 10% to as high as 70%, impacting a wide range of goods.

- July 24, 8:15 a.m.: The European Central Bank will announce its interest rate decision, with President Christine Lagarde’s press conference following 30 minutes later. Livestream link.

-

Earnings (Estimates based on FactSet data)

- July 29: PayPal Holdings (PYPL), pre-market, $1.30

- July 30: Robinhood Markets (HOOD), post-market, $0.31

- July 31: Coinbase Global (COIN), post-market, $1.39

- July 31: Reddit (RDDT), post-market, $0.19

- July 31: Sequans Communications (SQNS); pre-market, N/A

- Aug. 5: Galaxy Digital (GLXY), pre-market, $0.19

- Aug. 7: Block (XYZ), post-market, $0.67

- Aug. 7: Hut 8 (HUT), pre-market, -$0.08

- Aug. 27: NVIDIA (NVDA), post-market, $1.00

Token Events

-

Governance votes & calls

- Rocket Pool DAO is voting to finalize Saturn 1’s implementation. Approval by a 75% supermajority will ratify key protocol changes, including new transaction designs and a potential revenue share to the pDAO treasury. Voting ends July 24.

- Aavegotchi DAO is voting on a proposal to sell its treasury of around 16 million GHST at a discount to VC firm Rongming Investment for around $3.2 million in USDC, dissolve the DAO, and distribute funds to active members. The VC firm aims to scale Aavegotchi globally while Pixelcraft retains IP ownership. Voting ends July 25.

- Lido DAO is voting on a new system that lets validator exits be triggered automatically through the execution layer, not just by node operators. It includes tools for different authorization pathways, emergency controls, and built‑in limits to prevent misuse. The update is expected to make staking more decentralized, secure, and responsive. Voting ends July 28.

- GnosisDAO is voting on a proposal to provide $30 million per year, paid quarterly, to Gnosis Ltd., now a non-profit, to sustain its ~150‑person team building critical Gnosis Chain infrastructure, products (like Gnosis Pay and Circles), business development, and operations. Voting ends July 28.

- Aavegotchi DAO is voting on funding three new features for the official decentralized application: a Wearable Lendings UI, Gotchis Batch Lending and a BRS Optimizer. Voting ends July 29.

- NEAR Protocol is voting on potentially reducing NEAR’s inflation from 5% to 2.5%. Two-thirds of validators must approve the proposal for it to pass, and if so, it could be implemented by late Q3. Voting ends Aug. 1.

- July 29, 10 a.m.: Ether.fi to host a bi-quarterly analyst call.

- Unlocks

- July 25: Venom to unlock 2.84% of its circulating supply worth $12.36 million.

- July 28: Jupiter to unlock 1.78% of its circulating supply worth $29.04 million.

- July 31: Optimism to unlock 1.79% of its circulating supply worth $21.48 million.

- Aug. 1: Sui to unlock 1.27% of its circulating supply worth $163.66 million.

- Aug. 2: Ethena to unlock 0.64% of its circulating supply worth $18.92 million.

- Aug. 9: Immutable (IMX) to unlock 1.3% of its circulating supply worth $13.36 million.

- Aug. 12: Aptos to unlock 1.73% of its circulating supply worth $52.59 million.

- Token Launches

- July 24: Uranium.io (XU3O8) to be listed on KuCoin, MEXC, Gate.io, and others.

- July 24: Aspecta (ASP) to be listed on Binance Alpha, OKX, KuCoin, BingX and others.

- July 24: Rent (REKT) to be listed on Binance.US

Conferences

The CoinDesk Policy & Regulation conference (formerly known as State of Crypto) is a one-day boutique event held in Washington on Sept. 10 that allows general counsels, compliance officers and regulatory executives to meet with public officials responsible for crypto legislation and regulatory oversight. Space is limited.

- July 24: Decasonic’s Web3 Investor Day 2025 (Chicago)

- July 25: Blockchain Summit Global (Montevideo, Uruguay)

- July 28-29: TWS Conference 2025 (Singapore)

- Aug. 6-7: Blockchain.Rio 2025 (Rio de Janeiro, Brazil)

- Aug. 6-10: Rare EVO (Las Vegas)

- Aug. 7-8: bitcoin++ (Riga, Latvia)

- Aug. 9-10: Baltic Honeybadger 2025 (Riga, Latvia)

- Aug. 9-10: Conviction 2025 (Ho Chi Minh City, Vietnam)

Token Talk

By Shaurya Malwa

- PENGU surged to a record $0.044, reclaiming the title of top Solana meme token after overtaking BONK in a rally timed with the fourth anniversary of the Pudgy Penguins NFT collection.

- The token jumped 21% in 24 hours, extending a multiday rally and overtaking its previous all-time high of $0.042 from January.

- South Korean traders are driving momentum, with 38% of PENGU volume now in KRW pairs, up from 32% earlier this month, a significant concentration of localized demand.

- Open interest in PENGU futures is at a record high, indicative of expectations of further volatility.

- The Pudgy Penguins NFT floor price has almost doubled to 16.2 ETH, reinforcing the connection between token price and NFT ecosystem strength.

- PENGU’s rally comes amid weak sentiment around PUMP following its underwhelming post-ICO performance, pushing attention and liquidity toward other Solana memecoins.

- The token is increasingly being viewed as a proxy for meme market sentiment, combining high liquidity, exchange access, cultural mindshare and ties to a top-tier NFT IP.

Derivatives Positioning

- Open interest in BTC, ETH, XRP and SOL offshore perpetual has declined along with prices in the past 24 hours. Yet, funding rates hold positive. This combination indicates that the market swoon is predominantly driven by the unwinding of bullish bets rather than outright shorts.

- On the CME, the annualized three-month basis in BTC futures has ticked up to nearly 9%, the highest since May. However, open interest remains locked in familiar ranges.

- ETH CME futures open interest has pulled back slightly from the record 2.08 billion ETH to 1.87 billion ETH. Basis, meanwhile, has topped 10% for the first time since the end of May, indicating a bullish sentiment.

- On Deribit, the put bias in short-dated BTC risk reversals has strengthened, indicating fears of deeper price pull back. ETH options continue to show a bullish call bias across all tenors. Surprisingly, XRP risk reversals remain bullish despite the sharp price drop in the past 24 hours.

Market Movements

- BTC is up 0.49% from 4 p.m. ET Wednesday at $118,534.04 (24hrs: -0.09%)

- ETH is up 1.9% at $2,607.45 (24hrs: -1.15%)

- CoinDesk 20 is up 0.41% at 3,934.83 (24hrs: -3.55%)

- Ether CESR Composite Staking Rate is down 2 bps at 2.95%

- BTC funding rate is at 0.0091% (9.9645% annualized) on KuCoin

- DXY is up 0.14% at 97.35

- Gold futures are down 0.86% at $3,368.50

- Silver futures are down 0.32% at $39.38

- Nikkei 225 closed up 1.59% at 41,826.34

- Hang Seng closed up 0.51% at 25,667.18

- FTSE is up 1.00% at 9,151.80

- Euro Stoxx 50 is up 0.56% at 5,374.36

- DJIA closed on Wednesday up 1.14% at 45,010.29

- S&P 500 closed up 0.78% at 6,358.91

- Nasdaq Composite closed up 0.61% at 21,020.02

- S&P/TSX Composite closed up 0.19% at 27,416.41

- S&P 40 Latin America closed up 1.86% at 2,639.18

- U.S. 10-Year Treasury rate is up 1 bps at 4.398%

- E-mini S&P 500 futures are unchanged at 6,402.00

- E-mini Nasdaq-100 futures are up 0.33% at 23,387.75

- E-mini Dow Jones Industrial Average Index are down 0.30% at 45,078.00

Bitcoin Stats

- BTC Dominance: 62.1% (0.33%)

- Ether to bitcoin ratio: 0.3055 (unchanged)

- Hashrate (seven-day moving average): 908 EH/s

- Hashprice (spot): $59.59

- Total fees: 4.19 BTC / $496,766

- CME Futures Open Interest: 149,260 BTC

- BTC priced in gold: 35.2 oz.

- BTC vs gold market cap: 9.87%

Technical Analysis

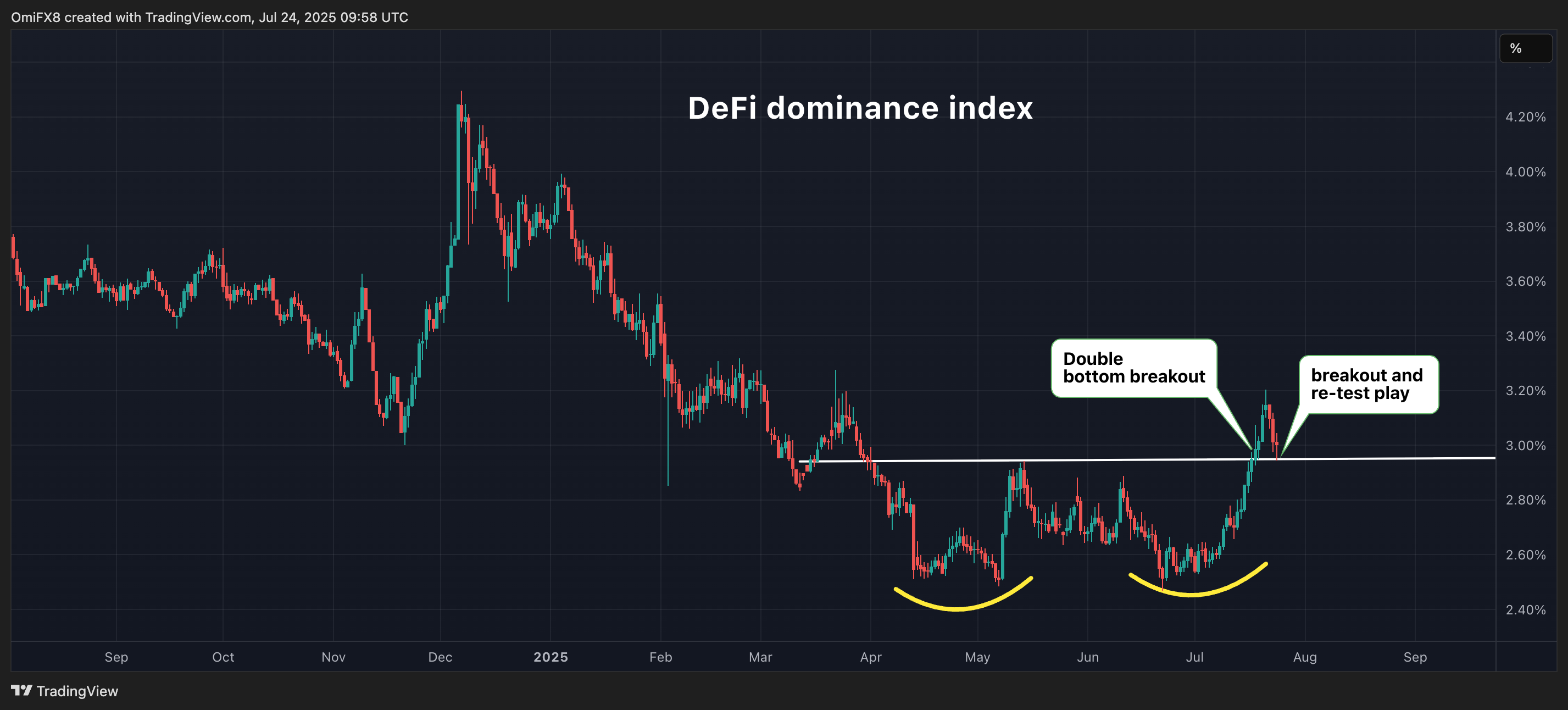

DeFi dominance index. (TradingView)

- The DeFi dominance index, which measures the share of decentralized finance coins in the total crypto market, is currently showing a classic “breakout and re-test” pattern.

- This technical setup, characterized by a re-test of the breakout point, typically signals that the index is consolidating before a potential significant rally.

Crypto Equities

- Strategy (MSTR): closed on Wednesday at $412.67 (-3.22%), unchanged in pre-market

- Coinbase Global (COIN): closed at $397.81 (-1.64%), unchanged in pre-market

- Circle (CRCL): closed at $202.41 (+2.07%), -1.6% at $199.18

- Galaxy Digital (GLXY): closed at $31.03 (+6.6%), -0.1% at $31

- MARA Holdings (MARA): closed at $17.57 (-11.62%), +0.23% at $17.61

- Riot Platforms (RIOT): closed at $14.34 (+0.49%), -0.49% at $14.27

- Core Scientific (CORZ): closed at $13.49 (+0.07%), +0.37% at $13.54

- CleanSpark (CLSK): closed at $12.45 (-3.04%), unchanged in pre-market

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $27.34 (-0.8%)

- Semler Scientific (SMLR): closed at $39.32 (-2.16%)

- Exodus Movement (EXOD): closed at $34.21 (-1.5%)

- SharpLink Gaming (SBET): closed at $25.81 (-5.8%), +0.66% at $25.98

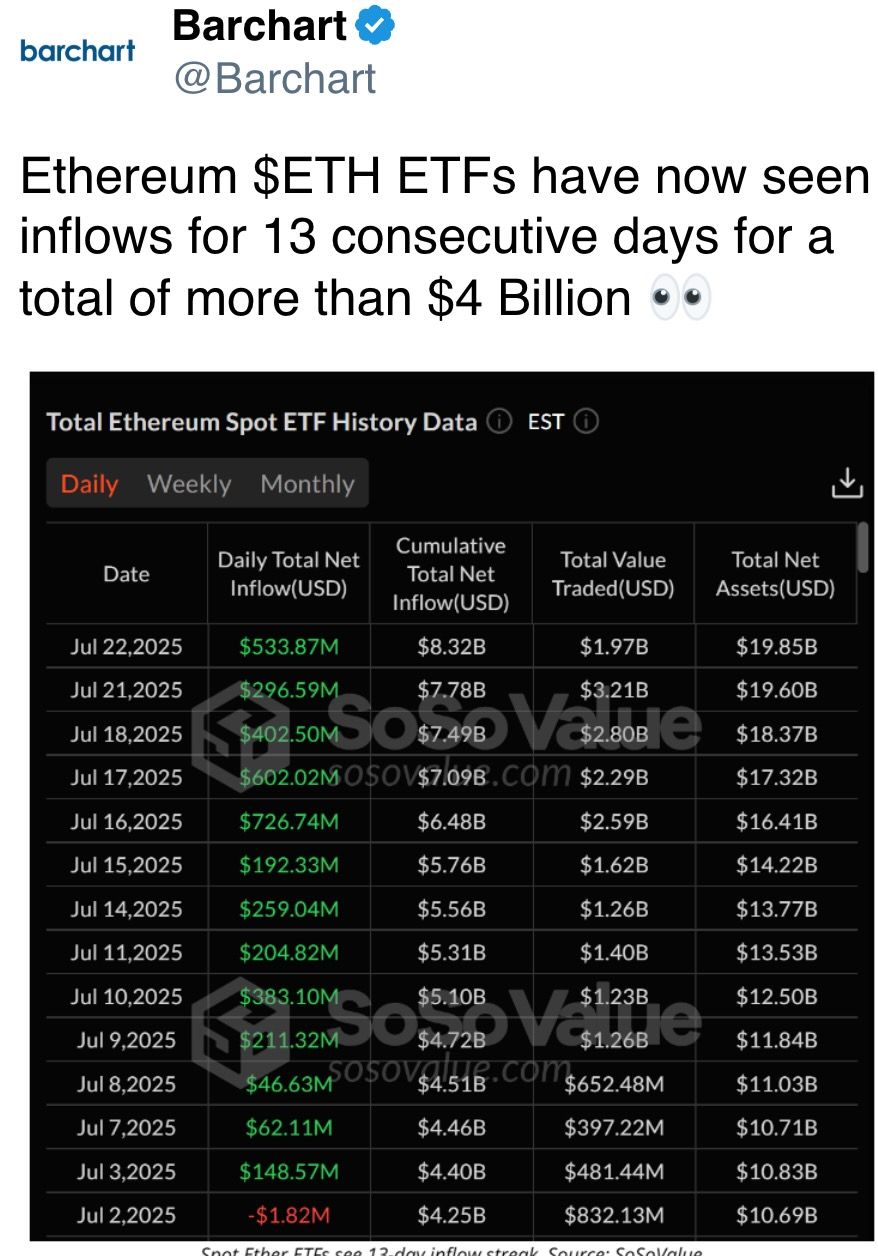

ETF Flows

Spot BTC ETFs

- Daily net flows: -$85.8 million

- Cumulative net flows: $54.44 billion

- Total BTC holdings ~1.3 million

Spot ETH ETFs

- Daily net flows: $332.2 million

- Cumulative net flows: $8.67 billion

- Total ETH holdings ~5.24 million

Source: Farside Investors

Overnight Flows

Chart of the Day

Ether validator queue. (beaconcha.in)

- The queue for unstaking ether now consists of 652,298 ETH with waiting time of over 11 days.

While You Were Sleeping

- FTX to Start Next Round of Creditor Repayments on Sept. 30 (CoinDesk): FTX, the bankrupt crypto exchange formerly led by Sam Bankman-Fried, has repaid nearly $6.2 billion to creditors. The next distribution will be handled by BitGo, Kraken and Payoneer.

- Crypto Industry Asks President Trump to Stop JPMorgan’s ‘Punitive Tax’ on Data Access (CoinDesk): A plan by JPMorgan to charge companies like Plaid and MX for linking bank accounts to crypto exchanges threatens fiat on-ramps, with Plaid alone facing fees that could wipe out most of its revenue.

- ‘Wall Streetization’ of Bitcoin: BTC Volatility Index and the S&P 500 VIX Boast Record 90-Day Correlation (CoinDesk): Institutional crypto traders are mirroring equity option strategies, reshaping bitcoin’s volatility signals into sentiment gauges and decoupling them from price trends, leading to record alignment with Wall Street fear metrics.

- BTC, XRP, SOL, ETH Witness ‘Long Squeeze’ as Futures Open Interest Slides With Prices (CoinDesk): Positive funding rates and declining futures exposure suggest bullish traders are being cleared out — not replaced — pointing to a leverage reset rather than a shift in sentiment.

- Chinese and EU Leaders Are About to Meet — but the U.S. Is Complicating Things (Financial Times): EU officials challenged Beijing over its $142 billion trade surplus and ties to Moscow, while China defended its stance and warned Brussels against tariffs or restricting market access through supply chain controls.

- How a Chinese Border Town Keeps Russia’s Economy Afloat (The New York Times): China’s booming imports of Russian energy, timber and grain now feed its manufacturing sector as Beijing replaces Western buyers across key sectors of the post-sanctions economy.

In the Ether